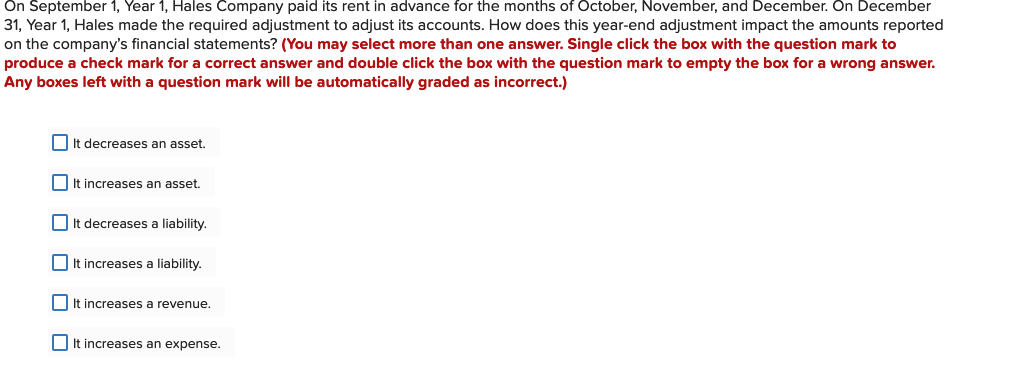

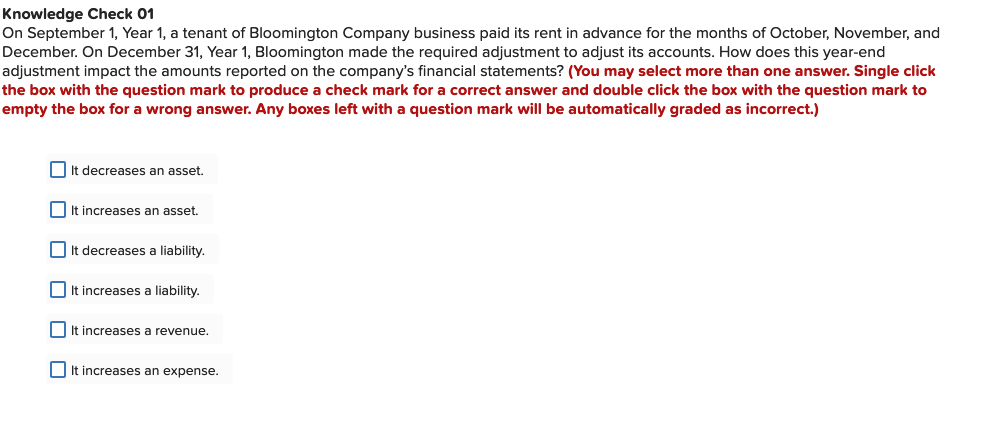

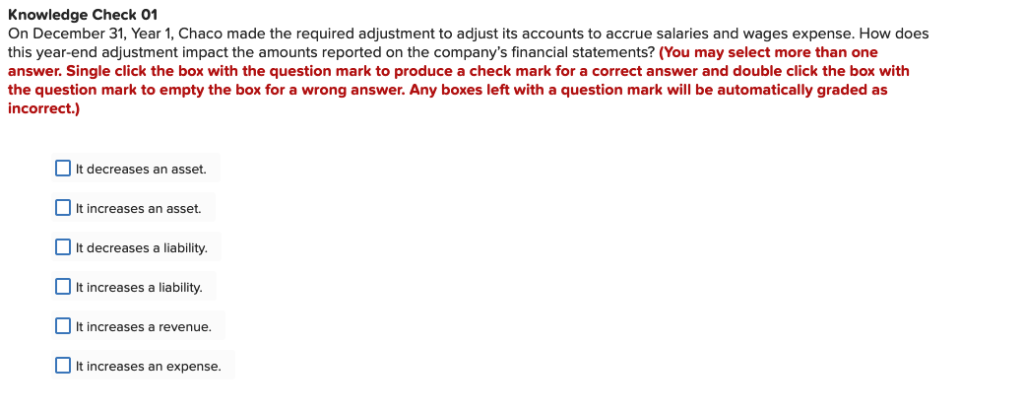

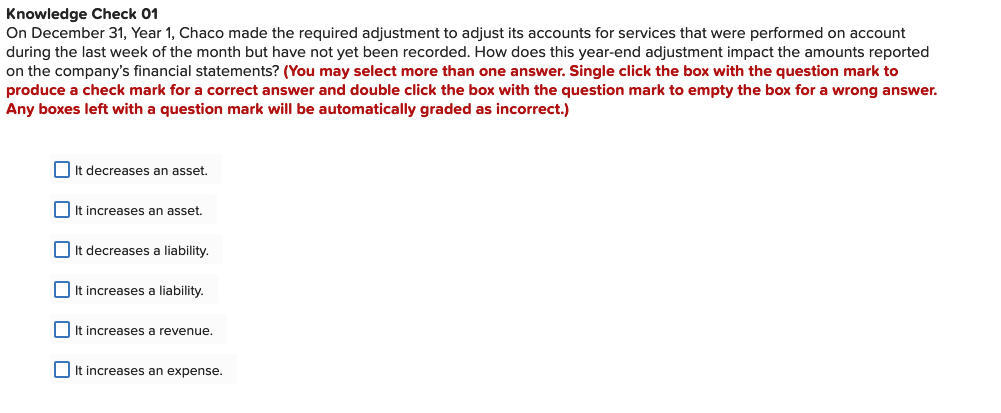

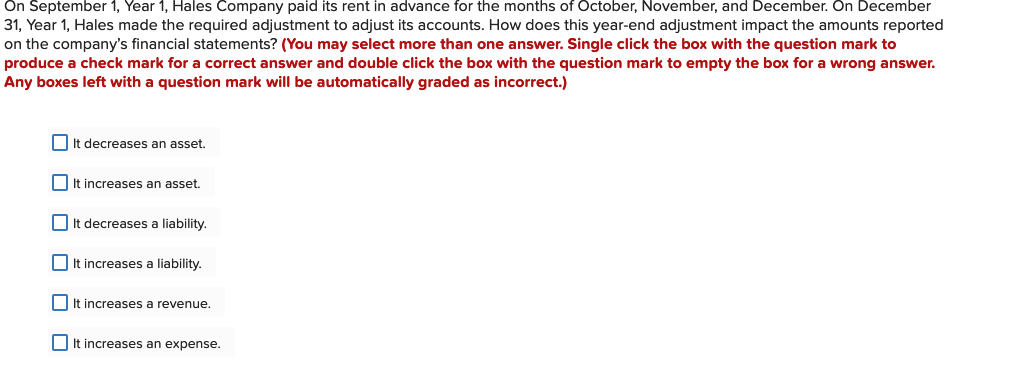

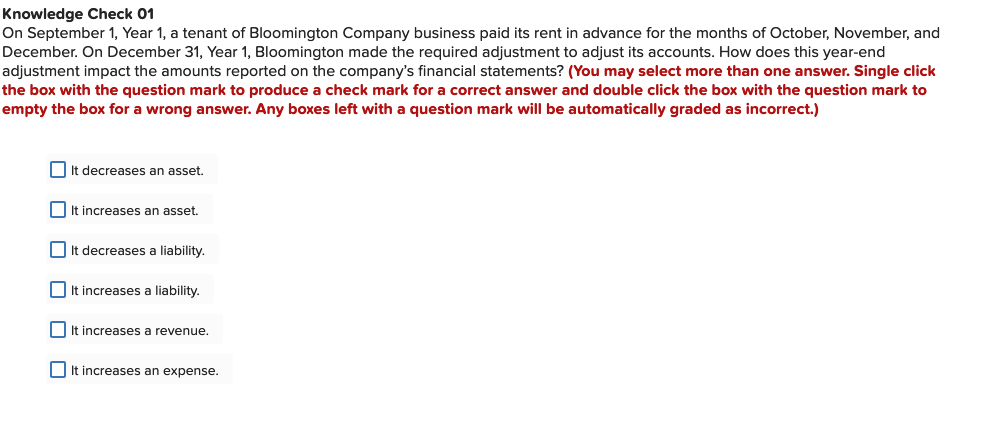

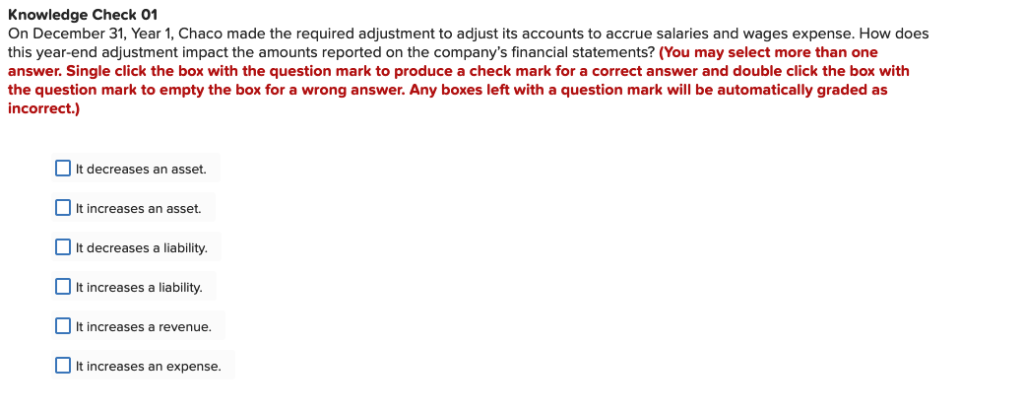

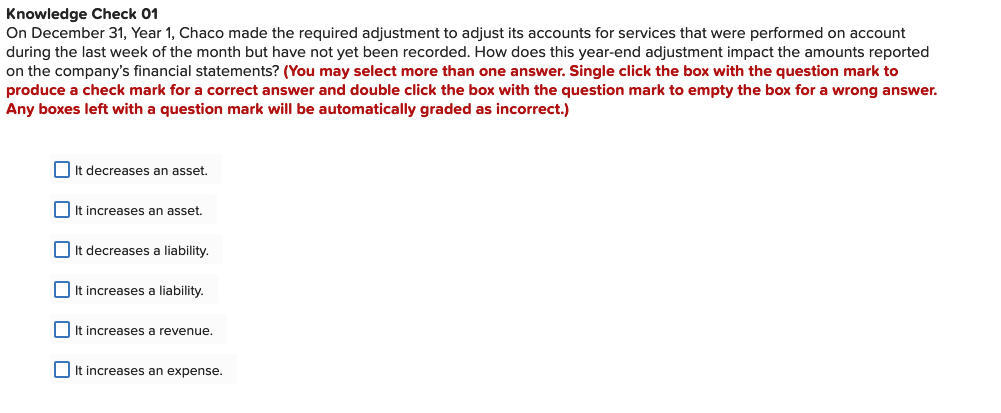

On September 1, Year 1, Hales Company paid its rent in advance for the months of October, November, and December. On December 31, Year 1, Hales made the required adjustment to adjust its accounts. How does this year-end adjustment impact the amounts reported on the company's financial statements? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) decreases n asset. t increasete an asset. decreases a liability. t increases a liability. It increases a revenue. increasese an expense. Knowledge Check 01 On September 1, Year 1, a tenant of Bloomington Company business paid its rent in advance for the months of October, November, and December. On December 31, Year 1, Bloomington made the required adjustment to adjust its accounts. How does this year-end adjustment impact the amounts reported on the company's financial statements? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) | It decreases an asset. |It increases an asset. | It decreases a liability. It increases a liability. It increases revenue. It increases an expense. Knowledge Check 01 On December 31, Year 1, Chaco made the required adjustment to adjust its accounts to accrue salaries and wages expense. How does this year-end adjustment impact the amounts reported on the company's financial statements? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) It decreases an asset. It increases an asset. It decreases a liability. It increases a liability. It increases a revenue. It increases an expense. Knowledge Check 01 On December 31, Year 1, Chaco made the required adjustment to adjust its accounts for services that were performed on account during the last week of the month but have not yet been recorded. How does this year-end adjustment impact the amounts reported on the company's financial statements? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) It decreases an asset. | It increases an asset. | It decreases a liability. It increases a liability. It increases a revenue. It increases an expense