Question

On September 3 0 , 2 0 2 3 , ?Cullumber Inc. issued $ 3 , 1 2 0 , 0 0 0 ?of

On September ?Cullumber Inc. issued $ ?of year, ?convertible bonds for $ ?The bonds pay interest on March ?and September ?and mature on Lo September ?Each $ ?bond can be converted into ?no par value common shares. In addition, each bond included ?detachable warrants. Each warrant can be used to purchase one common share at an exercise price of $ ?Immediately after the bond issuance, the warrants traded at $ ?each. Without the warrants and the conversion rights, the bonds would have been expected to sell for $ ?On March ?half of the warrants were exercised. The common shares of Cullumber were trading at $ ?each on this day. Immediately after the payment of interest on the bonds, on September ?all bonds outstanding were converted into common shares. Assume the entity follows IFRS.

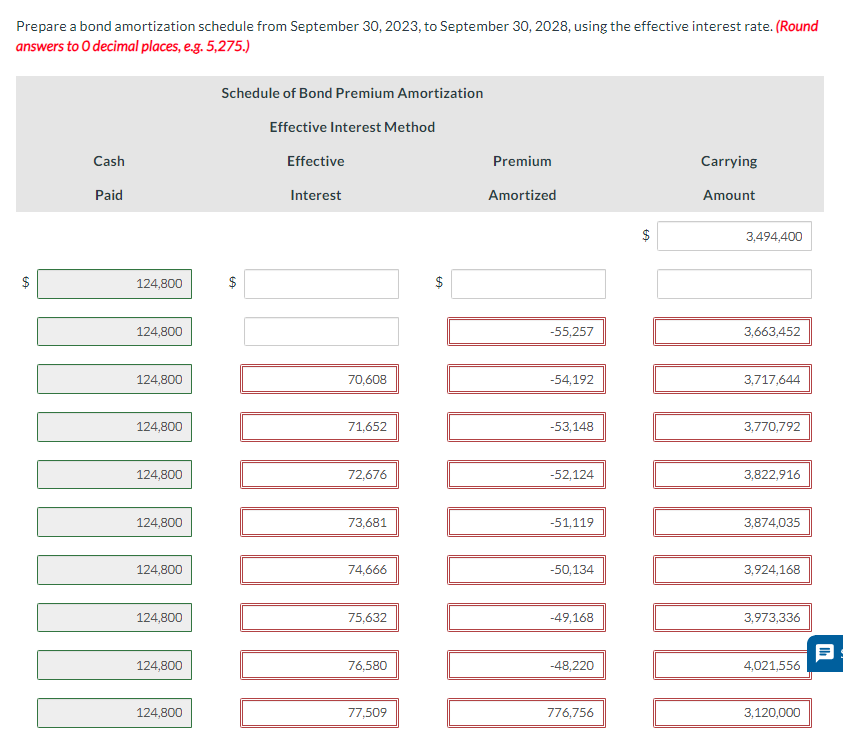

Prepare a bond amortization schedule from September ?to September ?using the effective interest rate of Prepare a bond amortization schedule from September ?to September ?using the effective interest rate.

Prepare a bond amortization schedule from September 30, 2023, to September 30, 2028, using the effective interest rate. (Round answers to O decimal places, e.g. 5,275.) Cash Paid Schedule of Bond Premium Amortization Effective Interest Method Effective Interest Premium Amortized $ Carrying Amount 3,494,400 $ 124,800 $ 124,800 124,800 +A $ -55,257 3,663,452 70,608 -54,192 3,717,644 124,800 71,652 -53,148 3,770,792 124,800 72,676 -52,124 3,822,916 124,800 73,681 -51,119 3,874,035 124,800 74,666 -50,134 3,924,168 124,800 75,632 -49,168 3,973,336 124,800 76,580 -48,220 4,021,556 124,800 77,509 776,756 3,120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the bond amortization schedule from September 30 2023 to September 30 2028 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started