Question

On September 5, 2021, Howard Corporation signed a purchase commitment to purchase inventory for $128,000 on or before March 31, 2022. The company's fiscal year-end

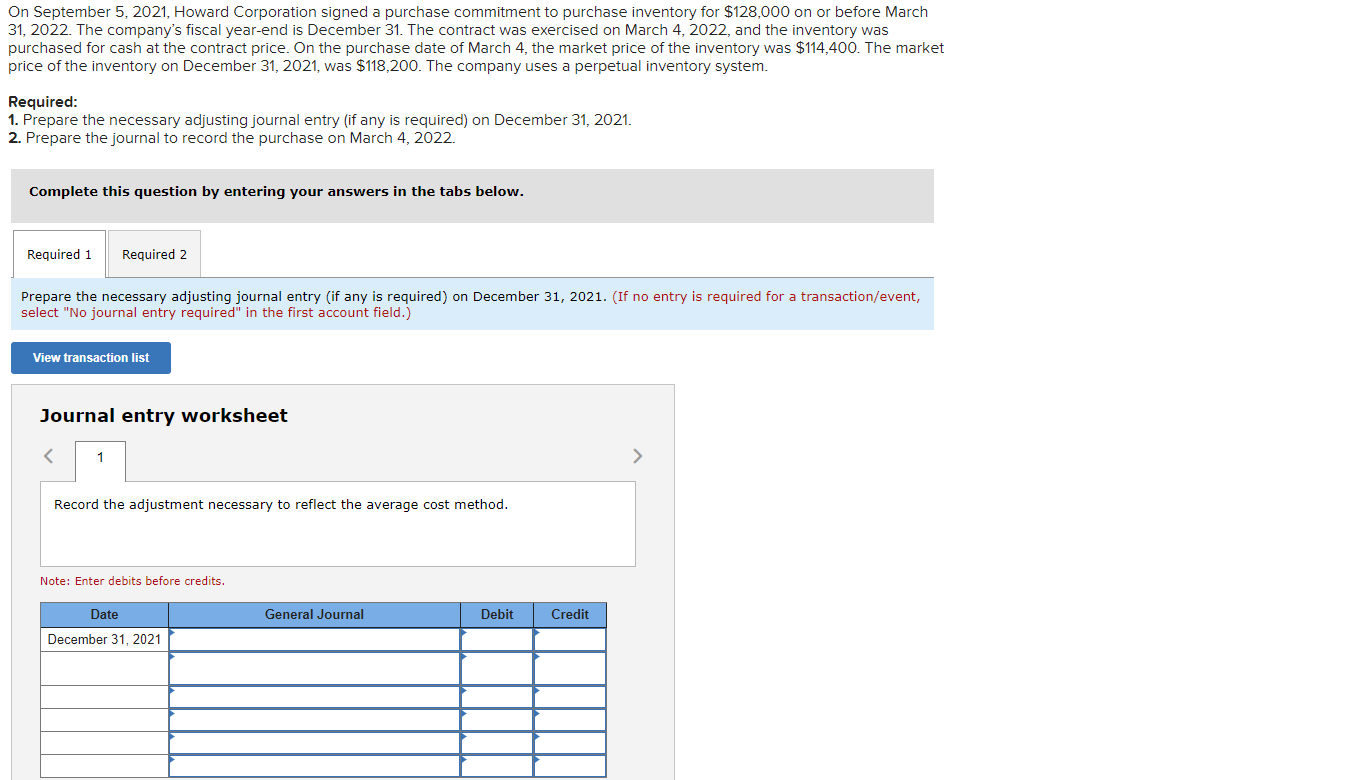

On September 5, 2021, Howard Corporation signed a purchase commitment to purchase inventory for $128,000 on or before March 31, 2022. The company's fiscal year-end is December 31. The contract was exercised on March 4, 2022, and the inventory was purchased for cash at the contract price. On the purchase date of March 4, the market price of the inventory was $114,400. The market price of the inventory on December 31, 2021, was $118,200. The company uses a perpetual inventory system. Required: 1. Prepare the necessary adjusting journal entry (if any is required) on December 31, 2021. 2. Prepare the journal to record the purchase on March 4, 2022. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the necessary adjusting journal entry (if any is required) on December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment necessary to reflect the average cost method. Note: Enter debits before credits. Date December 31, 2021 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started