Question

On the 1st of July 2022, Savannah Inc. underwent an acquisition process in which they acquired all the issued shares of Amelia Inc. The total

On the 1st of July 2022, Savannah Inc. underwent an acquisition process in which they acquired all the issued shares of Amelia Inc. The total consideration for this acquisition included $30,000 in cash and 20,000 shares in Savannah Ltd, valued at $3 per share on the acquisition date.

At the time of this acquisition, the equity structure of Amelia Inc. was as follows:

- Share Capital: Amelia Inc. had a total share capital of $66,000.

- Retained Earnings: Amelia Inc. had retained earnings amounting to $6,000

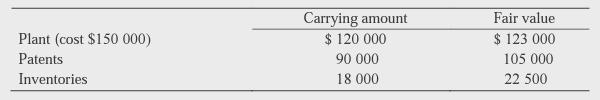

As of 1 July 2022, all the identifiable assets and liabilities of Amelia Inc. were recorded at amounts equal to their fair values, with a few exceptions:

- The plant identified on the acquisition date (1 July 2022) was expected to have a 5-year lifespan starting from that date. On August 18, 2022, the patents identified at the time of acquisition were sold for $120,000 to an external entity, ABC Corporation. The patents had indefinite useful life and had not been amortised. All inventories identified during the acquisition process were subsequently sold to another company, XYZ Enterprise, by 30 June 2023.

- On 1 January 2023, Savannah Inc. sold inventories to Amelia Inc. for $1,200. The cost of these inventories was $600. However, as of 30 June 2023, Amelia Inc. had not yet sold these inventories and continued to hold them in their inventory.

- On June 1, 2023, Amelia Inc. purchased a plant from an external company, Darwin Inc., for a cost of $14,000. On the same date, Amelia Inc. sold this plant to Savannah Inc. for $15,200. The plant is subject to depreciation at an annual rate of 10%.

Prepare consolidation worksheet entries as at 30 June 2023.

Plant (cost $150 000) Patents Inventories Carrying amount $ 120 000 90 000 18 000 Fair value $123 000 105 000 22 500

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the consolidation worksheet entries as of 30 June 2023 we need to consider the transactions and events that occurred after the acq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started