Answered step by step

Verified Expert Solution

Question

1 Approved Answer

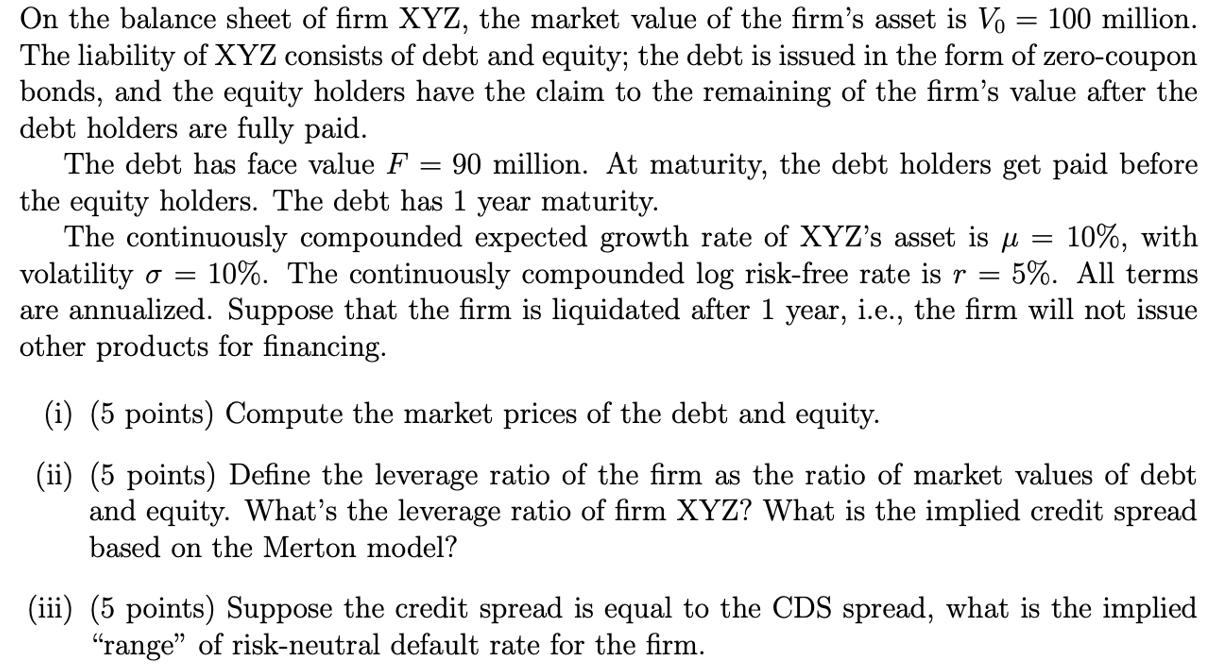

On the balance sheet of firm XYZ, the market value of the firm's asset is Vo 100 million. The liability of XYZ consists of

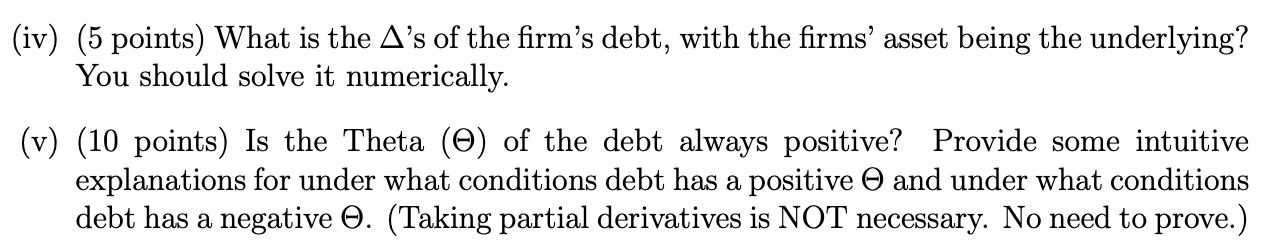

On the balance sheet of firm XYZ, the market value of the firm's asset is Vo 100 million. The liability of XYZ consists of debt and equity; the debt is issued in the form of zero-coupon bonds, and the equity holders have the claim to the remaining of the firm's value after the debt holders are fully paid. The debt has face value F 90 million. At maturity, the debt holders get paid before the equity holders. The debt has 1 year maturity. = The continuously compounded expected growth rate of XYZ's asset is u 10%, with volatility o = 10%. The continuously compounded log risk-free rate is r = 5%. All terms are annualized. Suppose that the firm is liquidated after 1 year, i.e., the firm will not issue other products for financing. = - (i) (5 points) Compute the market prices of the debt and equity. (ii) (5 points) Define the leverage ratio of the firm as the ratio of market values of debt and equity. What's the leverage ratio of firm XYZ? What is the implied credit spread based on the Merton model? (iii) (5 points) Suppose the credit spread is equal to the CDS spread, what is the implied "range" of risk-neutral default rate for the firm. (iv) (5 points) What is the A's of the firm's debt, with the firms' asset being the underlying? You should solve it numerically. (v) (10 points) Is the Theta () of the debt always positive? Provide some intuitive explanations for under what conditions debt has a positive and under what conditions debt has a negative O. (Taking partial derivatives is NOT necessary. No need to prove.)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i To compute the market prices of the debt and equity we can use the Merton model The Merton model assumes that the value of the firms equity follows a geometric Brownian motion and can be expressed a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started