Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. This year oil-prices increased sharply at the end of the summer and early fall. In earlier episodes of large oil price swings it

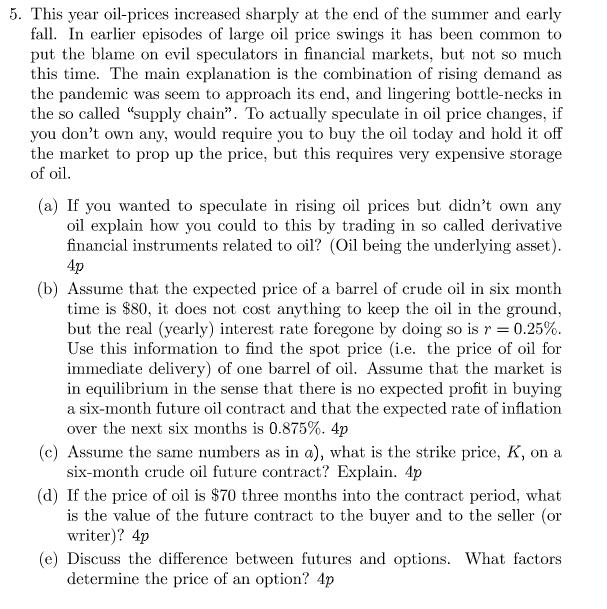

5. This year oil-prices increased sharply at the end of the summer and early fall. In earlier episodes of large oil price swings it has been common to put the blame on evil speculators in financial markets, but not so much this time. The main explanation is the combination of rising demand as the pandemic was seem to approach its end, and lingering bottle-necks in the so called "supply chain". To actually speculate in oil price changes, if you don't own any, would require you to buy the oil today and hold it off the market to prop up the price, but this requires very expensive storage of oil. (a) If you wanted to speculate in rising oil prices but didn't own any oil explain how you could to this by trading in so called derivative financial instruments related to oil? (Oil being the underlying asset). 4p (b) Assume that the expected price of a barrel of crude oil in six month time is $80, it does not cost anything to keep the oil in the ground, but the real (yearly) interest rate foregone by doing so is r = 0.25%. Use this information to find the spot price (i.e. the price of oil for immediate delivery) of one barrel of oil. Assume that the market is in equilibrium in the sense that there is no expected profit in buying a six-month future oil contract and that the expected rate of inflation over the next six months is 0.875%. 4p (c) Assume the same numbers as in a), what is the strike price, K, on a six-month crude oil future contract? Explain. 4p (d) If the price of oil is $70 three months into the contract period, what is the value of the future contract to the buyer and to the seller (or writer)? 4p (e) Discuss the difference between futures and options. What factors determine the price of an option? 4p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Let us illustrate the speculation strategy using a futures contract which is a derivative instrume...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started