On the basis of following information about Castrol India Private limited for period from financial year 2016 to 2020, you are required to: (a) Analyse

On the basis of following information about Castrol India Private limited for period from financial year 2016 to 2020, you are required to:

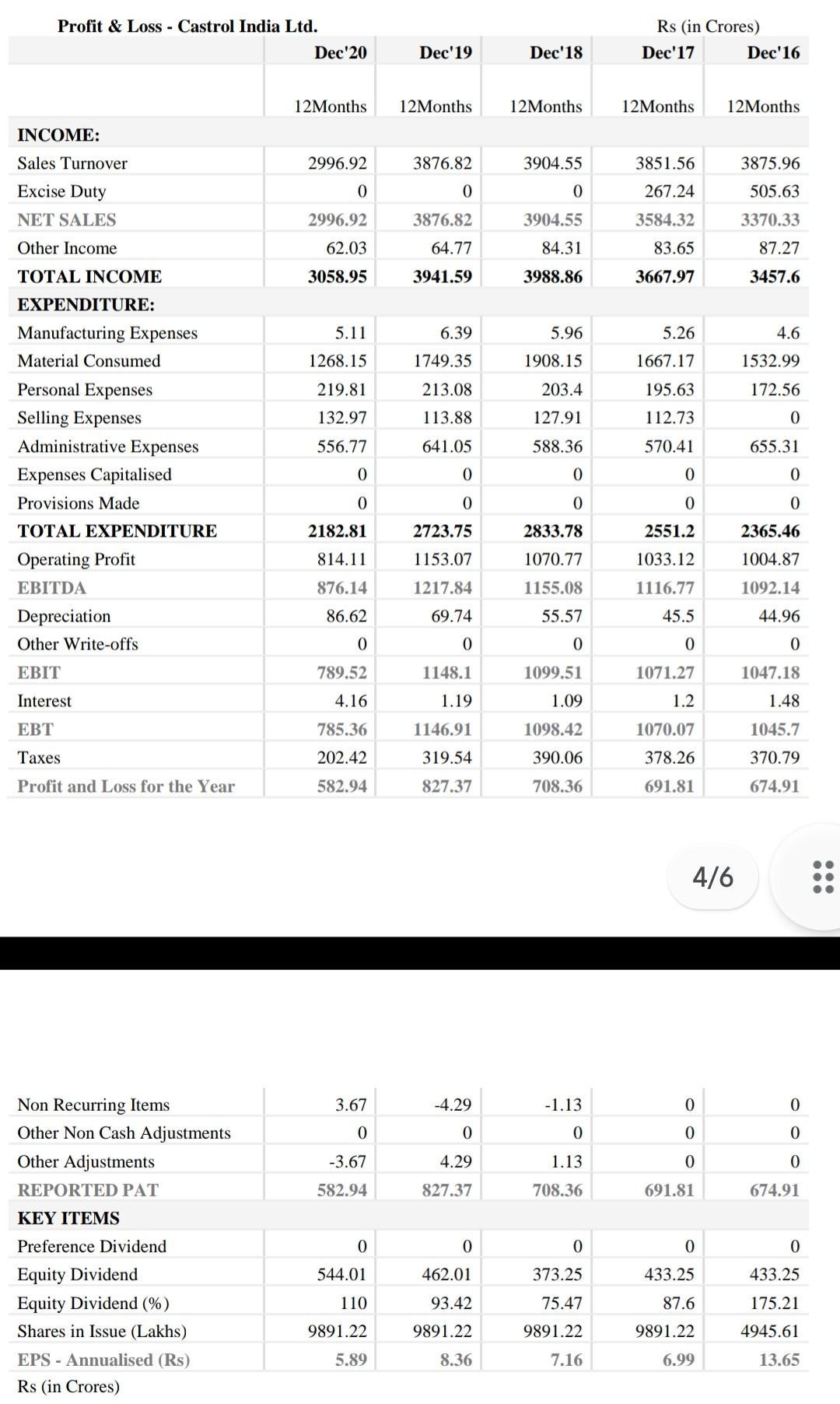

(a) Analyse the company's financial results using any 3 key ratios each on the basis of Leverage and profitability.

(b) Comment on the overall financial health of the company using Du Pont Analysis and explain the findings.

(c) "Annual Reports meet not only compliance requirements but also serve as an important tool for qualitative analysis." In the light of this statement, explain how Annual Report contributes in financial analysis and valuation of a company.

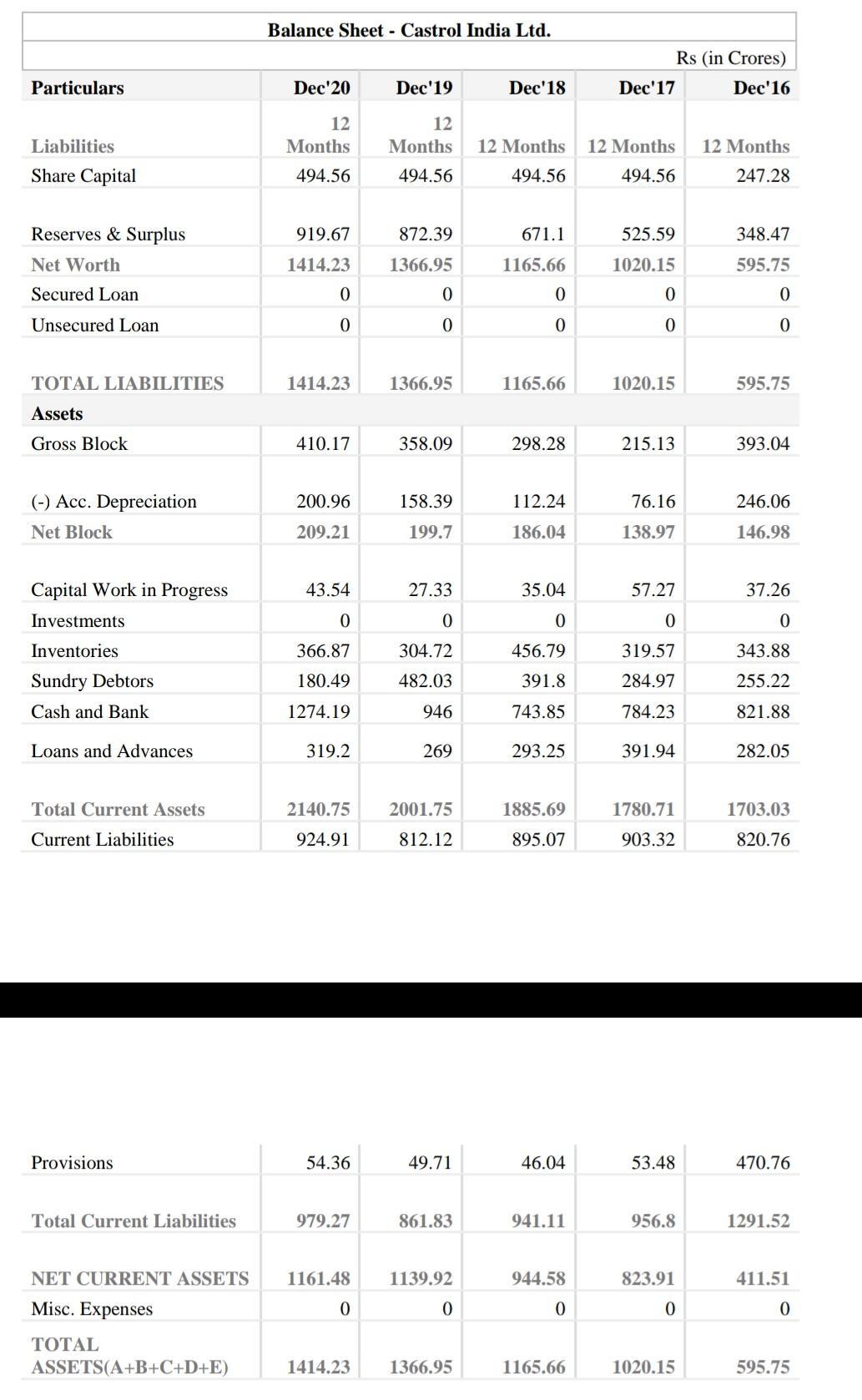

Balance Sheet - Castrol India Ltd. Rs (in Crores) Particulars Dec'20 Dec'19 Dec'18 Dec'17 Dec'16 12 12 Liabilities Months Months 12 Months 12 Months 12 Months Share Capital 494.56 494.56 494.56 494.56 247.28 Reserves & Surplus 919.67 872.39 671.1 525.59 348.47 Net Worth 1414.23 1366.95 1165.66 1020.15 595.75 Secured Loan Unsecured Loan TOTAL LIABILITIES 1414.23 1366.95 1165.66 1020.15 595.75 Assets Gross Block 410.17 358.09 298.28 215.13 393.04 (-) Acc. Depreciation 200.96 158.39 112.24 76.16 246.06 Net Block 209.21 199.7 186.04 138.97 146.98 Capital Work in Progress 43.54 27.33 35.04 57.27 37.26 Investments Inventories 366.87 304.72 456.79 319.57 343.88 Sundry Debtors 180.49 482.03 391.8 284.97 255.22 Cash and Bank 1274.19 946 743.85 784.23 821.88 Loans and Advances 319.2 269 293.25 391.94 282.05 Total Current Assets 2140.75 2001.75 1885.69 1780.71 1703.03 Current Liabilities 924.91 812.12 895.07 903.32 820.76 Provisions 54.36 49.71 46.04 53.48 470.76 Total Current Liabilities 979.27 861.83 941.11 956.8 1291.52 NET CURRENT ASSETS 1161.48 1139.92 944.58 823.91 411.51 Misc. Expenses TAL ASSETS(A+B+C+D+E) 1414.23 1366.95 1165.66 1020.15 595.75

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

11 answers 1 for analysising financial result we have analyse the debt equity ratio tota...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started