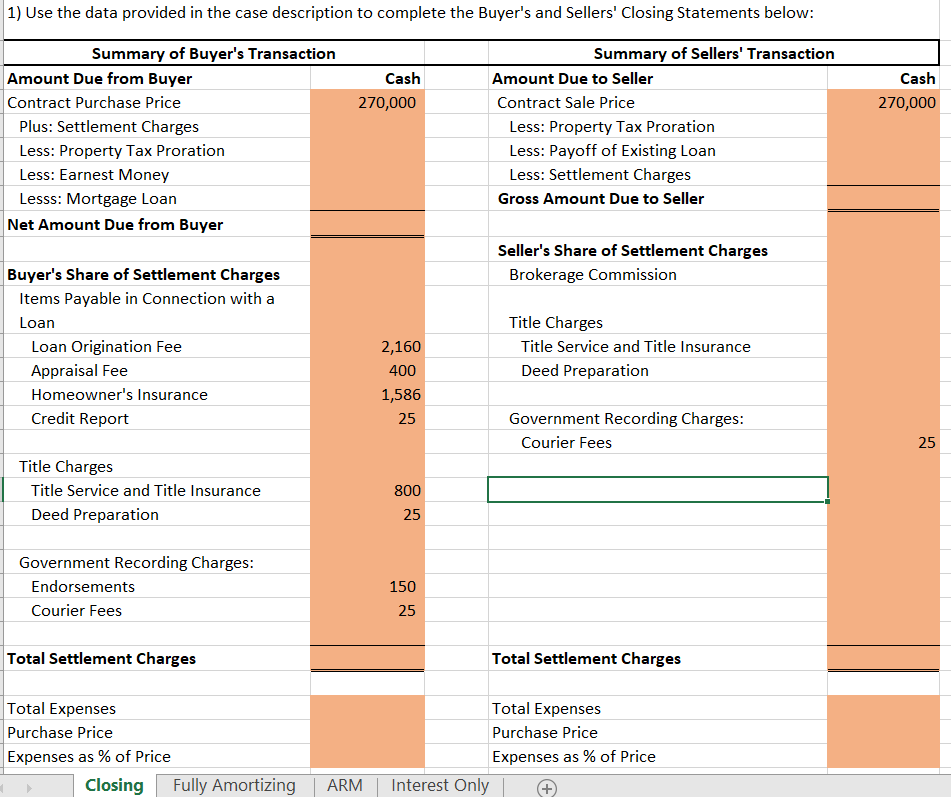

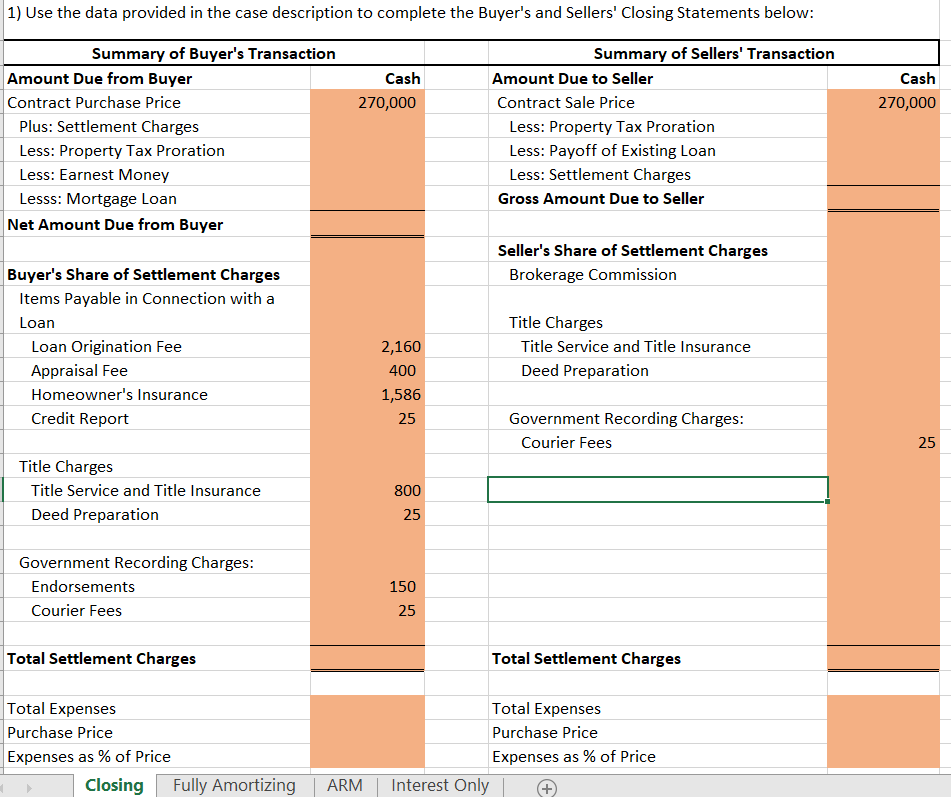

On the Closing tab of the spreadsheet, complete the Buyers and Sellers closing statements based on the following data: On June 15, Wilbur and Wilma Wildcat (Sellers) listed their Flagstaff rental property for $285,000 with Re/Max Peak Properties and agreed to pay a 6% commission on the sale price. They have a mortgage for $140,000 remaining on the home. Wildcat Investment Company (Buyer) offered $264,000 for the property. Wilbur and Wilma countered the offer and the parties agreed on a sales price of $270,000. At that time, the Buyer put down $1,000 of earnest money. The Buyer will put 20% down and finance the rest through Bear Down Bank. The sale will close on July 1st at which time Wildcat will take possession. Bear Down requires a loan origination fee of 1% of the value of the loan along with a property appraisal which will cost $400 and a credit report at a cost of $25. Property taxes for the current year are $1,264 and will be paid by the Buyer at year-end. The Buyers title insurance policy will cost $800, and the Sellers title insurance policy will be $1,690. Homeowners insurance will cost the Buyer $1,586. Recording the deed will cost $50 (equally split between the Buyer and Sellers). Endorsements of $150 would be paid by the Buyer. Courier fees will be $25 for the Buyer and $25 for the Sellers. All prorations are based on a 30-day month. Calculate the costs to the Buyer and the Sellers as a percentage of the purchase/sales price.

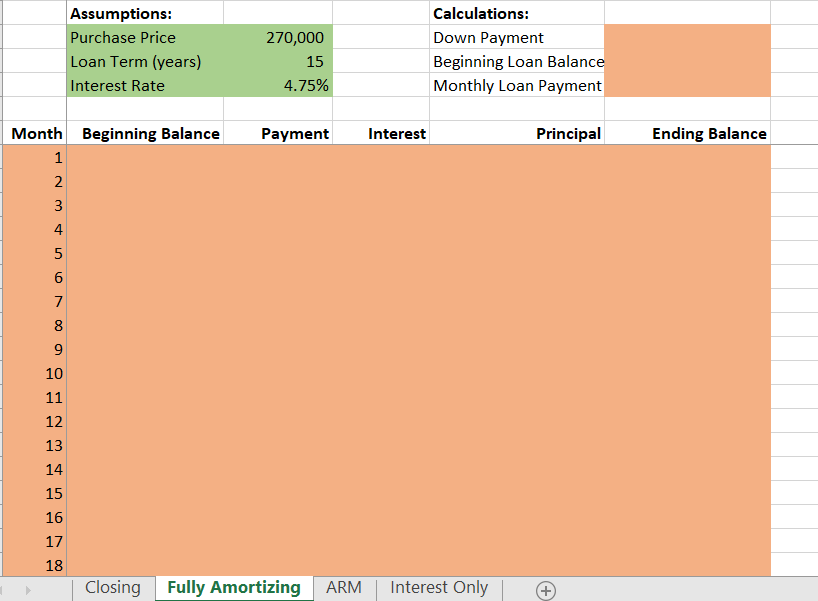

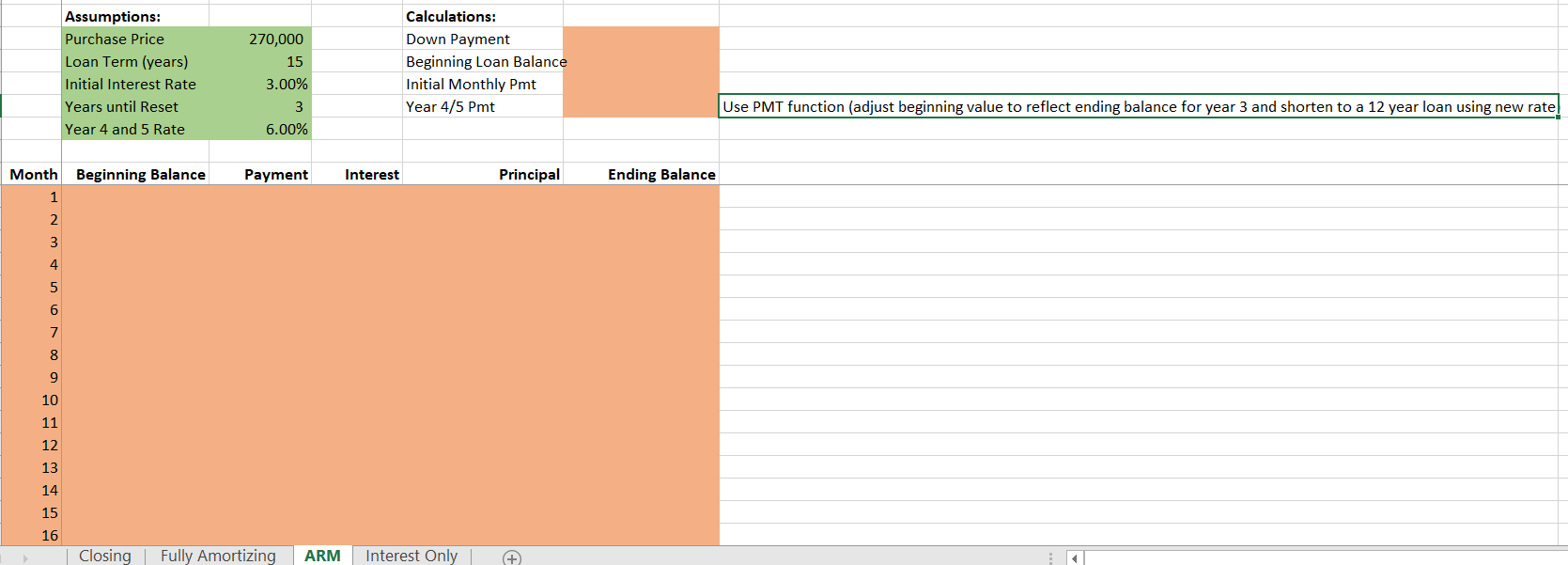

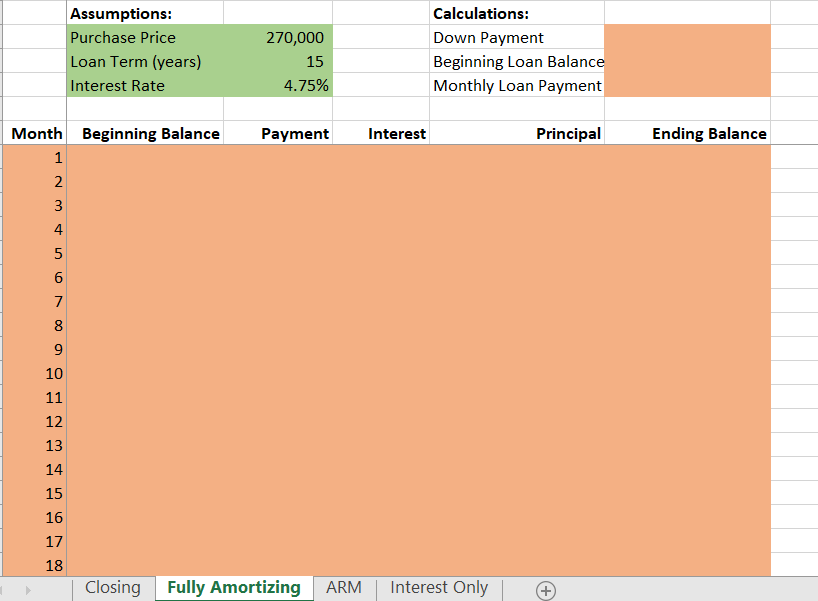

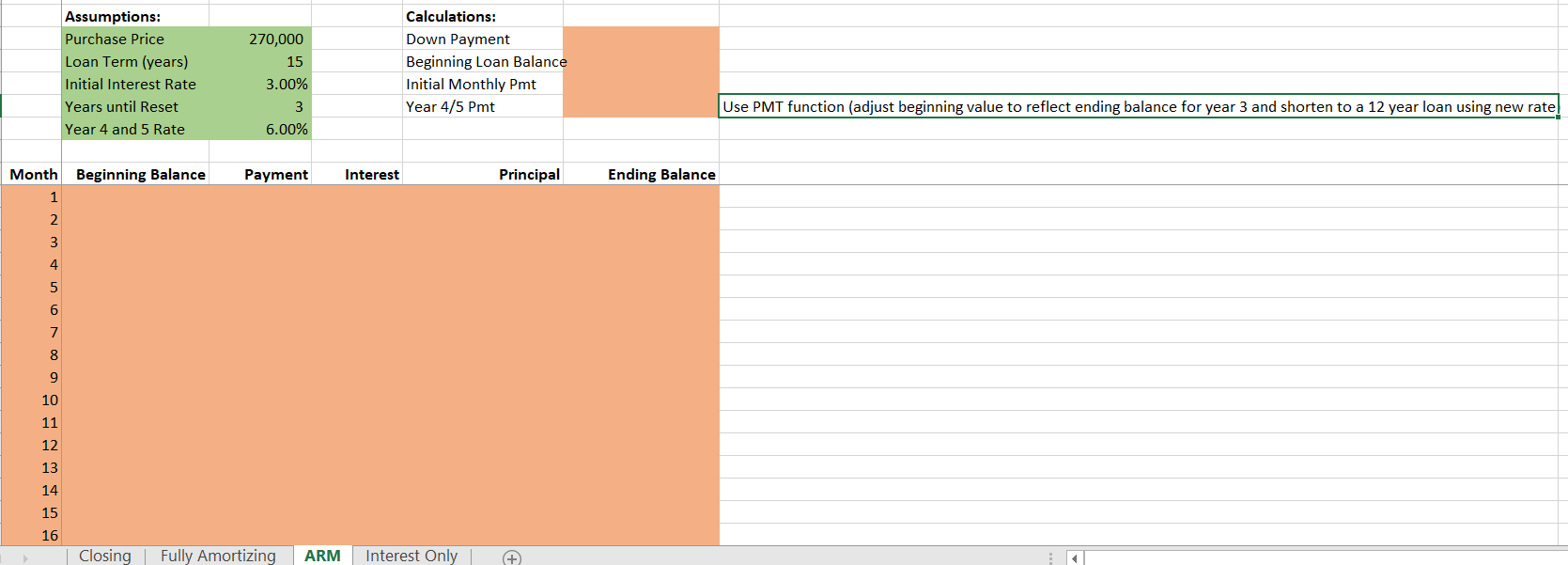

1) Use the data provided in the case description to complete the Buyer's and Sellers' Closing Statements below: Cash 270,000 Cash 270,000 Summary of Buyer's Transaction Amount Due from Buyer Contract Purchase Price Plus: Settlement Charges Less: Property Tax Proration Less: Earnest Money Lesss: Mortgage Loan Net Amount Due from Buyer Summary of Sellers' Transaction Amount Due to Seller Contract Sale Price Less: Property Tax Proration Less: Payoff of Existing Loan Less: Settlement Charges Gross Amount Due to Seller Seller's Share of Settlement Charges Brokerage Commission Buyer's Share of Settlement Charges Items Payable in Connection with a Loan Loan Origination Fee Appraisal Fee Homeowner's Insurance Credit Report 2,160 400 1,586 Title Charges Title Service and Title Insurance Deed Preparation 25 Government Recording Charges: Courier Fees 25 Title Charges Title Service and Title Insurance Deed Preparation 800 25 Government Recording Charges: Endorsements Courier Fees 150 25 Total Settlement Charges Total Settlement Charges Total Expenses Purchase Price Expenses as % of Price Closing Fully Amortizing Total Expenses Purchase Price Expenses as % of Price Interest Only ARM Assumptions: Purchase Price Loan Term (years) Interest Rate 270,000 15 4.75% Calculations: Down Payment Beginning Loan Balance Monthly Loan Payment Payment Interest Principal Ending Balance Month Beginning Balance 1 2 N 3 3 4 st 5 6 7 8 9 10 11 12 13 upBB 14 15 16 17 18 Closing Fully Amortizing ARM Interest Only Assumptions: Purchase Price Loan Term (years) Initial Interest Rate Years until Reset Year 4 and 5 Rate 270,000 15 3.00% 3 6.00% Calculations: Down Payment Beginning Loan Balance Initial Monthly Pmt Year 4/5 Pmt Use PMT function (adjust beginning value to reflect ending balance for year 3 and shorten to a 12 year loan using new rate Payment Interest Principal Ending Balance Month Beginning Balance 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Closing Fully Amortizing ARM Interest Only 1) Use the data provided in the case description to complete the Buyer's and Sellers' Closing Statements below: Cash 270,000 Cash 270,000 Summary of Buyer's Transaction Amount Due from Buyer Contract Purchase Price Plus: Settlement Charges Less: Property Tax Proration Less: Earnest Money Lesss: Mortgage Loan Net Amount Due from Buyer Summary of Sellers' Transaction Amount Due to Seller Contract Sale Price Less: Property Tax Proration Less: Payoff of Existing Loan Less: Settlement Charges Gross Amount Due to Seller Seller's Share of Settlement Charges Brokerage Commission Buyer's Share of Settlement Charges Items Payable in Connection with a Loan Loan Origination Fee Appraisal Fee Homeowner's Insurance Credit Report 2,160 400 1,586 Title Charges Title Service and Title Insurance Deed Preparation 25 Government Recording Charges: Courier Fees 25 Title Charges Title Service and Title Insurance Deed Preparation 800 25 Government Recording Charges: Endorsements Courier Fees 150 25 Total Settlement Charges Total Settlement Charges Total Expenses Purchase Price Expenses as % of Price Closing Fully Amortizing Total Expenses Purchase Price Expenses as % of Price Interest Only ARM Assumptions: Purchase Price Loan Term (years) Interest Rate 270,000 15 4.75% Calculations: Down Payment Beginning Loan Balance Monthly Loan Payment Payment Interest Principal Ending Balance Month Beginning Balance 1 2 N 3 3 4 st 5 6 7 8 9 10 11 12 13 upBB 14 15 16 17 18 Closing Fully Amortizing ARM Interest Only Assumptions: Purchase Price Loan Term (years) Initial Interest Rate Years until Reset Year 4 and 5 Rate 270,000 15 3.00% 3 6.00% Calculations: Down Payment Beginning Loan Balance Initial Monthly Pmt Year 4/5 Pmt Use PMT function (adjust beginning value to reflect ending balance for year 3 and shorten to a 12 year loan using new rate Payment Interest Principal Ending Balance Month Beginning Balance 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Closing Fully Amortizing ARM Interest Only