Answered step by step

Verified Expert Solution

Question

1 Approved Answer

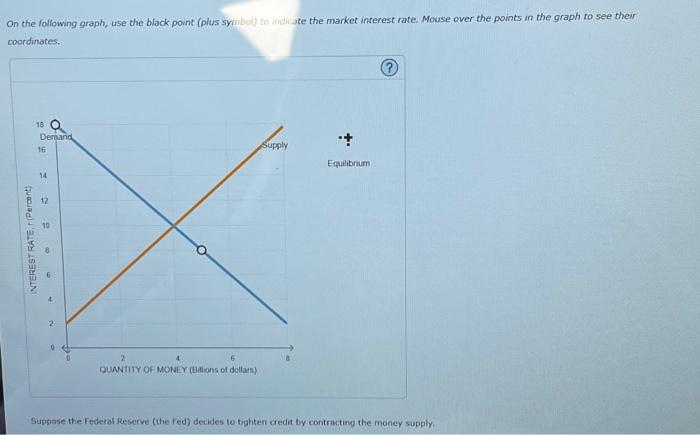

On the following graph, use the black point (plus symbol) to indicate the market interest rate. Mouse over the points in the graph to see

On the following graph, use the black point (plus symbol) to indicate the market interest rate. Mouse over the points in the graph to see their coordinates. Where does the market interest rate need to be placed on the graph in the picture?

5. Themarket for capital Firms require capital to invest in productive opportunities. The best firms with the most profitable opportunities can attract capital away from inefficient firms with less profitable opportunities. Investors supply firms with capital at a cost calied the interest rate. The interest rate that investors require is determined by several factors, including the availability of production opportunities, the time preference for current consumption, risk, and inflation. The following graph shows the supply of and demand for capital in a market. The upward-sloping supply curve suggests that investors are willing to invest more (delay more current consumption) in exchange for higher interest rates. The downward-sloping demand curve suggests that borrowers of capital (companies) will fund thear most profitable opportunities first and their least profitable opportunities later. This fact explains why they are wiling to pay a father high price (interest rate) for capital initially, but also why their appecite for capital decreases over time. On the following graph, use the black point (plus symbol) to indicate the market interest rate. Mouse over the points in the graph to see their coordinates. On the following graph, use the black point (plus symbol) to kidrate the market interest rate. Mouse over the points in the graph to see their coordinates. Suppose the federal Reserve (the fed) decides to tighten credit by contracting the money supply Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started