Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On the last day of its fiscal year ending December 31, 2024, the Safe & Reliable (S&R) Glass Company completed two financing arrangements. The funds

On the last day of its fiscal year ending December 31, 2024, the Safe & Reliable (S&R) Glass Company completed two financing arrangements. The funds provided by these initiatives will allow the company to expand its operations.

- S&R issued 8% stated rate bonds with a face amount of $100 million. The bonds mature on December 31, 2044 (20 years). The market rate of interest for similar bond issues was 9% (4.5% semiannual rate). Interest is paid semiannually (4%) on June 30 and December 31, beginning on June 30, 2025.

- The company leased two manufacturing facilities. Lease A requires 20 annual lease payments of $200,000 beginning on January 1, 2025. Lease B also is for 20 years, beginning January 1, 2025. Terms of the lease require 17 annual lease payments of $220,000 beginning on January 1, 2028. Generally accepted accounting principles require both leases to be recorded as liabilities for the present value of the scheduled payments. Assume that a 10% interest rate properly reflects the time value of money for the lease obligations.

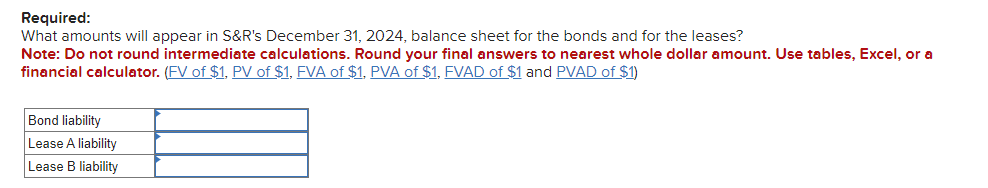

Required: What amounts will appear in S\&R's December 31, 2024, balance sheet for the bonds and for the leases? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1,PV of $1,FVA of $1,PVA of $1,FVAD of $1 and PVAD of $1 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started