example given below Tasks: 1. Using the residual income model, prepare a valuation of the common stock of Best Buy as of Year 2 under

example given below

example given below

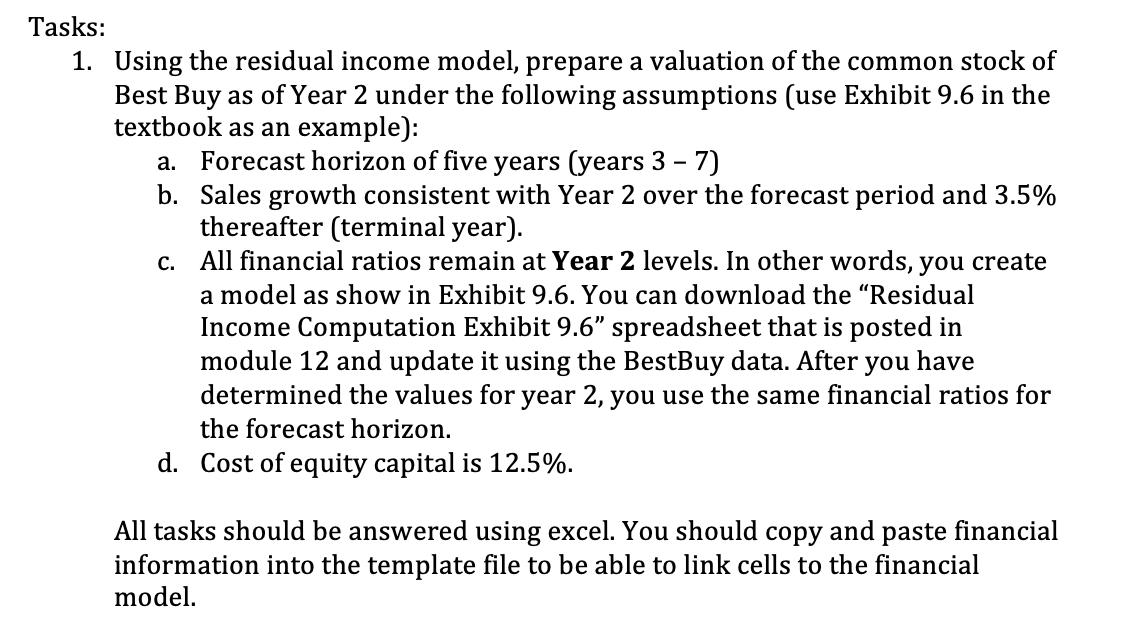

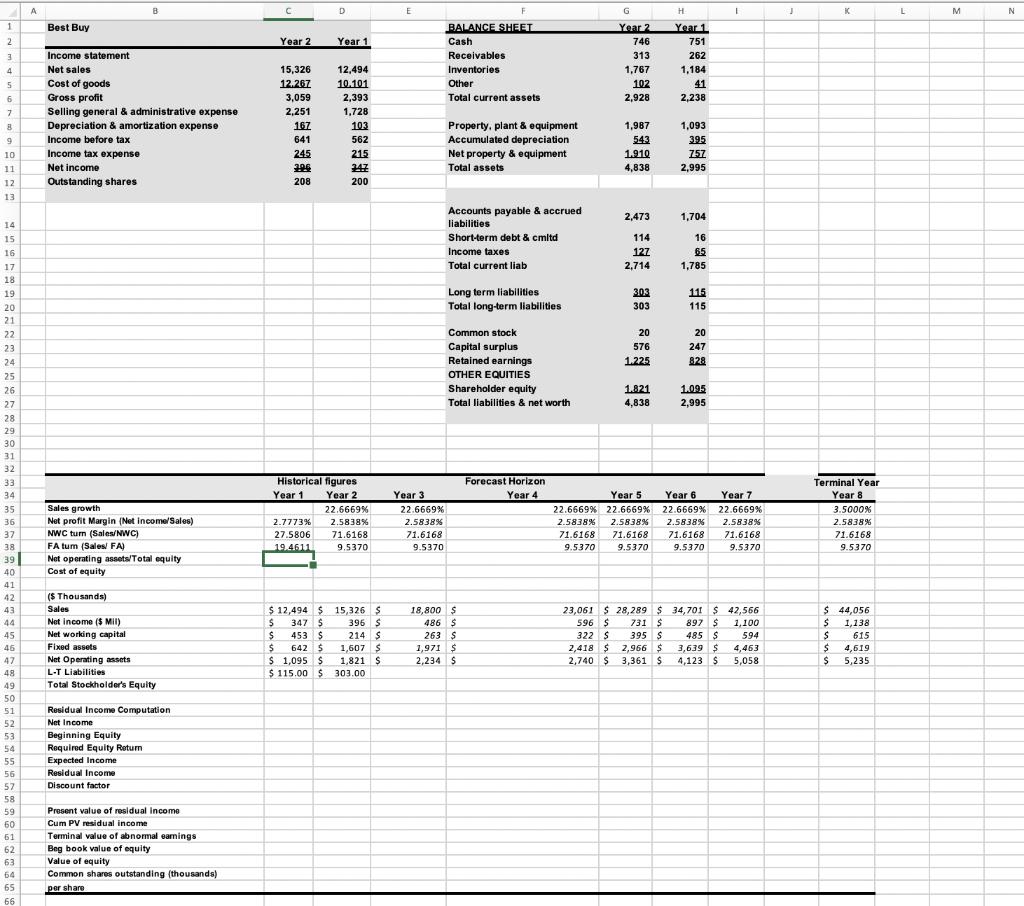

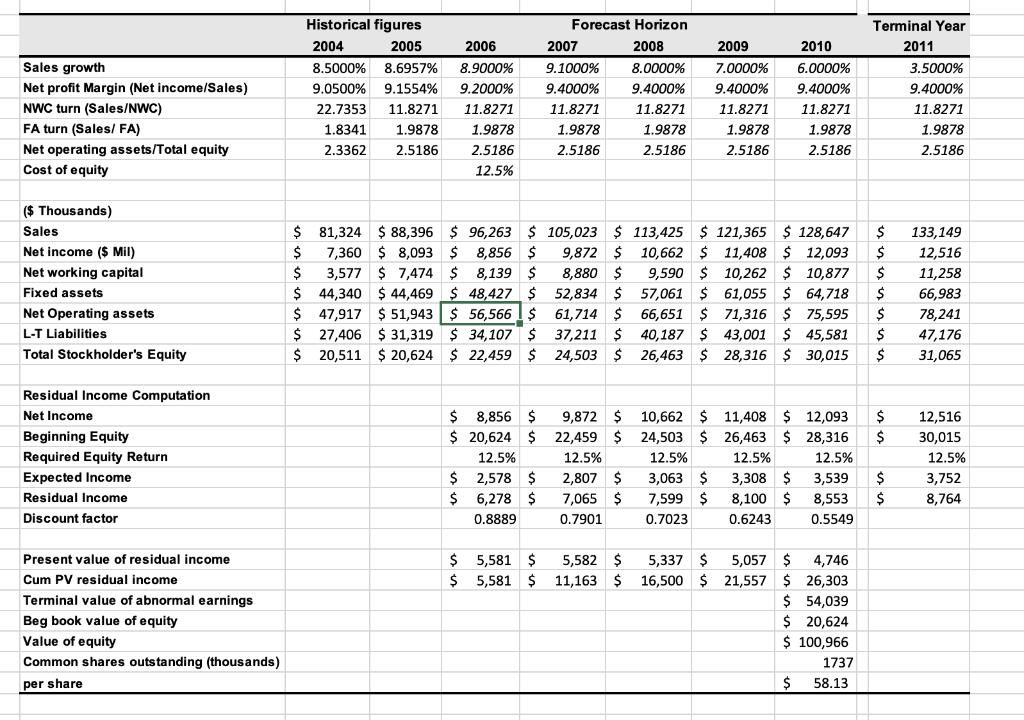

Tasks: 1. Using the residual income model, prepare a valuation of the common stock of Best Buy as of Year 2 under the following assumptions (use Exhibit 9.6 in the textbook as an example): a. Forecast horizon of five years (years 3 - 7) b. Sales growth consistent with Year 2 over the forecast period and 3.5% thereafter (terminal year). c. All financial ratios remain at Year 2 levels. In other words, you create a model as show in Exhibit 9.6. You can download the "Residual Income Computation Exhibit 9.6" spreadsheet that is posted in module 12 and update it using the BestBuy data. After you have determined the values for year 2, you use the same financial ratios for the forecast horizon. d. Cost of equity capital is 12.5%. All tasks should be answered using excel. You should copy and paste financial information into the template file to be able to link cells to the financial model.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for valuing Best Buy common stock using the residual income mod...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started