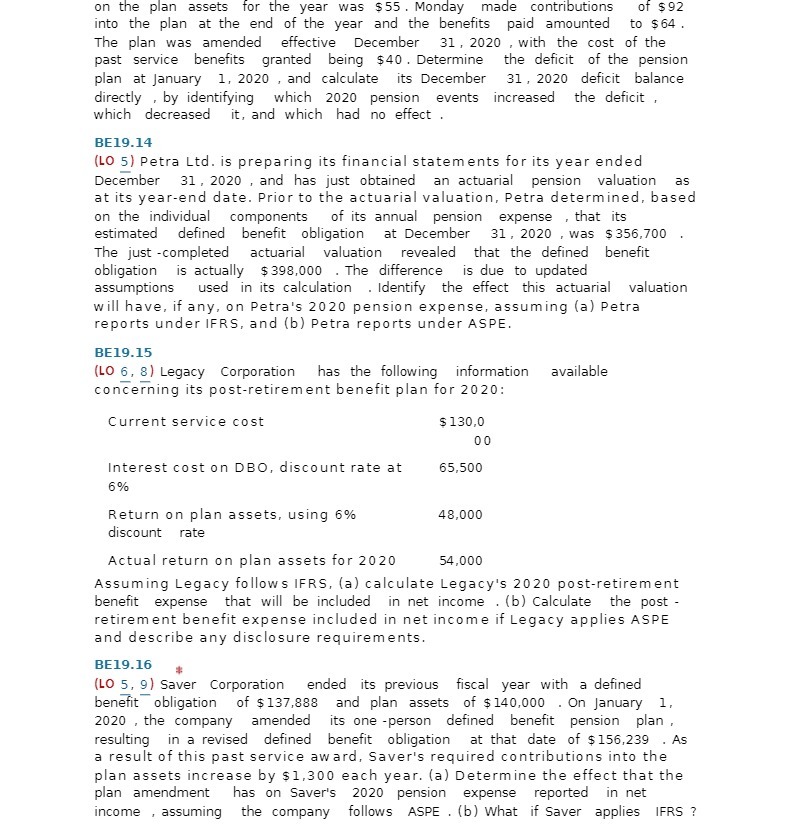

on the plan assets for the year was $55 . Monday made contributions of $92 into the plan at the end of the year and the benefits paid amounted to $64 . The plan was amended effective December 31 , 2020 , with the cost of the past service benefits granted being $40 . Determine the deficit of the pension plan at January 1, 2020 , and calculate its December 31 , 2020 deficit balance directly , by identifying which 2020 pension e events increased the deficit , which decreased it, and which had no effect . BE19.14 (LO 5) Petra Ltd. is preparing its financial statements for its year ended December 31 , 2020 , and has just obtained an actuarial pension valuation as at its year-end date. Prior to the actuarial valuation, Petra determined, based on the individual components of its annual pension expense , that its estimated defined benefit obligation at December 31 , 2020 , was $ 356,700 The just -completed actuarial valuation revealed that the defined benefit obligation is actually $398,000 . The difference is due to updated assumptions used in its calculation . Identify the effect this actuarial valuation will have, if any, on Petra's 2020 pension expense, assuming (a) Petra reports under IFRS, and (b) Petra reports under ASPE. BE19.15 (LO 6, 8) Legacy Corporation has the following information available concerning its post-retirement benefit plan for 2020: Current service cost $ 130,0 00 Interest cost on DBO, discount rate at 65,500 6% Return on plan assets, using 6% 48,000 discount rate Actual return on plan assets for 2020 54,000 Assuming Legacy follows IFRS, (a) calculate Legacy's 2020 post-retirement benefit expense that will be included in net income . (b) Calculate the post - retirement benefit expense included in net income if Legacy applies ASPE and describe any disclosure requirements. BE19.16 (LO 5, 9) Saver Corporation ended its previous fiscal year with a defined benefit obligation of $137,888 and plan assets of $ 140,000 . On January 1, 2020 , the company amended its one -person defined benefit pension plan , resulting in a revised defined benefit obligation at that date of $ 156,239 . As a result of this past service award, Saver's required contributions into the plan assets increase by $1,300 each year. (a) Determine the effect that the plan amendment has on Saver's 2020 pension expense reported in net income , assuming the company follows ASPE . (b) What if Saver applies IFRS