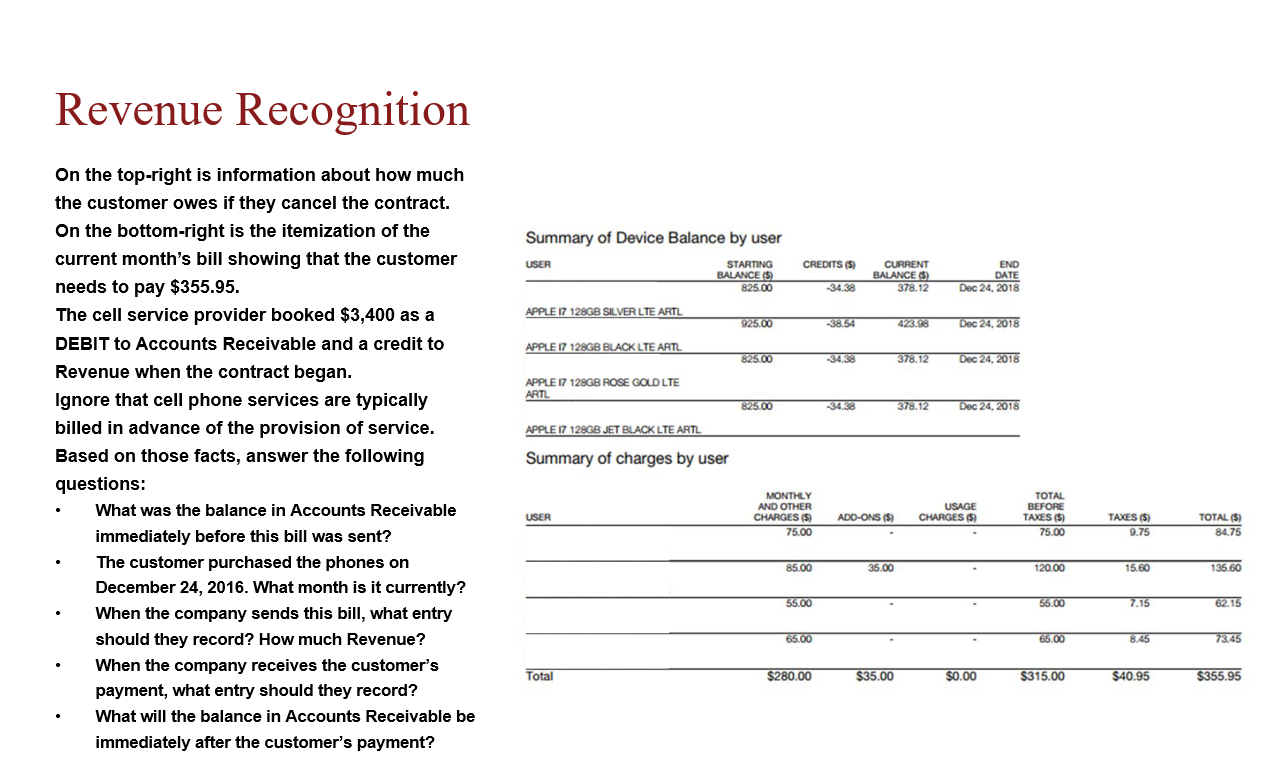

On the top-right is information about how much the customer owes if they cancel the contract.

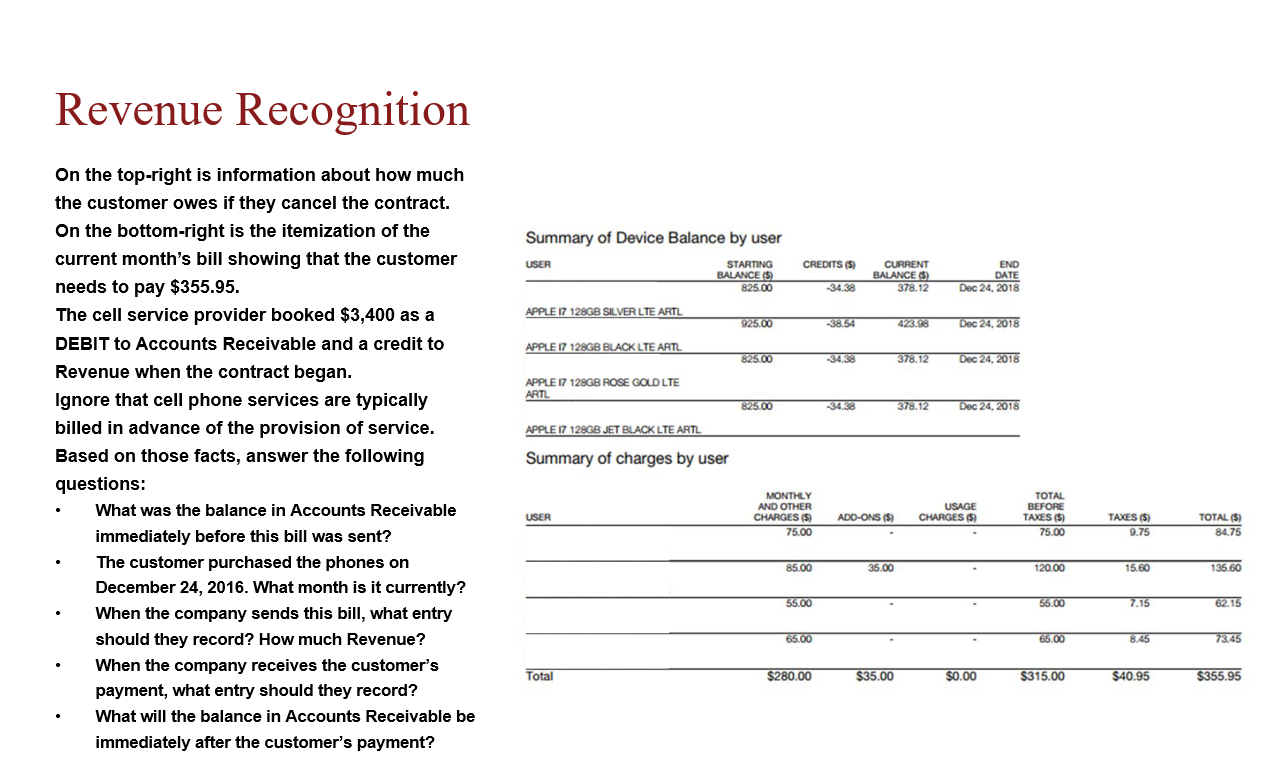

On the bottom-right is the itemization of the current months bill showing that the customer needs to pay $355.95.

The cell service provider booked $3,400 as a DEBIT to Accounts Receivable and a credit to Revenue when the contract began.

Ignore that cell phone services are typically billed in advance of the provision of service.

Based on those facts, answer the following questions:

What was the balance in Accounts Receivable immediately before this bill was sent?

The customer purchased the phones on December 24, 2016. What month is it currently?

When the company sends this bill, what entry should they record? How much Revenue?

When the company receives the customers payment, what entry should they record?

What will the balance in Accounts Receivable be immediately after the customers payment?

Revenue Recognition Summary of Device Balance by user USER CREDITS (5) STARTING BALANCES 825.00 CURRENT BALANCES 378.12 END DATE Dec 24, 2018 -34.38 APPLE I7 128GB SILVER LTE ARTL 925.00 4279 Dec 24, 2018 APPLE 17 128GB BLACK LTE ARTL 825.00 378.12 Dec 24, 2018 APPLE I7 128GB ROSE GOLD LTE ARTL 825.00 378.12 Dec 24, 2018 APPLE 17 128GB JET BLACK LTE ARTL On the top-right is information about how much the customer owes if they cancel the contract. On the bottom-right is the itemization of the current month's bill showing that the customer needs to pay $355.95. The cell service provider booked $3,400 as a DEBIT to Accounts Receivable and a credit to Revenue when the contract began. Ignore that cell phone services are typically billed in advance of the provision of service. Based on those facts, answer the following questions: What was the balance in Accounts Receivable immediately before this bill was sent? The customer purchased the phones on December 24, 2016. What month is it currently? When the company sends this bill, what entry should they record? How much Revenue? When the company receives the customer's payment, what entry should they record? What will the balance in Accounts Receivable be immediately after the customer's payment? Summary of charges by user MONTHLY AND OTHER CHARGES (5) 75.00 USER TOTAL BEFORE TAXES (5) USAGE CHARGES (5) ADD-ONS (5) TOTAL (5) 75.00 TAXES ($) 9.75 84.75 85.00 35.00 120.00 15.60 135.60 55.00 55.00 7.15 62.15 65.00 65.00 8.45 73.45 Total $280.00 $35.00 $0.00 $315.00 $40.95 $355.95 Revenue Recognition Summary of Device Balance by user USER CREDITS (5) STARTING BALANCES 825.00 CURRENT BALANCES 378.12 END DATE Dec 24, 2018 -34.38 APPLE I7 128GB SILVER LTE ARTL 925.00 4279 Dec 24, 2018 APPLE 17 128GB BLACK LTE ARTL 825.00 378.12 Dec 24, 2018 APPLE I7 128GB ROSE GOLD LTE ARTL 825.00 378.12 Dec 24, 2018 APPLE 17 128GB JET BLACK LTE ARTL On the top-right is information about how much the customer owes if they cancel the contract. On the bottom-right is the itemization of the current month's bill showing that the customer needs to pay $355.95. The cell service provider booked $3,400 as a DEBIT to Accounts Receivable and a credit to Revenue when the contract began. Ignore that cell phone services are typically billed in advance of the provision of service. Based on those facts, answer the following questions: What was the balance in Accounts Receivable immediately before this bill was sent? The customer purchased the phones on December 24, 2016. What month is it currently? When the company sends this bill, what entry should they record? How much Revenue? When the company receives the customer's payment, what entry should they record? What will the balance in Accounts Receivable be immediately after the customer's payment? Summary of charges by user MONTHLY AND OTHER CHARGES (5) 75.00 USER TOTAL BEFORE TAXES (5) USAGE CHARGES (5) ADD-ONS (5) TOTAL (5) 75.00 TAXES ($) 9.75 84.75 85.00 35.00 120.00 15.60 135.60 55.00 55.00 7.15 62.15 65.00 65.00 8.45 73.45 Total $280.00 $35.00 $0.00 $315.00 $40.95 $355.95