On the Trial Balance sheet, label two columns, Debit and Credit, and move the amounts into the proper columns to show the correct debit and credit balances, and prove that the columns balance. Using the Trial Balance sheet with the appropriate balances create a properly labeled and formatted Income Statement and Balance Sheet.Be sure to use proper GAAP formatting on each statement. show the formula, and calculate the following ratios.

- Current Ratio

- Gross Profit Ratio

- Debt to Equity Ratio

- Acid Test (Quick Ratio)

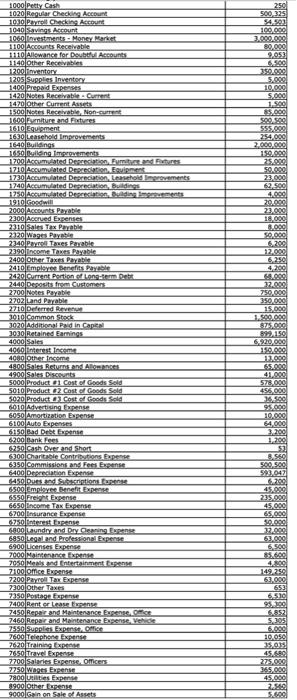

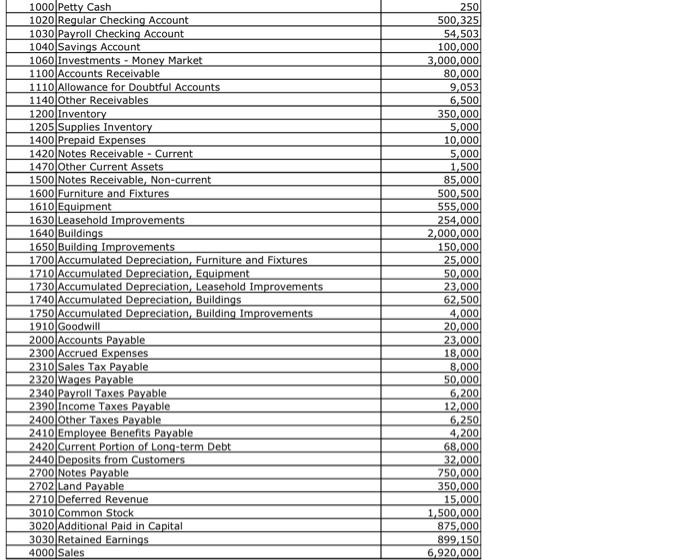

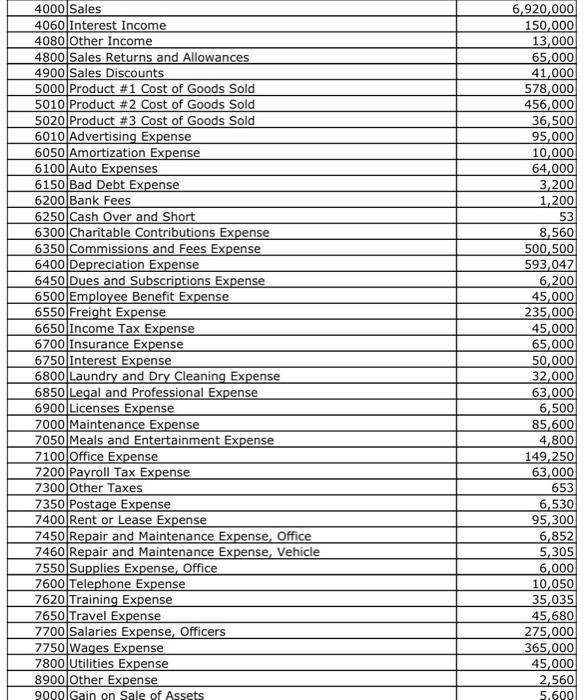

\begin{tabular}{|c|c|c|} \hline 1000/P12 & Petty Cash & 250 \\ \hline 1020 & Regular Cheding Accoung & 500,325 \\ \hline 1030 & Perroll Coecking Ascoum & 54,503 \\ \hline 1040 & Sovings Aecount & 100,000 \\ \hline 1060 & Inestments - Moner Merket & 3.000000 \\ \hline 1100 & Accounts Receivable. & 82,000 \\ \hline 11100 & Alswance for Deubtifu Acebunts. & 3,053 \\ \hline 1140 & Other Recrovablet & 5.500 \\ \hline 1200 & imventory & 35000 \\ \hline 1205 & Supplies inventoo & 5.000 \\ \hline 1400 & Prepaid Expensts & 10.00C \\ \hline 14201 & Nutes Recelvable - Current & 5,000 \\ \hline 1470 & Other Current Asseds & 1.500 \\ \hline 1500 & Nates Rectehrable, Non-cuires & 85,000 \\ \hline 1600 & Fumiture and Fatyeres & sogsec \\ \hline 1610 & Equigment & cos5000 \\ \hline 1630L & Leasehold Improverments & 254,000 \\ \hline 1640 & Bullings & 2,000,000 \\ \hline 1650 & Pyllesing improvements. & 150,000 \\ \hline 1700 & & 25,000 \\ \hline 17210 & Accumulated Depreclytion, Feyipmens. & 50000 \\ \hline 1730 & Accumulated Dearnciation, Leanehold Inesovements & 23,000 \\ \hline 17400 & Aceumulated Derareciation, Buldiness & 62,500 \\ \hline & & 4.000 \\ \hline 1910 & Croofwill & 20,000 \\ \hline 2000 & Accounts Parable & 23,000 \\ \hline 2300 & Accrued Expenses & 18,000 \\ \hline 23105 & Salm Tex Pryabie & 8.000 \\ \hline & Wages Payabie & 50,000 \\ \hline 2340 & Prynel Touses Porable. & 6.200 \\ \hline 2390 & Income Taxes Payable. & 12,000 \\ \hline 24000 & Other Taxes Parabie & 6.250 \\ \hline 24101 & Empleyree Benefits Fayole & 4,200 \\ \hline 2420 & Current Portion of ions-term pets. & sin000 \\ \hline 244010 & Desoeits frem Customer: & 52000 \\ \hline 2700 & Noses Parable & 750,000 \\ \hline 2702 & Land Parabir & 350,000 \\ \hline 27100 & Deferred Revenue & 15,000 \\ \hline 3010 & Common Stack & 1.500,000 \\ \hline 3020 & Additiongl Paid in Caperd. & 8500 \\ \hline 3030 & Retained Eamings & 83.150 \\ \hline 4000 & Soles & 6.920,000 \\ \hline 4000 & Interest inctime & 180.000 \\ \hline 4000 & Diner income & 12000 \\ \hline 4800 & Sales Returns and Aliomencet: & 65.000 \\ \hline 49005 & Soles Dereverts. & 41.000 \\ \hline 5000 & Preduct of Cost of Coods Seld & 578,000 \\ \hline 5010 & Product 12 Cost of Cosds Sold & 456,000 \\ \hline 5020 & Product a) Cost ef Coods Sold & \\ \hline 6010 & Afvertising Expense & sog \\ \hline 6050 & Amortization Expense. & 10,006 \\ \hline 6100 & Aute Expenses & 64,000 \\ \hline 6450 & Ead Drbt Expense. & 3,200 \\ \hline 62001 & Bank fees & 1.200 \\ \hline 6250 & Cash oxe and Short & 53 \\ \hline 6300 & Charitable Contripations Experese & 8.580 \\ \hline 6350 & Commissions bnd Fees Exasnse & 500.500 \\ \hline 6400 & Despreciasion Expense. & 53,047 \\ \hline 8450 & Dues end Sabstriptions tapente & 6.200 \\ \hline 65001 & Emploxe lenchit Fxperse. & 45,000 \\ \hline 6550. & Frelohs Exgense. & 235.000 \\ \hline 66501 & Income Tax Expense & 45,000 \\ \hline 6700 & Insurance Expense & 65,000 \\ \hline 6750 & finterest Fupense & 58000 \\ \hline 6900 & Layndry and Pry Ciepning Eupesne: & \\ \hline 69501 & Legal and Prolestiond I Expense. & 53,000 \\ \hline 6900 & Licenses Expense & 6.590 \\ \hline 7000 & Maintenence fxpente. & 85.600 \\ \hline 7050 & Meals end Intertainment fepense & \\ \hline 7100 & office Expenge & 149.240 \\ \hline 2200 & Parnoll Tax Expense & 63,000 \\ \hline 23000 & Other Taxes & 653 \\ \hline 73sop & Poultage fupense & 6.510 \\ \hline 7400 & Rent er lease trpense & os 200 \\ \hline 74501 & Repair and Maintensnce Fupense, Cefice. & 5.852 \\ \hline 7460 & Repar and Maintensnce Expense, Yehide & 5,305 \\ \hline 7550 & Supples Expenst, CHise & 6000 \\ \hline 7600 & Telephose Expense & 10,050 \\ \hline 7620 & Training fxpetsen & 35,053 \\ \hline 7650 & Travel Pxperder & 45. Ses. \\ \hline & Salaries Expense, Officers. & 275,000 \\ \hline 7350 & Wages Erpense & 365.000 \\ \hline 7800 & ugillies Expenst & 45,000 \\ \hline 8900 & Other Erense & 2.50 \\ \hline 9000 & Gain on Sale of Asuets & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline 4000 & Sales & 6,920,000 \\ \hline 4060 & Interest Income & 150,000 \\ \hline 4080 & Other Income & 13,000 \\ \hline 4800 & Sales Returns and Allowances & 65,000 \\ \hline 4900 & Sales Discounts & 41,000 \\ \hline 5000 & Product \#1 Cost of Goods Sold & 578,000 \\ \hline 5010 & Product #2 Cost of Goods Sold & 456,000 \\ \hline 5020 & Product #3 Cost of Goods Sold & 36,500 \\ \hline 6010 & Advertising Expense & 95,000 \\ \hline 6050 & Amortization Expense & 10,000 \\ \hline 6100 & Auto Expenses & 64,000 \\ \hline 6150 & Bad Debt Expense & 3,200 \\ \hline 6200 & Bank Fees & 1,200 \\ \hline 6250 & Cash Over and Short & 53 \\ \hline 6300 & Charitable Contributions Expense & 8,560 \\ \hline 6350 & Commissions and Fees Expense & 500,500 \\ \hline 6400 & Depreciation Expense & 593,047 \\ \hline 6450 & Dues and Subscriptions Expense & 6,200 \\ \hline 6500 & Employee Benefit Expense & 45,000 \\ \hline 6550 & Freight Expense & 235,000 \\ \hline 6650 & Income Tax Expense & 45,000 \\ \hline 6700 & Insurance Expense & 65,000 \\ \hline 6750 & Interest Expense & 50,000 \\ \hline 6800 & Laundry and Dry Cleaning Expense & 32,000 \\ \hline 6850 & Legal and Professional Expense & 63,000 \\ \hline 6900 & Licenses Expense & 6,500 \\ \hline 7000 & Maintenance Expense & 85,600 \\ \hline 7050 & Meals and Entertainment Expense & 4,800 \\ \hline 7100 & Office Expense & 149,250 \\ \hline 7200 & Payroll Tax Expense & 63,000 \\ \hline 7300 & Other Taxes & 653 \\ \hline 7350 & Postage Expense & 6,530 \\ \hline 7400 & Rent or Lease Expense & 95,300 \\ \hline 7450 & Repair and Maintenance Expense, Office & 6,852 \\ \hline 7460 & Repair and Maintenance Expense, Vehicle & 5,305 \\ \hline 7550 & Supplies Expense, Office & 6,000 \\ \hline 7600 & Telephone Expense & 10,050 \\ \hline 7620 & Training Expense & 35,035 \\ \hline 7650 & Travel Expense & 45,680 \\ \hline 7700 & Salaries Expense, Officers & 275,000 \\ \hline 7750 & Wages Expense & 365,000 \\ \hline 7800 & Utilities Expense & 45,000 \\ \hline 8900 & Other Expense & 2,560 \\ \hline 9000 & Gain on Sale of As & 5.600 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 1000 & Petty Cash & 250 \\ \hline 1020 & Regular Checking Account & 500,325 \\ \hline 1030 & Payroll Checking Account & 54,503 \\ \hline 1040 & Savings Account & 100,000 \\ \hline 1060 & Investments - Money Market & 3,000,000 \\ \hline 1100 & Accounts Receivable & 80,000 \\ \hline 1110 & Allowance for Doubtful Accounts & 9,053 \\ \hline 1140 & Other Receivables & 6,500 \\ \hline 1200 & Inventory & 350,000 \\ \hline 1205 & Supplies Inventory & 5,000 \\ \hline 1400 & Prepaid Expenses & 10,000 \\ \hline 1420 & Notes Receivable - Current & 5,000 \\ \hline 1470 & Other Current Assets & 1,500 \\ \hline 1500 & Notes Receivable, Non-Current & 85,000 \\ \hline 1600 & Furniture and Fixtures & 500,500 \\ \hline 1610 & Equipment & 555,000 \\ \hline 1630 & Leasehold Improvements & 254,000 \\ \hline 1640 & Buildings & 2,000,000 \\ \hline 1650 & Building Improvements & 150,000 \\ \hline 1700 & Accumulated Depreciation, Furniture and Fixtures & 25,000 \\ \hline 1710 & Accumulated Depreciation, Equipment & 50,000 \\ \hline 1730 & Accumulated Depreciation, Leasehold Improvements & 23,000 \\ \hline 1740 & Accumulated Depreciation, Buildings & 62,500 \\ \hline 1750 & Accumulated Depreciation, Building Improvements & 4,000 \\ \hline 1910 & Goodwill & 20,000 \\ \hline 2000 & Accounts Payable & 23,000 \\ \hline 2300 & Accrued Expenses & 18,000 \\ \hline 2310 & Sales Tax Payable & 8,000 \\ \hline 2320 & Wages Payable & 50,000 \\ \hline 2340 & Payroll Taxes Payable & 6,200 \\ \hline 2390 & Income Taxes Payable & 12,000 \\ \hline 2400 & Other Taxes Payable & 6,250 \\ \hline 2410 & Employee Benefits Payable & 4,200 \\ \hline 2420 & Current Portion of Long-term Debt & 68,000 \\ \hline 2440 & Deposits from Customers & 32,000 \\ \hline 2700 & Notes Payable & 750,000 \\ \hline 2702 & Land Payable & 350,000 \\ \hline 2710 & Deferred Revenue & 15,000 \\ \hline 3010 & Common Stock & 1,500,000 \\ \hline 3020 & Additional Paid in Capital & 875,000 \\ \hline 3030 & Retained Eamings & 899,150 \\ \hline 4000 & Sales & 6,920,000 \\ \hline \end{tabular}