Answered step by step

Verified Expert Solution

Question

1 Approved Answer

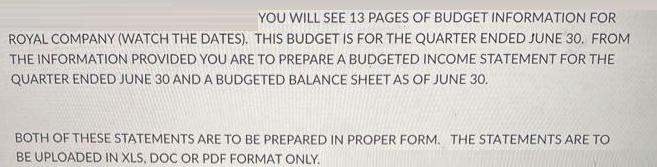

YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM

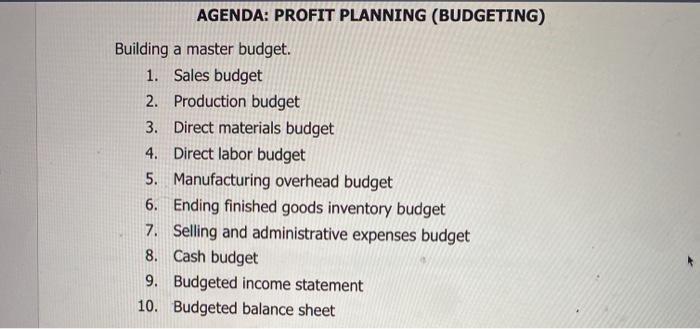

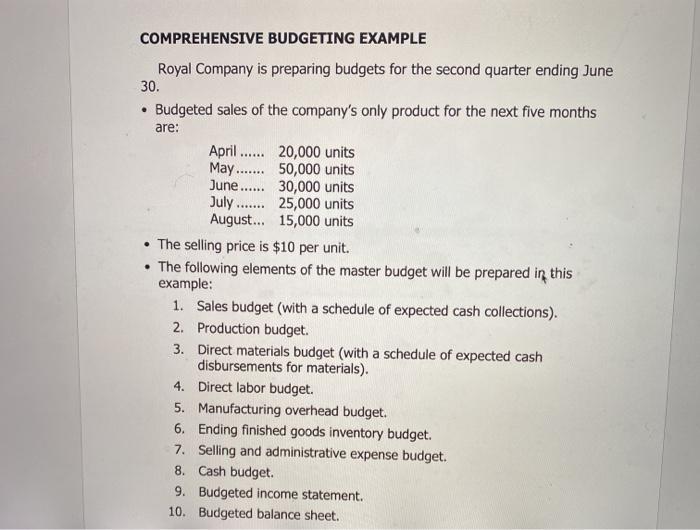

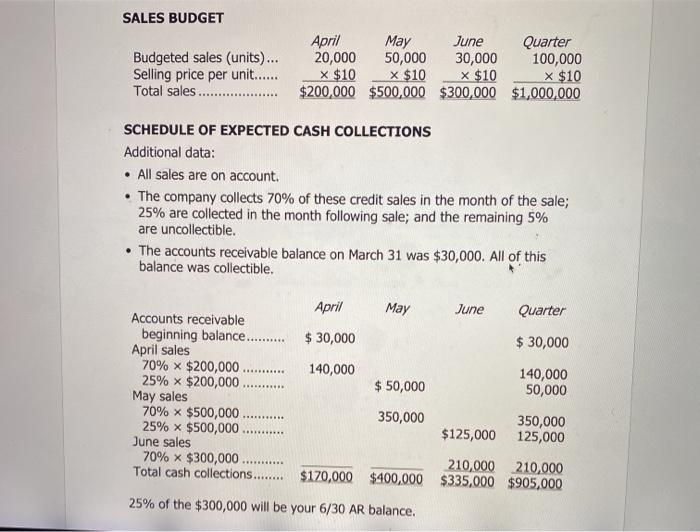

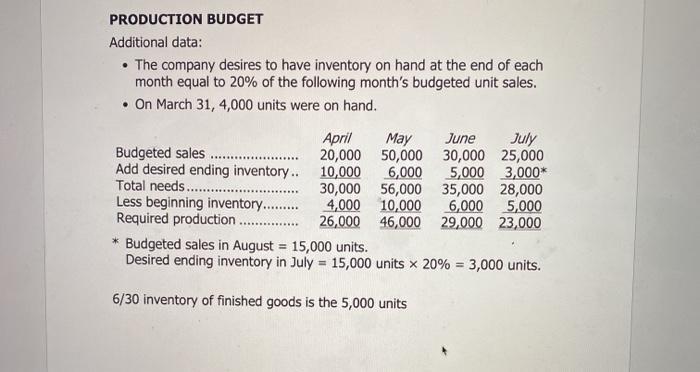

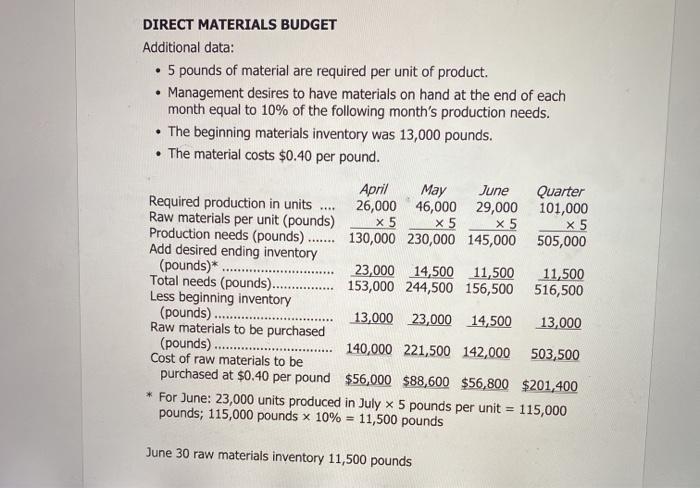

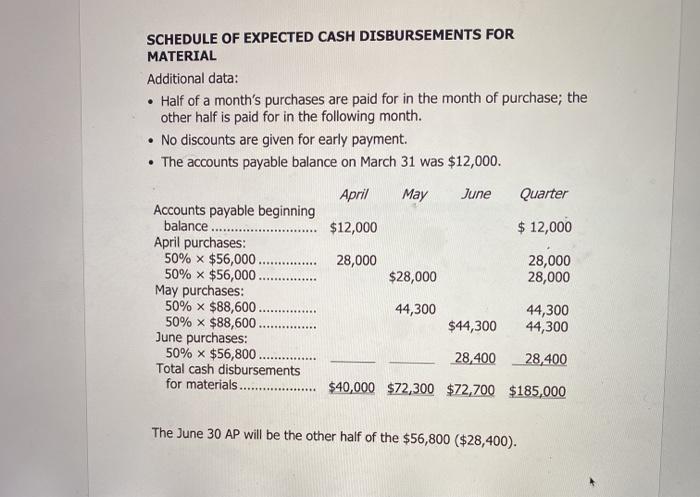

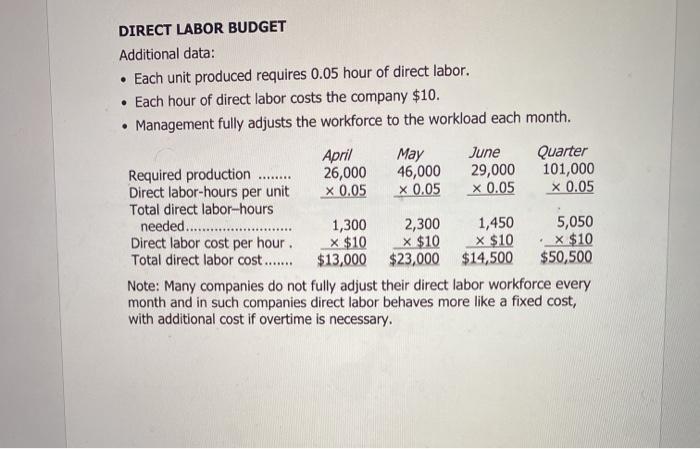

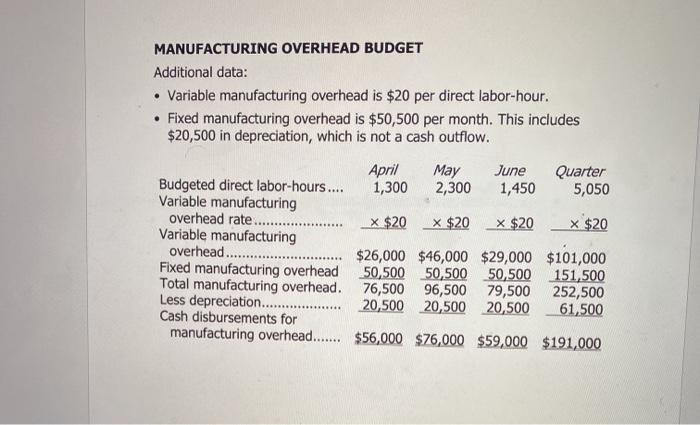

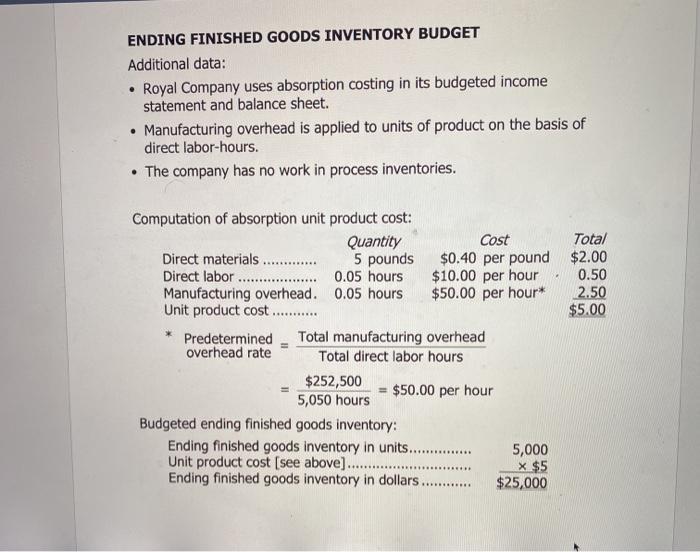

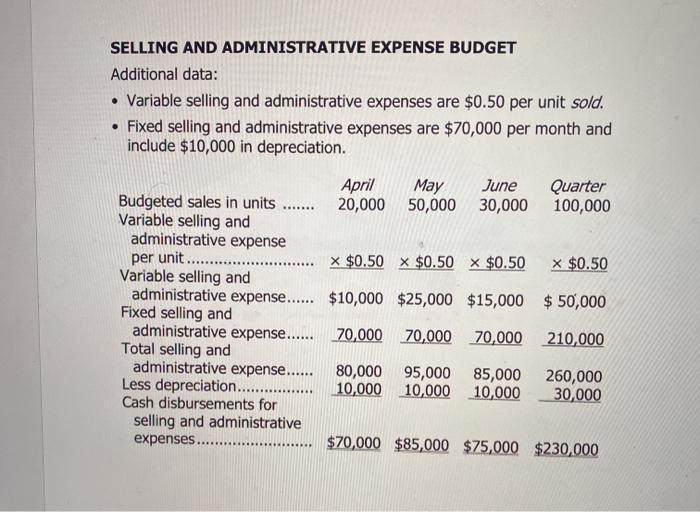

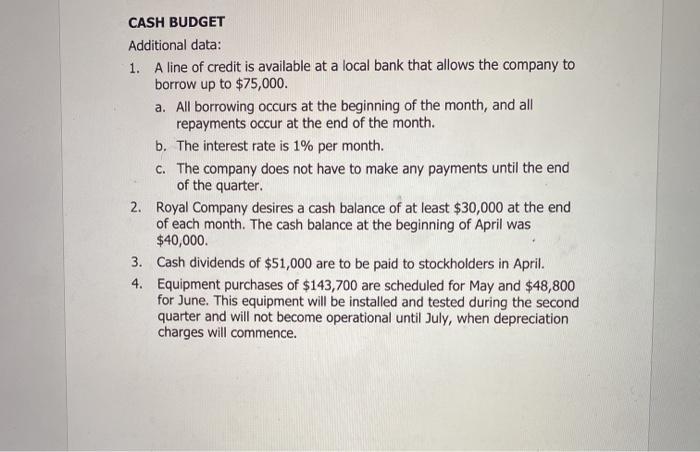

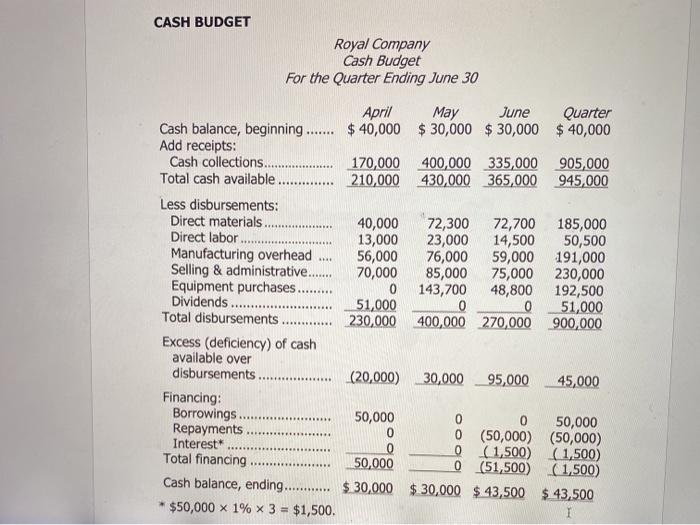

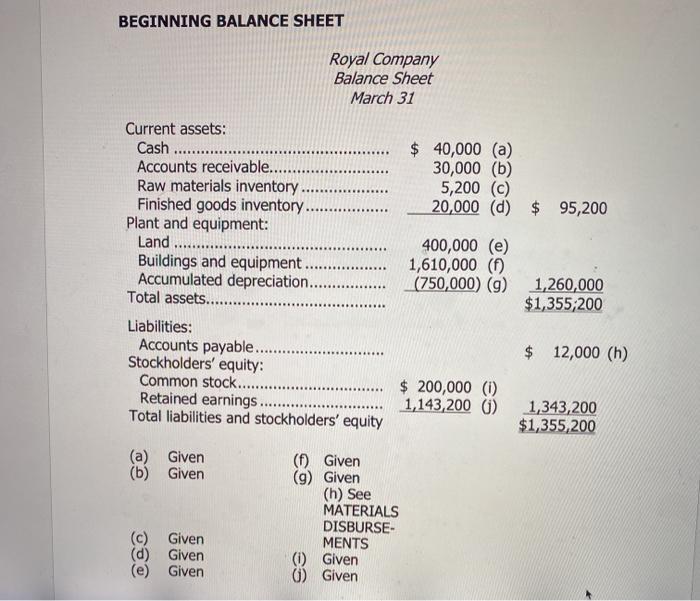

YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM THE INFORMATION PROVIDED YOU ARE TO PREPARE A BUDGETED INCOME STATEMENT FOR THE QUARTER ENDED JUNE 30 AND A BUDGETED BALANCE SHEET AS OF JUNE 30. BOTH OF THESE STATEMENTS ARE TO BE PREPARED IN PROPER FORM. THE STATEMENTS ARE TO BE UPLOADED IN XLS, DOC OR PDF FORMAT ONLY. AGENDA: PROFIT PLANNING (BUDGETING) Building a master budget. 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Manufacturing overhead budget 6. Ending finished goods inventory budget 7. Selling and administrative expenses budget 8. Cash budget 9. Budgeted income statement 10. Budgeted balance sheet COMPREHENSIVE BUDGETING EXAMPLE Royal Company is preparing budgets for the second quarter ending June 30. Budgeted sales of the company's only product for the next five months are: April . 20,000 units May. June. 30,000 units July. August... 15,000 units 50,000 units ....... ...... 25,000 units ....... The selling price is $10 per unit. The following elements of the master budget will be prepared in this example: 1. Sales budget (with a schedule of expected cash collections). 2. Production budget. 3. Direct materials budget (with a schedule of expected cash disbursements for materials). 4. Direct labor budget. 5. Manufacturing overhead budget. 6. Ending finished goods inventory budget. 7. Selling and administrative expense budget. 8. Cash budget. 9. Budgeted income statement. 10. Budgeted balance sheet. SALES BUDGET pril 20,000 x $10 May 50,000 June Budgeted sales (units)... Selling price per unit.. Total sales. Quarter 100,000 x $10 30,000 x $10 x $10 $200,000 $500,000 $300,000 $1,000,000 SCHEDULE OF EXPECTED CASH COLLECTIONS Additional data: All sales are on account. The company collects 70% of these credit sales in the month of the sale; 25% are collected in the month following sale; and the remaining 5% are uncollectible. The accounts receivable balance on March 31 was $30,000. All of this balance was collectible. April May June Quarter Accounts receivable beginning balance. . $ 30,000 April sales 70% x $200,000. 25% x $200,000. May sales 70% x $500,000. 25% x $500,000 . June sales 70% x $300,000 . Total cash collections.. $ 30,000 140,000 140,000 50,000 ........ $ 50,000 ......... 350,000 350,000 125,000 $125,000 210,000 210,000 $170,000 $400,000 $335,000 $905,000 25% of the $300,000 will be your 6/30 AR balance. PRODUCTION BUDGET Additional data: The company desires to have inventory on hand at the end of each month equal to 20% of the following month's budgeted unit sales. On March 31, 4,000 units were on hand. April July May 20,000 50,000 30,000 25,000 6,000 30,000 56,000 35,000 28,000 6,000 26,000 46,000 29,000 23,000 June Budgeted sales ... Add desired ending inventory.. Total needs.. Less beginning inventory. . Required production. 10,000 5,000 3,000* 4,000 10,000 5,000 * Budgeted sales in August = 15,000 units. Desired ending inventory in July = 15,000 units x 20% = 3,000 units. 6/30 inventory of finished goods is the 5,000 units DIRECT MATERIALS BUDGET Additional data: 5 pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 10% of the following month's production needs. The beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound. May 46,000 x 5 130,000 230,000 145,000 April 26,000 x 5 Quarter 29,000 101,000 x 5 505,000 June Required production in units .. Raw materials per unit (pounds) Production needs (pounds) .. Add desired ending inventory (pounds)* Total needs (pounds).. Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound $56,000 $88,600 $56,800 $201,400 x 5 ....... 23,000 14,500 11,500 153,000 244,500 156,500 11,500 516,500 13,000 23,000 14,500 13,000 140,000 221,500 142,000 503,500 * For June: 23,000 units produced in July x 5 pounds per unit pounds; 115,000 pounds x 10% = 11,500 pounds 115,000 June 30 raw materials inventory 11,500 pounds SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Additional data: Half of a month's purchases are paid for in the month of purchase; the other half is paid for in the following month. No discounts are given for early payment. The accounts payable balance on March 31 was $12,000. April May June Quarter Accounts payable beginning balance. April purchases: 50% x $56,000. 50% x $56,000. May purchases: 50% x $88,600. 50% x $88,600. June purchases: 50% x $56,800. Total cash disbursements for materials.. $12,000 $ 12,000 28,000 28,000 28,000 $28,000 44,300 44,300 44,300 $44,300 28,400 28,400 $40,000 $72,300 $72,700 $185,000 The June 30 AP will be the other half of the $56,800 ($28,400). DIRECT LABOR BUDGET Additional data: Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the company $10. Management fully adjusts the workforce to the workload each month. April 26,000 x 0.05 May 46,000 x 0.05 Quarter 101,000 x 0.05 June Required production . Direct labor-hours per unit Total direct labor-hours 29,000 x 0.05 1,300 x $10 Total direct labor cost.. $13,000 2,300 x $10 $23,000 $14,500 1,450 x $10 5,050 x $10 $50,500 needed... Direct labor cost per hour. Note: Many companies do not fully adjust their direct labor workforce every month and in such companies direct labor behaves more like a fixed cost, with additional cost if overtime is necessary. MANUFACTURING OVERHEAD BUDGET Additional data: Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash outflow. April 1,300 May 2,300 June Quarter 5,050 Budgeted direct labor-hours.. Variable manufacturing overhead rate.. Variable manufacturing overhead... Fixed manufacturing overhead 50,500 50,500 50,500 Total manufacturing overhead. Less depreciation... Cash disbursements for manufacturing overhead.. $56,000 $76,000 $59,000 $191,000 1,450 x $20 x $20 x $20 x $20 $26,000 $46,000 $29,000 $101,000 151,500 252,500 61,500 76,500 96,500 20,500 20,500 20,500 79,500 ENDING FINISHED GOODS INVENTORY BUDGET Additional data: Royal Company uses absorption costing in its budgeted income statement and balance sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours. The company has no work in process inventories. Computation of absorption unit product cost: Cost Total Direct materials. Direct labor .. Manufacturing overhead. 0.05 hours Unit product cost.. Quantity 5 pounds 0.05 hours $0.40 per pound $2.00 $10.00 per hour $50.00 per hour* 0.50 2.50 $5.00 Predetermined overhead rate Total manufacturing overhead Total direct labor hours $252,500 $50.00 per hour 5,050 hours Budgeted ending finished goods inventory: Ending finished goods inventory in units.. Unit product cost [see above]. Ending finished goods inventory in dollars 5,000 x $5 $25,000 ........... SELLING AND ADMINISTRATIVE EXPENSE BUDGET Additional data: Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses are $70,000 per month and include $10,000 in depreciation. May 20,000 50,000 30,000 pril June Quarter 100,000 Budgeted sales in units .. Variable selling and administrative expense per unit.. . Variable selling and administrative expense.. $10,000 $25,000 $15,000 $ 50,000 Fixed selling and administrative expense.. Total selling and administrative expense... Less depreciation... Cash disbursements for selling and administrative x $0.50 x $0.50 x $0.50 x $0.50 70,000 70,000 70,000 210,000 80,000 95,000 85,000 10,000 10,000 10,000 260,000 30,000 expenses... $70,000 $85,000 $75,000 $230,000 CASH BUDGET Additional data: 1. A line of credit is available at a local bank that allows the company to borrow up to $75,000. a. All borrowing occurs at the beginning of the month, and all repayments occur at the end of the month. b. The interest rate is 1% per month. c. The company does not have to make any payments until the end of the quarter. 2. Royal Company desires a cash balance of at least $30,000 at the end of each month. The cash balance at the beginning of April was $40,000. 3. Cash dividends of $51,000 are to be paid to stockholders in April. 4. Equipment purchases of $143,700 are scheduled for May and $48,800 for June. This equipment will be installed and tested during the second quarter and will not become operational until July, when depreciation charges will commence. CASH BUDGET Royal Company Cash Budget For the Quarter Ending June 30 April ay June Quarter Cash balance, beginning. $ 40,000 $ 30,000 $ 30,000 $ 40,000 Add receipts: Cash collections. . Total cash available . 400,000 335,000 905,000 170,000 210,000 430,000 365,000 945,000 ...... Less disbursements: Direct materials. Direct labor 40,000 13,000 56,000 70,000 72,300 23,000 76,000 85,000 143,700 72,700 185,000 50,500 59,000 191,000 75,000 230,000 48,800 192,500 51,000 14,500 Manufacturing overhead Selling & administrative.. Equipment purchases.. Dividends Total disbursements .... ......... 51,000 230,000 400,000 270,000 900,000 ....... ............. Excess (deficiency) of cash available over disbursements (20,000) 30,000 95,000 45,000 Financing: Borrowings. Repayments Interest* Total financing 50,000 50,000 (50,000) (50,000) (1,500) (1,500) 0 (51,500) ( 1,500) Cash balance, ending. . $ 30,000 $ 30,000 $ 43,500 $ 43,500 .......... 50,000 $50,000 x 1% x 3 = $1,500. BEGINNING BALANCE SHEET Royal Company Balance Sheet March 31 Current assets: Cash Accounts receivable.... $ 40,000 (a) 30,000 (b) 5,200 (c) 20,000 (d) $ 95,200 Raw materials inventory. Finished goods inventory. Plant and equipment: Land .. Buildings and equipment. Accumulated depreciation.. Total assets.... ............... 400,000 (e) 1,610,000 (f) (750,000) (g) 1,260,000 $1,355;200 Liabilities: Accounts payable... Stockholders' equity: Common stock.. Retained earnings. Total liabilities and stockholders' equity $ 12,000 (h) $ 200,000 (i) 1,143,200 (1) 1,343,200 $1,355,200 (a) Given (b) Given (f) Given (g) Given (h) See MATERIALS DISBURSE- MENTS (i) Given () Given Given (d) Given Given YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM THE INFORMATION PROVIDED YOU ARE TO PREPARE A BUDGETED INCOME STATEMENT FOR THE QUARTER ENDED JUNE 30 AND A BUDGETED BALANCE SHEET AS OF JUNE 30. BOTH OF THESE STATEMENTS ARE TO BE PREPARED IN PROPER FORM. THE STATEMENTS ARE TO BE UPLOADED IN XLS, DOC OR PDF FORMAT ONLY. AGENDA: PROFIT PLANNING (BUDGETING) Building a master budget. 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Manufacturing overhead budget 6. Ending finished goods inventory budget 7. Selling and administrative expenses budget 8. Cash budget 9. Budgeted income statement 10. Budgeted balance sheet COMPREHENSIVE BUDGETING EXAMPLE Royal Company is preparing budgets for the second quarter ending June 30. Budgeted sales of the company's only product for the next five months are: April . 20,000 units May. June. 30,000 units July. August... 15,000 units 50,000 units ....... ...... 25,000 units ....... The selling price is $10 per unit. The following elements of the master budget will be prepared in this example: 1. Sales budget (with a schedule of expected cash collections). 2. Production budget. 3. Direct materials budget (with a schedule of expected cash disbursements for materials). 4. Direct labor budget. 5. Manufacturing overhead budget. 6. Ending finished goods inventory budget. 7. Selling and administrative expense budget. 8. Cash budget. 9. Budgeted income statement. 10. Budgeted balance sheet. SALES BUDGET pril 20,000 x $10 May 50,000 June Budgeted sales (units)... Selling price per unit.. Total sales. Quarter 100,000 x $10 30,000 x $10 x $10 $200,000 $500,000 $300,000 $1,000,000 SCHEDULE OF EXPECTED CASH COLLECTIONS Additional data: All sales are on account. The company collects 70% of these credit sales in the month of the sale; 25% are collected in the month following sale; and the remaining 5% are uncollectible. The accounts receivable balance on March 31 was $30,000. All of this balance was collectible. April May June Quarter Accounts receivable beginning balance. . $ 30,000 April sales 70% x $200,000. 25% x $200,000. May sales 70% x $500,000. 25% x $500,000 . June sales 70% x $300,000 . Total cash collections.. $ 30,000 140,000 140,000 50,000 ........ $ 50,000 ......... 350,000 350,000 125,000 $125,000 210,000 210,000 $170,000 $400,000 $335,000 $905,000 25% of the $300,000 will be your 6/30 AR balance. PRODUCTION BUDGET Additional data: The company desires to have inventory on hand at the end of each month equal to 20% of the following month's budgeted unit sales. On March 31, 4,000 units were on hand. April July May 20,000 50,000 30,000 25,000 6,000 30,000 56,000 35,000 28,000 6,000 26,000 46,000 29,000 23,000 June Budgeted sales ... Add desired ending inventory.. Total needs.. Less beginning inventory. . Required production. 10,000 5,000 3,000* 4,000 10,000 5,000 * Budgeted sales in August = 15,000 units. Desired ending inventory in July = 15,000 units x 20% = 3,000 units. 6/30 inventory of finished goods is the 5,000 units DIRECT MATERIALS BUDGET Additional data: 5 pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 10% of the following month's production needs. The beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound. May 46,000 x 5 130,000 230,000 145,000 April 26,000 x 5 Quarter 29,000 101,000 x 5 505,000 June Required production in units .. Raw materials per unit (pounds) Production needs (pounds) .. Add desired ending inventory (pounds)* Total needs (pounds).. Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound $56,000 $88,600 $56,800 $201,400 x 5 ....... 23,000 14,500 11,500 153,000 244,500 156,500 11,500 516,500 13,000 23,000 14,500 13,000 140,000 221,500 142,000 503,500 * For June: 23,000 units produced in July x 5 pounds per unit pounds; 115,000 pounds x 10% = 11,500 pounds 115,000 June 30 raw materials inventory 11,500 pounds SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Additional data: Half of a month's purchases are paid for in the month of purchase; the other half is paid for in the following month. No discounts are given for early payment. The accounts payable balance on March 31 was $12,000. April May June Quarter Accounts payable beginning balance. April purchases: 50% x $56,000. 50% x $56,000. May purchases: 50% x $88,600. 50% x $88,600. June purchases: 50% x $56,800. Total cash disbursements for materials.. $12,000 $ 12,000 28,000 28,000 28,000 $28,000 44,300 44,300 44,300 $44,300 28,400 28,400 $40,000 $72,300 $72,700 $185,000 The June 30 AP will be the other half of the $56,800 ($28,400). DIRECT LABOR BUDGET Additional data: Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the company $10. Management fully adjusts the workforce to the workload each month. April 26,000 x 0.05 May 46,000 x 0.05 Quarter 101,000 x 0.05 June Required production . Direct labor-hours per unit Total direct labor-hours 29,000 x 0.05 1,300 x $10 Total direct labor cost.. $13,000 2,300 x $10 $23,000 $14,500 1,450 x $10 5,050 x $10 $50,500 needed... Direct labor cost per hour. Note: Many companies do not fully adjust their direct labor workforce every month and in such companies direct labor behaves more like a fixed cost, with additional cost if overtime is necessary. MANUFACTURING OVERHEAD BUDGET Additional data: Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash outflow. April 1,300 May 2,300 June Quarter 5,050 Budgeted direct labor-hours.. Variable manufacturing overhead rate.. Variable manufacturing overhead... Fixed manufacturing overhead 50,500 50,500 50,500 Total manufacturing overhead. Less depreciation... Cash disbursements for manufacturing overhead.. $56,000 $76,000 $59,000 $191,000 1,450 x $20 x $20 x $20 x $20 $26,000 $46,000 $29,000 $101,000 151,500 252,500 61,500 76,500 96,500 20,500 20,500 20,500 79,500 ENDING FINISHED GOODS INVENTORY BUDGET Additional data: Royal Company uses absorption costing in its budgeted income statement and balance sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours. The company has no work in process inventories. Computation of absorption unit product cost: Cost Total Direct materials. Direct labor ... Manufacturing overhead. 0.05 hours Unit product cost.. Quantity 5 pounds 0.05 hours $0.40 per pound $2.00 $10.00 per hour $50.00 per hour* 0.50 2.50 $5.00 Predetermined overhead rate Total manufacturing overhead Total direct labor hours $252,500 $50.00 per hour 5,050 hours Budgeted ending finished goods inventory: Ending finished goods inventory in units.. Unit product cost [see above].. Ending finished goods inventory in dollars 5,000 x $5 $25,000 ........... SELLING AND ADMINISTRATIVE EXPENSE BUDGET Additional data: Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses are $70,000 per month and include $10,000 in depreciation. May 20,000 50,000 30,000 pril June Quarter 100,000 Budgeted sales in units .. Variable selling and administrative expense per unit.. . Variable selling and administrative expense.. $10,000 $25,000 $15,000 $ 50,000 Fixed selling and administrative expense.. Total selling and administrative expense... Less depreciation... Cash disbursements for selling and administrative x $0.50 x $0.50 x $0.50 x $0.50 70,000 70,000 70,000 210,000 80,000 95,000 85,000 10,000 10,000 10,000 260,000 30,000 expenses... $70,000 $85,000 $75,000 $230,000 CASH BUDGET Additional data: 1. A line of credit is available at a local bank that allows the company to borrow up to $75,000. a. All borrowing occurs at the beginning of the month, and all repayments occur at the end of the month. b. The interest rate is 1% per month. c. The company does not have to make any payments until the end of the quarter. 2. Royal Company desires a cash balance of at least $30,000 at the end of each month. The cash balance at the beginning of April was $40,000. 3. Cash dividends of $51,000 are to be paid to stockholders in April. 4. Equipment purchases of $143,700 are scheduled for May and $48,800 for June. This equipment will be installed and tested during the second quarter and will not become operational until July, when depreciation charges will commence. CASH BUDGET Royal Company Cash Budget For the Quarter Ending June 30 April ay June Quarter Cash balance, beginning. $ 40,000 $ 30,000 $ 30,000 $ 40,000 Add receipts: Cash collections. . Total cash available . 400,000 335,000 905,000 170,000 210,000 430,000 365,000 945,000 ...... Less disbursements: Direct materials. Direct labor 40,000 13,000 56,000 70,000 72,300 23,000 76,000 85,000 143,700 72,700 185,000 50,500 59,000 191,000 75,000 230,000 48,800 192,500 51,000 14,500 Manufacturing overhead Selling & administrative.. Equipment purchases.. Dividends Total disbursements .... ......... 51,000 230,000 400,000 270,000 900,000 ....... ............. Excess (deficiency) of cash available over disbursements (20,000) 30,000 95,000 45,000 Financing: Borrowings. Repayments Interest* Total financing 50,000 50,000 (50,000) (50,000) (1,500) (1,500) 0 (51,500) ( 1,500) Cash balance, ending. . $ 30,000 $ 30,000 $ 43,500 $ 43,500 .......... 50,000 $50,000 x 1% x 3 = $1,500. BEGINNING BALANCE SHEET Royal Company Balance Sheet March 31 Current assets: Cash Accounts receivable.... $ 40,000 (a) 30,000 (b) 5,200 (c) 20,000 (d) $ 95,200 Raw materials inventory. Finished goods inventory. Plant and equipment: Land .. Buildings and equipment. Accumulated depreciation.. Total assets.... ............... 400,000 (e) 1,610,000 (f) (750,000) (g) 1,260,000 $1,355;200 Liabilities: Accounts payable... Stockholders' equity: Common stock.. Retained earnings. Total liabilities and stockholders' equity $ 12,000 (h) $ 200,000 (i) 1,143,200 (1) 1,343,200 $1,355,200 (a) Given (b) Given (f) Given (g) Given (h) See MATERIALS DISBURSE- MENTS (i) Given () Given Given (d) Given Given YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM THE INFORMATION PROVIDED YOU ARE TO PREPARE A BUDGETED INCOME STATEMENT FOR THE QUARTER ENDED JUNE 30 AND A BUDGETED BALANCE SHEET AS OF JUNE 30. BOTH OF THESE STATEMENTS ARE TO BE PREPARED IN PROPER FORM. THE STATEMENTS ARE TO BE UPLOADED IN XLS, DOC OR PDF FORMAT ONLY. AGENDA: PROFIT PLANNING (BUDGETING) Building a master budget. 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Manufacturing overhead budget 6. Ending finished goods inventory budget 7. Selling and administrative expenses budget 8. Cash budget 9. Budgeted income statement 10. Budgeted balance sheet COMPREHENSIVE BUDGETING EXAMPLE Royal Company is preparing budgets for the second quarter ending June 30. Budgeted sales of the company's only product for the next five months are: April . 20,000 units May. June. 30,000 units July. August... 15,000 units 50,000 units ....... ...... 25,000 units ....... The selling price is $10 per unit. The following elements of the master budget will be prepared in this example: 1. Sales budget (with a schedule of expected cash collections). 2. Production budget. 3. Direct materials budget (with a schedule of expected cash disbursements for materials). 4. Direct labor budget. 5. Manufacturing overhead budget. 6. Ending finished goods inventory budget. 7. Selling and administrative expense budget. 8. Cash budget. 9. Budgeted income statement. 10. Budgeted balance sheet. SALES BUDGET pril 20,000 x $10 May 50,000 June Budgeted sales (units)... Selling price per unit.. Total sales. Quarter 100,000 x $10 30,000 x $10 x $10 $200,000 $500,000 $300,000 $1,000,000 SCHEDULE OF EXPECTED CASH COLLECTIONS Additional data: All sales are on account. The company collects 70% of these credit sales in the month of the sale; 25% are collected in the month following sale; and the remaining 5% are uncollectible. The accounts receivable balance on March 31 was $30,000. All of this balance was collectible. April May June Quarter Accounts receivable beginning balance. . $ 30,000 April sales 70% x $200,000. 25% x $200,000. May sales 70% x $500,000. 25% x $500,000 . June sales 70% x $300,000 . Total cash collections.. $ 30,000 140,000 140,000 50,000 ........ $ 50,000 ......... 350,000 350,000 125,000 $125,000 210,000 210,000 $170,000 $400,000 $335,000 $905,000 25% of the $300,000 will be your 6/30 AR balance. PRODUCTION BUDGET Additional data: The company desires to have inventory on hand at the end of each month equal to 20% of the following month's budgeted unit sales. On March 31, 4,000 units were on hand. April July May 20,000 50,000 30,000 25,000 6,000 30,000 56,000 35,000 28,000 6,000 26,000 46,000 29,000 23,000 June Budgeted sales ... Add desired ending inventory.. Total needs.. Less beginning inventory. . Required production. 10,000 5,000 3,000* 4,000 10,000 5,000 * Budgeted sales in August = 15,000 units. Desired ending inventory in July = 15,000 units x 20% = 3,000 units. 6/30 inventory of finished goods is the 5,000 units DIRECT MATERIALS BUDGET Additional data: 5 pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 10% of the following month's production needs. The beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound. May 46,000 x 5 130,000 230,000 145,000 April 26,000 x 5 Quarter 29,000 101,000 x 5 505,000 June Required production in units .. Raw materials per unit (pounds) Production needs (pounds) .. Add desired ending inventory (pounds)* Total needs (pounds).. Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound $56,000 $88,600 $56,800 $201,400 x 5 ....... 23,000 14,500 11,500 153,000 244,500 156,500 11,500 516,500 13,000 23,000 14,500 13,000 140,000 221,500 142,000 503,500 * For June: 23,000 units produced in July x 5 pounds per unit pounds; 115,000 pounds x 10% = 11,500 pounds 115,000 June 30 raw materials inventory 11,500 pounds SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Additional data: Half of a month's purchases are paid for in the month of purchase; the other half is paid for in the following month. No discounts are given for early payment. The accounts payable balance on March 31 was $12,000. April May June Quarter Accounts payable beginning balance. April purchases: 50% x $56,000. 50% x $56,000. May purchases: 50% x $88,600. 50% x $88,600. June purchases: 50% x $56,800. Total cash disbursements for materials.. $12,000 $ 12,000 28,000 28,000 28,000 $28,000 44,300 44,300 44,300 $44,300 28,400 28,400 $40,000 $72,300 $72,700 $185,000 The June 30 AP will be the other half of the $56,800 ($28,400). DIRECT LABOR BUDGET Additional data: Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the company $10. Management fully adjusts the workforce to the workload each month. April 26,000 x 0.05 May 46,000 x 0.05 Quarter 101,000 x 0.05 June Required production . Direct labor-hours per unit Total direct labor-hours 29,000 x 0.05 1,300 x $10 Total direct labor cost.. $13,000 2,300 x $10 $23,000 $14,500 1,450 x $10 5,050 x $10 $50,500 needed... Direct labor cost per hour. Note: Many companies do not fully adjust their direct labor workforce every month and in such companies direct labor behaves more like a fixed cost, with additional cost if overtime is necessary. MANUFACTURING OVERHEAD BUDGET Additional data: Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash outflow. April 1,300 May 2,300 June Quarter 5,050 Budgeted direct labor-hours.. Variable manufacturing overhead rate.. Variable manufacturing overhead... Fixed manufacturing overhead 50,500 50,500 50,500 Total manufacturing overhead. Less depreciation... Cash disbursements for manufacturing overhead.. $56,000 $76,000 $59,000 $191,000 1,450 x $20 x $20 x $20 x $20 $26,000 $46,000 $29,000 $101,000 151,500 252,500 61,500 76,500 96,500 20,500 20,500 20,500 79,500 ENDING FINISHED GOODS INVENTORY BUDGET Additional data: Royal Company uses absorption costing in its budgeted income statement and balance sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours. The company has no work in process inventories. Computation of absorption unit product cost: Cost Total Direct materials. Direct labor .. Manufacturing overhead. 0.05 hours Unit product cost.. Quantity 5 pounds 0.05 hours $0.40 per pound $2.00 $10.00 per hour $50.00 per hour* 0.50 2.50 $5.00 Predetermined overhead rate Total manufacturing overhead Total direct labor hours $252,500 $50.00 per hour 5,050 hours Budgeted ending finished goods inventory: Ending finished goods inventory in units.. Unit product cost [see above]. Ending finished goods inventory in dollars 5,000 x $5 $25,000 ........... SELLING AND ADMINISTRATIVE EXPENSE BUDGET Additional data: Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses are $70,000 per month and include $10,000 in depreciation. May 20,000 50,000 30,000 pril June Quarter 100,000 Budgeted sales in units .. Variable selling and administrative expense per unit.. . Variable selling and administrative expense.. $10,000 $25,000 $15,000 $ 50,000 Fixed selling and administrative expense.. Total selling and administrative expense... Less depreciation... Cash disbursements for selling and administrative x $0.50 x $0.50 x $0.50 x $0.50 70,000 70,000 70,000 210,000 80,000 95,000 85,000 10,000 10,000 10,000 260,000 30,000 expenses... $70,000 $85,000 $75,000 $230,000 CASH BUDGET Additional data: 1. A line of credit is available at a local bank that allows the company to borrow up to $75,000. a. All borrowing occurs at the beginning of the month, and all repayments occur at the end of the month. b. The interest rate is 1% per month. c. The company does not have to make any payments until the end of the quarter. 2. Royal Company desires a cash balance of at least $30,000 at the end of each month. The cash balance at the beginning of April was $40,000. 3. Cash dividends of $51,000 are to be paid to stockholders in April. 4. Equipment purchases of $143,700 are scheduled for May and $48,800 for June. This equipment will be installed and tested during the second quarter and will not become operational until July, when depreciation charges will commence. CASH BUDGET Royal Company Cash Budget For the Quarter Ending June 30 April ay June Quarter Cash balance, beginning. $ 40,000 $ 30,000 $ 30,000 $ 40,000 Add receipts: Cash collections. . Total cash available . 400,000 335,000 905,000 170,000 210,000 430,000 365,000 945,000 ...... Less disbursements: Direct materials. Direct labor 40,000 13,000 56,000 70,000 72,300 23,000 76,000 85,000 143,700 72,700 185,000 50,500 59,000 191,000 75,000 230,000 48,800 192,500 51,000 14,500 Manufacturing overhead Selling & administrative.. Equipment purchases.. Dividends Total disbursements .... ......... 51,000 230,000 400,000 270,000 900,000 ....... ............. Excess (deficiency) of cash available over disbursements (20,000) 30,000 95,000 45,000 Financing: Borrowings. Repayments Interest* Total financing 50,000 50,000 (50,000) (50,000) (1,500) (1,500) 0 (51,500) ( 1,500) Cash balance, ending. . $ 30,000 $ 30,000 $ 43,500 $ 43,500 .......... 50,000 $50,000 x 1% x 3 = $1,500. BEGINNING BALANCE SHEET Royal Company Balance Sheet March 31 Current assets: Cash Accounts receivable.... $ 40,000 (a) 30,000 (b) 5,200 (c) 20,000 (d) $ 95,200 Raw materials inventory. Finished goods inventory. Plant and equipment: Land .. Buildings and equipment. Accumulated depreciation.. Total assets.... ............... 400,000 (e) 1,610,000 (f) (750,000) (g) 1,260,000 $1,355;200 Liabilities: Accounts payable... Stockholders' equity: Common stock.. Retained earnings. Total liabilities and stockholders' equity $ 12,000 (h) $ 200,000 (i) 1,143,200 (1) 1,343,200 $1,355,200 (a) Given (b) Given (f) Given (g) Given (h) See MATERIALS DISBURSE- MENTS (i) Given () Given Given (d) Given Given YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM THE INFORMATION PROVIDED YOU ARE TO PREPARE A BUDGETED INCOME STATEMENT FOR THE QUARTER ENDED JUNE 30 AND A BUDGETED BALANCE SHEET AS OF JUNE 30. BOTH OF THESE STATEMENTS ARE TO BE PREPARED IN PROPER FORM. THE STATEMENTS ARE TO BE UPLOADED IN XLS, DOC OR PDF FORMAT ONLY. AGENDA: PROFIT PLANNING (BUDGETING) Building a master budget. 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Manufacturing overhead budget 6. Ending finished goods inventory budget 7. Selling and administrative expenses budget 8. Cash budget 9. Budgeted income statement 10. Budgeted balance sheet COMPREHENSIVE BUDGETING EXAMPLE Royal Company is preparing budgets for the second quarter ending June 30. Budgeted sales of the company's only product for the next five months are: April . 20,000 units May. June. 30,000 units July. August... 15,000 units 50,000 units ....... ...... 25,000 units ....... The selling price is $10 per unit. The following elements of the master budget will be prepared in this example: 1. Sales budget (with a schedule of expected cash collections). 2. Production budget. 3. Direct materials budget (with a schedule of expected cash disbursements for materials). 4. Direct labor budget. 5. Manufacturing overhead budget. 6. Ending finished goods inventory budget. 7. Selling and administrative expense budget. 8. Cash budget. 9. Budgeted income statement. 10. Budgeted balance sheet. SALES BUDGET pril 20,000 x $10 May 50,000 June Budgeted sales (units)... Selling price per unit.. Total sales. Quarter 100,000 x $10 30,000 x $10 x $10 $200,000 $500,000 $300,000 $1,000,000 SCHEDULE OF EXPECTED CASH COLLECTIONS Additional data: All sales are on account. The company collects 70% of these credit sales in the month of the sale; 25% are collected in the month following sale; and the remaining 5% are uncollectible. The accounts receivable balance on March 31 was $30,000. All of this balance was collectible. April May June Quarter Accounts receivable beginning balance. . $ 30,000 April sales 70% x $200,000. 25% x $200,000. May sales 70% x $500,000. 25% x $500,000 . June sales 70% x $300,000 . Total cash collections.. $ 30,000 140,000 140,000 50,000 ........ $ 50,000 ......... 350,000 350,000 125,000 $125,000 210,000 210,000 $170,000 $400,000 $335,000 $905,000 25% of the $300,000 will be your 6/30 AR balance. PRODUCTION BUDGET Additional data: The company desires to have inventory on hand at the end of each month equal to 20% of the following month's budgeted unit sales. On March 31, 4,000 units were on hand. April July May 20,000 50,000 30,000 25,000 6,000 30,000 56,000 35,000 28,000 6,000 26,000 46,000 29,000 23,000 June Budgeted sales ... Add desired ending inventory.. Total needs.. Less beginning inventory. . Required production. 10,000 5,000 3,000* 4,000 10,000 5,000 * Budgeted sales in August = 15,000 units. Desired ending inventory in July = 15,000 units x 20% = 3,000 units. 6/30 inventory of finished goods is the 5,000 units DIRECT MATERIALS BUDGET Additional data: 5 pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 10% of the following month's production needs. The beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound. May 46,000 x 5 130,000 230,000 145,000 April 26,000 x 5 Quarter 29,000 101,000 x 5 505,000 June Required production in units .. Raw materials per unit (pounds) Production needs (pounds) .. Add desired ending inventory (pounds)* Total needs (pounds).. Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound $56,000 $88,600 $56,800 $201,400 x 5 ....... 23,000 14,500 11,500 153,000 244,500 156,500 11,500 516,500 13,000 23,000 14,500 13,000 140,000 221,500 142,000 503,500 * For June: 23,000 units produced in July x 5 pounds per unit pounds; 115,000 pounds x 10% = 11,500 pounds 115,000 June 30 raw materials inventory 11,500 pounds SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Additional data: Half of a month's purchases are paid for in the month of purchase; the other half is paid for in the following month. No discounts are given for early payment. The accounts payable balance on March 31 was $12,000. April May June Quarter Accounts payable beginning balance. April purchases: 50% x $56,000. 50% x $56,000. May purchases: 50% x $88,600. 50% x $88,600. June purchases: 50% x $56,800. Total cash disbursements for materials.. $12,000 $ 12,000 28,000 28,000 28,000 $28,000 44,300 44,300 44,300 $44,300 28,400 28,400 $40,000 $72,300 $72,700 $185,000 The June 30 AP will be the other half of the $56,800 ($28,400). DIRECT LABOR BUDGET Additional data: Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the company $10. Management fully adjusts the workforce to the workload each month. April 26,000 x 0.05 May 46,000 x 0.05 Quarter 101,000 x 0.05 June Required production . Direct labor-hours per unit Total direct labor-hours 29,000 x 0.05 1,300 x $10 Total direct labor cost.. $13,000 2,300 x $10 $23,000 $14,500 1,450 x $10 5,050 x $10 $50,500 needed... Direct labor cost per hour. Note: Many companies do not fully adjust their direct labor workforce every month and in such companies direct labor behaves more like a fixed cost, with additional cost if overtime is necessary. MANUFACTURING OVERHEAD BUDGET Additional data: Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash outflow. April 1,300 May 2,300 June Quarter 5,050 Budgeted direct labor-hours.. Variable manufacturing overhead rate.. Variable manufacturing overhead... Fixed manufacturing overhead 50,500 50,500 50,500 Total manufacturing overhead. Less depreciation... Cash disbursements for manufacturing overhead.. $56,000 $76,000 $59,000 $191,000 1,450 x $20 x $20 x $20 x $20 $26,000 $46,000 $29,000 $101,000 151,500 252,500 61,500 76,500 96,500 20,500 20,500 20,500 79,500 ENDING FINISHED GOODS INVENTORY BUDGET Additional data: Royal Company uses absorption costing in its budgeted income statement and balance sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours. The company has no work in process inventories. Computation of absorption unit product cost: Cost Total Direct materials. Direct labor .. Manufacturing overhead. 0.05 hours Unit product cost.. Quantity 5 pounds 0.05 hours $0.40 per pound $2.00 $10.00 per hour $50.00 per hour* 0.50 2.50 $5.00 Predetermined overhead rate Total manufacturing overhead Total direct labor hours $252,500 $50.00 per hour 5,050 hours Budgeted ending finished goods inventory: Ending finished goods inventory in units.. Unit product cost [see above]. Ending finished goods inventory in dollars 5,000 x $5 $25,000 ........... SELLING AND ADMINISTRATIVE EXPENSE BUDGET Additional data: Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses are $70,000 per month and include $10,000 in depreciation. May 20,000 50,000 30,000 pril June Quarter 100,000 Budgeted sales in units .. Variable selling and administrative expense per unit.. . Variable selling and administrative expense.. $10,000 $25,000 $15,000 $50,000 Fixed selling and administrative expense.. Total selling and administrative expense... Less depreciation... Cash disbursements for selling and administrative x $0.50 x $0.50 x $0.50 x $0.50 70,000 70,000 70,000 210,000 80,000 95,000 85,000 10,000 10,000 10,000 260,000 30,000 expenses... $70,000 $85,000 $75,000 $230,000 CASHj BUDGET Additijonal data: 1. A line of credit is available at a local bank that allows the company to borrow up to $75,000. a. All borrowing occurs at the beginning of the month, and all repayments occur at the end of the month. b. The interest rate is 1% per month. c. The company does not have to make any payments until the end of the quarter. 2. Royal Company desires a cash balance of at least $30,000 at the end of each month. The cash balance at the beginning of April was $40,000. 3. Cash dividends of $51,000 are to be paid to stockholders in April. 4. Equipment purchases of $143,700 are scheduled for May and $48,800 for June. This equipment will be installed and tested during the second quarter and will not become operational until July, when depreciation charges will commence. CASH BUDGET Royal Company Cash Budget For the Quarter Ending June 30 April ay June Quarter Cash balance, beginning. $ 40,000 $ 30,000 $ 30,000 $ 40,000 Add receipts: Cash collections. . Total cash available . 400,000 335,000 905,000 170,000 210,000 430,000 365,000 945,000 ...... Less disbursements: Direct materials. Direct labor 40,000 13,000 56,000 70,000 72,300 23,000 76,000 85,000 143,700 72,700 185,000 50,500 59,000 191,000 75,000 230,000 48,800 192,500 51,000 14,500 Manufacturing overhead Selling & administrative.. Equipment purchases.. Dividends Total disbursements .... ......... 51,000 230,000 400,000 270,000 900,000 ....... ............. Excess (deficiency) of cash available over disbursements (20,000) 30,000 95,000 45,000 Financing: Borrowings. Repayments Interest* Total financing 50,000 50,000 (50,000) (50,000) (1,500) (1,500) 0 (51,500) ( 1,500) Cash balance, ending. . $ 30,000 $ 30,000 $ 43,500 $ 43,500 .......... 50,000 $50,000 x 1% x 3 = $1,500. BEGINNING BALANCE SHEET Royal Company Balance Sheet March 31 Current assets: Cash Accounts receivable.... $ 40,000 (a) 30,000 (b) 5,200 (c) 20,000 (d) $ 95,200 Raw materials inventory. Finished goods inventory. Plant and equipment: Land .. Buildings and equipment. Accumulated depreciation.. Total assets.... ............... 400,000 (e) 1,610,000 (f) (750,000) (g) 1,260,000 $1,355;200 Liabilities: Accounts payable... Stockholders' equity: Common stock.. Retained earnings. Total liabilities and stockholders' equity $ 12,000 (h) $ 200,000 (i) 1,143,200 (1) 1,343,200 $1,355,200 (a) Given (b) Given (f) Given (g) Given (h) See MATERIALS DISBURSE- MENTS (i) Given () Given Given (d) Given Given YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM THE INFORMATION PROVIDED YOU ARE TO PREPARE A BUDGETED INCOME STATEMENT FOR THE QUARTER ENDED JUNE 30 AND A BUDGETED BALANCE SHEET AS OF JUNE 30. BOTH OF THESE STATEMENTS ARE TO BE PREPARED IN PROPER FORM. THE STATEMENTS ARE TO BE UPLOADED IN XLS, DOC OR PDF FORMAT ONLY. AGENDA: PROFIT PLANNING (BUDGETING) Building a master budget. 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Manufacturing overhead budget 6. Ending finished goods inventory budget 7. Selling and administrative expenses budget 8. Cash budget 9. Budgeted income statement 10. Budgeted balance sheet COMPREHENSIVE BUDGETING EXAMPLE Royal Company is preparing budgets for the second quarter ending June 30. Budgeted sales of the company's only product for the next five months are: April . 20,000 units May. June. 30,000 units July. August... 15,000 units 50,000 units ....... ...... 25,000 units ....... The selling price is $10 per unit. The following elements of the master budget will be prepared in this example: 1. Sales budget (with a schedule of expected cash collections). 2. Production budget. 3. Direct materials budget (with a schedule of expected cash disbursements for materials). 4. Direct labor budget. 5. Manufacturing overhead budget. 6. Ending finished goods inventory budget. 7. Selling and administrative expense budget. 8. Cash budget. 9. Budgeted income statement. 10. Budgeted balance sheet. SALES BUDGET pril 20,000 x $10 May 50,000 June Budgeted sales (units)... Selling price per unit.. Total sales. Quarter 100,000 x $10 30,000 x $10 x $10 $200,000 $500,000 $300,000 $1,000,000 SCHEDULE OF EXPECTED CASH COLLECTIONS Additional data: All sales are on account. The company collects 70% of these credit sales in the month of the sale; 25% are collected in the month following sale; and the remaining 5% are uncollectible. The accounts receivable balance on March 31 was $30,000. All of this balance was collectible. April May June Quarter Accounts receivable beginning balance. . $ 30,000 April sales 70% x $200,000. 25% x $200,000. May sales 70% x $500,000. 25% x $500,000 . June sales 70% x $300,000 . Total cash collections.. $ 30,000 140,000 140,000 50,000 ........ $ 50,000 ......... 350,000 350,000 125,000 $125,000 210,000 210,000 $170,000 $400,000 $335,000 $905,000 25% of the $300,000 will be your 6/30 AR balance. PRODUCTION BUDGET Additional data: The company desires to have inventory on hand at the end of each month equal to 20% of the following month's budgeted unit sales. On March 31, 4,000 units were on hand. April July May 20,000 50,000 30,000 25,000 6,000 30,000 56,000 35,000 28,000 6,000 26,000 46,000 29,000 23,000 June Budgeted sales ... Add desired ending inventory.. Total needs.. Less beginning inventory. . Required production. 10,000 5,000 3,000* 4,000 10,000 5,000 * Budgeted sales in August = 15,000 units. Desired ending inventory in July = 15,000 units x 20% = 3,000 units. 6/30 inventory of finished goods is the 5,000 units DIRECT MATERIALS BUDGET Additional data: 5 pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 10% of the following month's production needs. The beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound. May 46,000 x 5 130,000 230,000 145,000 April 26,000 x 5 Quarter 29,000 101,000 x 5 505,000 June Required production in units .. Raw materials per unit (pounds) Production needs (pounds) .. Add desired ending inventory (pounds)* Total needs (pounds).. Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound $56,000 $88,600 $56,800 $201,400 x 5 ....... 23,000 14,500 11,500 153,000 244,500 156,500 11,500 516,500 13,000 23,000 14,500 13,000 140,000 221,500 142,000 503,500 * For June: 23,000 units produced in July x 5 pounds per unit pounds; 115,000 pounds x 10% = 11,500 pounds 115,000 June 30 raw materials inventory 11,500 pounds SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Additional data: Half of a month's purchases are paid for in the month of purchase; the other half is paid for in the following month. No discounts are given for early payment. The accounts payable balance on March 31 was $12,000. April May June Quarter Accounts payable beginning balance. April purchases: 50% x $56,000. 50% x $56,000. May purchases: 50% x $88,600. 50% x $88,600. June purchases: 50% x $56,800. Total cash disbursements for materials.. $12,000 $ 12,000 28,000 28,000 28,000 $28,000 44,300 44,300 44,300 $44,300 28,400 28,400 $40,000 $72,300 $72,700 $185,000 The June 30 AP will be the other half of the $56,800 ($28,400). DIRECT LABOR BUDGET Additional data: Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the company $10. Management fully adjusts the workforce to the workload each month. April 26,000 x 0.05 May 46,000 x 0.05 Quarter 101,000 x 0.05 June Required production . Direct labor-hours per unit Total direct labor-hours 29,000 x 0.05 1,300 x $10 Total direct labor cost.. $13,000 2,300 x $10 $23,000 $14,500 1,450 x $10 5,050 x $10 $50,500 needed... Direct labor cost per hour. Note: Many companies do not fully adjust their direct labor workforce every month and in such companies direct labor behaves more like a fixed cost, with additional cost if overtime is necessary. MANUFACTURING OVERHEAD BUDGET Additional data: Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash outflow. April 1,300 May 2,300 June Quarter 5,050 Budgeted direct labor-hours.. Variable manufacturing overhead rate.. Variable manufacturing overhead... Fixed manufacturing overhead 50,500 50,500 50,500 Total manufacturing overhead. Less depreciation... Cash disbursements for manufacturing overhead.. $56,000 $76,000 $59,000 $191,000 1,450 x $20 x $20 x $20 x $20 $26,000 $46,000 $29,000 $101,000 151,500 252,500 61,500 76,500 96,500 20,500 20,500 20,500 79,500 ENDING FINISHED GOODS INVENTORY BUDGET Additional data: Royal Company uses absorption costing in its budgeted income statement and balance sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours. The company has no work in process inventories. Computation of absorption unit product cost: Cost Total Direct materials. Direct labor .. Manufacturing overhead. 0.05 hours Unit product cost.. Quantity 5 pounds 0.05 hours $0.40 per pound $2.00 $10.00 per hour $50.00 per hour* 0.50 2.50 $5.00 Predetermined overhead rate Total manufacturing overhead Total direct labor hours $252,500 $50.00 per hour 5,050 hours Budgeted ending finished goods inventory: Ending finished goods inventory in units.. Unit product cost [see above]. Ending finished goods inventory in dollars 5,000 x $5 $25,000 ........... SELLING AND ADMINISTRATIVE EXPENSE BUDGET Additional data: Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses are $70,000 per month and include $10,000 in depreciation. May 20,000 50,000 30,000 pril June Quarter 100,000 Budgeted sales in units .. Variable selling and administrative expense per unit.. . Variable selling and administrative expense.. $10,000 $25,000 $15,000 $ 50,000 Fixed selling and administrative expense.. Total selling and administrative expense... Less depreciation... Cash disbursements for selling and administrative x $0.50 x $0.50 x $0.50 x $0.50 70,000 70,000 70,000 210,000 80,000 95,000 85,000 10,000 10,000 10,000 260,000 30,000 expenses... $70,000 $85,000 $75,000 $230,000 CASH BUDGET Additional data: 1. A line of credit is available at a local bank that allows the company to borrow up to $75,000. a. All borrowing occurs at the beginning of the month, and all repayments occur at the end of the month. b. The interest rate is 1% per month. c. The company does not have to make any payments until the end of the quarter. 2. Royal Company desires a cash balance of at least $30,000 at the end of each month. The cash balance at the beginning of April was $40,000. 3. Cash dividends of $51,000 are to be paid to stockholders in April. 4. Equipment purchases of $143,700 are scheduled for May and $48,800 for June. This equipment will be installed and tested during the second quarter and will not become operational until July, when depreciation charges will commence. CASH BUDGET Royal Company Cash Budget For the Quarter Ending June 30 April ay June Quarter Cash balance, beginning. $ 40,000 $ 30,000 $ 30,000 $ 40,000 Add receipts: Cash collections. . Total cash available . 400,000 335,000 905,000 170,000 210,000 430,000 365,000 945,000 ...... Less disbursements: Direct materials. Direct labor 40,000 13,000 56,000 70,000 72,300 23,000 76,000 85,000 143,700 72,700 185,000 50,500 59,000 191,000 75,000 230,000 48,800 192,500 51,000 14,500 Manufacturing overhead Selling & administrative.. Equipment purchases.. Dividends Total disbursements .... ......... 51,000 230,000 400,000 270,000 900,000 ....... ............. Excess (deficiency) of cash available over disbursements (20,000) 30,000 95,000 45,000 Financing: Borrowings. Repayments Interest* Total financing 50,000 50,000 (50,000) (50,000) (1,500) (1,500) 0 (51,500) ( 1,500) Cash balance, ending. . $ 30,000 $ 30,000 $ 43,500 $ 43,500 .......... 50,000 $50,000 x 1% x 3 = $1,500. BEGINNING BALANCE SHEET Royal Company Balance Sheet March 31 Current assets: Cash Accounts receivable.... $ 40,000 (a) 30,000 (b) 5,200 (c) 20,000 (d) $ 95,200 Raw materials inventory. Finished goods inventory. Plant and equipment: Land .. Buildings and equipment. Accumulated depreciation.. Total assets.... ............... 400,000 (e) 1,610,000 (f) (750,000) (g) 1,260,000 $1,355;200 Liabilities: Accounts payable... Stockholders' equity: Common stock.. Retained earnings. Total liabilities and stockholders' equity $ 12,000 (h) $ 200,000 (i) 1,143,200 (1) 1,343,200 $1,355,200 (a) Given (b) Given (f) Given (g) Given (h) See MATERIALS DISBURSE- MENTS (i) Given () Given Given (d) Given Given YOU WILL SEE 13 PAGES OF BUDGET INFORMATION FOR ROYAL COMPANY (WATCH THE DATES). THIS BUDGET IS FOR THE QUARTER ENDED JUNE 30. FROM THE INFORMATION PROVIDED YOU ARE TO PREPARE A BUDGETED INCOME STATEMENT FOR THE QUARTER ENDED JUNE 30 AND A BUDGETED BALANCE SHEET AS OF JUNE 30. BOTH OF THESE STATEMENTS ARE TO BE PREPARED IN PROPER FORM. THE STATEMENTS ARE TO BE UPLOADED IN XLS, DOC OR PDF FORMAT ONLY. AGENDA: PROFIT PLANNING (BUDGETING) Building a master budget. 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Manufacturing overhead budget 6. Ending finished goods inventory budget 7. Selling and administrative expenses budget 8. Cash budget 9. Budgeted income statement 10. Budgeted balance sheet COMPREHENSIVE BUDGETING EXAMPLE Royal Company is preparing budgets for the second quarter ending June 30. Budgeted sales of the company's only product for the next five months are: April . 20,000 units May. June. 30,000 units July. August... 15,000 units 50,000 units ....... ...... 25,000 units ....... The selling price is $10 per unit. The following elements of the master budget will be prepared in this example: 1. Sales budget (with a schedule of expected cash collections). 2. Production budget. 3. Direct materials budget (with a schedule of expected cash disbursements for materials). 4. Direct labor budget. 5. Manufacturing overhead budget. 6. Ending finished goods inventory budget. 7. Selling and administrative expense budget. 8. Cash budget. 9. Budgeted income statement. 10. Budgeted balance sheet. SALES BUDGET pril 20,000 x $10 May 50,000 June Budgeted sales (units)... Selling price per unit.. Total sales. Quarter 100,000 x $10 30,000 x $10 x $10 $200,000 $500,000 $300,000 $1,000,000 SCHEDULE OF EXPECTED CASH COLLECTIONS Additional data: All sales are on account. The company collects 70% of these credit sales in the month of the sale; 25% are collected in the month following sale; and the remaining 5% are uncollectible. The accounts receivable balance on March 31 was $30,000. All of this balance was collectible. April May June Quarter Accounts receivable beginning balance. . $ 30,000 April sales 70% x $200,000. 25% x $200,000. May sales 70% x $500,000. 25% x $500,000 . June sales 70% x $300,000 . Total cash collections.. $ 30,000 140,000 140,000 50,000 ........ $ 50,000 ......... 350,000 350,000 125,000 $125,000 210,000 210,000 $170,000 $400,000 $335,000 $905,000 25% of the $300,000 will be your 6/30 AR balance. PRODUCTION BUDGET Additional data: The company desires to have inventory on hand at the end of each month equal to 20% of the following month's budgeted unit sales. On March 31, 4,000 units were on hand. April July May 20,000 50,000 30,000 25,000 6,000 30,000 56,000 35,000 28,000 6,000 26,000 46,000 29,000 23,000 June Budgeted sales ... Add desired ending inventory.. Total needs.. Less beginning inventory. . Required production. 10,000 5,000 3,000* 4,000 10,000 5,000 * Budgeted sales in August = 15,000 units. Desired ending inventory in July = 15,000 units x 20% = 3,000 units. 6/30 inventory of finished goods is the 5,000 units DIRECT MATERIALS BUDGET Additional data: 5 pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 10% of the following month's production needs. The beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound. May 46,000 x 5 130,000 230,000 145,000 April 26,000 x 5 Quarter 29,000 101,000 x 5 505,000 June Required production in units .. Raw materials per unit (pounds) Production needs (pounds) .. Add desired ending inventory (pounds)* Total needs (pounds).. Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound $56,000 $88,600 $56,800 $201,400 x 5 ....... 23,000 14,500 11,500 15j0 244,500 156,500 11,500 516,500 13,000 23,000 14,500 13,000 14j0 221,500 142,000 503,500 * For June: 23,000 units produced in July x 5 pounds per unit pounds; 115,000 pounds x 10% = 11,500 pounds 115,000 June 30 raw materials inventory 11,500 pounds SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL Additional data: Half of a month's purchases are paid for in the month of purchase; the other half is paid for in the following month. No discounts are given for early payment. The accounts payable balance on March 31 was $12,000. April May June Quarter Accounts payable beginning balance. April purchases: 50% x $56,000. 50% x $56,000. May purchases: 50% x $88,600. 50% x $88,600. June purchases: 50% x $56,800. Total cash disbursements for materials.. $12,000 $ 12,000 28,000 28,000 28,000 $28,000 44,300 44,300 44,300 $44,300 28,400 28,400 $40,000 $72,300 $72,700 $185,000 The June 30 AP will be the other half of the $56,800 ($28,400). DIRECT LABOR BUDGET Additional data: Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the company $10. Management fully adjusts the workforce to the workload each month. April 26,000 x 0.05 May 46,000 x 0.05 Quarter 101,000 x 0.05 June Required production . Direct labor-hours per unit Total direct labor-hours 29,000 x 0.05 1,300 x $10 Total direct labor cost.. $13,000 2,300 x $10 $23,000 $14,500 1,450 x $10 5,050 x $10 $50,500 needed... Direct labor cost per hour. Note: Many companies do not fully adjust their direct labor workforce every month and in such companies direct labor behaves more like a fixed cost, with additional cost if overtime is necessary. MANUFACTURING OVERHEAD BUDGET Additional data: Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash outflow. April 1,300 May 2,300 June Quarter 5,050 Budgeted direct labor-hours.. Variable manufacturing overhead rate.. Variable manufacturing overhead... Fixed manufacturing overhead 50,500 50,500 50,500 Total manufacturing overhead. Less depreciation... Cash disbursements for manufacturing overhead.. $56,000 $76,000 $59,000 $191,000 1,450 x $20 x $20 x $20 x $20 $26,000 $46,000 $29,000 $101,000 151,500 252,500 61,500 76,500 96,500 20,500 20,500 20,500 79,500 ENDING FINISHED GOODS INVENTORY BUDGET Additional data: Royal Company uses absorption costing in its budgeted income statement and balance sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours. The company has no work in process inventories. Computation of absorption unit product cost: Cost Total Direct materials. Direct labor .. Manufacturing overhead. 0.05 hours Unit product cost.. Quantity 5 pounds 0.05 hours $0.40 per pound $2.00 $10.00 per hour $50.00 per hour* 0.50 2.50 $5.00 Predetermined overhead rate Total manufacturing overhead Total direct labor hours $252,500 $50.00 per hour 5,050 hours Budgeted ending finished goods inventory: Ending finished goods inventory in units.. Unit product cost [see above]. Ending finished goods inventory in dollars 5,000 x $5 $25,000 ........... SELLING AND ADMINISTRATIVE EXPENSE BUDGET Additional data: Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses are $70,000 per month and include $10,000 in depreciation. May 20,000 50,000 30,000 pril June Quarter 100,000 Budgeted sales in units .. Variable selling and administrative expense per unit.. . Variable selling and administrative expense.. $10,000 $25,000 $15,000 $ 50,000 Fixed selling and administrative expense.. Total selling and administrative expense... Less depreciation... Cash disbursements for selling and administrative x $0.50 x $0.50 x $0.50 x $0.50 70,000 70,000 70,000 210,000 80,000 95,000 85,000 10,000 10,000 10,000 260,000 30,000 expenses... $70,000 $85,000 $75,000 $230,000 CASH BUDGET Additional data: 1. A line of credit is available at a local bank that allows the company to borrow up to $75,000. a. All borrowing occurs at the beginning of the month, and all repayments occur at the end of the month. b. The interest rate is 1% per month. c. The company does not have to make any payments until the end of the quarter. 2. Royal Company desires a cash balance of at least $30,000 at the end of each month. The cash balance at the beginning of April was $40,000. 3. Cash dividends of $51,000 are to be paid to stockholders in April. 4. Equipment purchases of $143,700 are scheduled for May and $48,800 for June. This equipment will be installed and tested during the second quarter and will not become operational until July, when depreciation charges will commence. CASH BUDGET Royal Company Cash Budget For the Quarter Ending June 30 April ay June Quarter Cash balance, beginning. $ 40,000 $ 30,000 $ 30,000 $ 40,000 Add receipts: Cash collections. . Total cash available . 400,000 335,000 905,000 170,000 210,000 430,000 365,000 945,000 ...... Less disbursements: Direct materials. Direct labor 40,000 13,000 56,000 70,000 72,300 23,000 76,000 85,000 143,700 72,700 185,000 50,500 59,000 191,000 75,000 230,000 48,800 192,500 51,000 14,500 Manufacturing overhead Selling & administrative.. Equipment purchases.. Dividends Total disbursements .... ......... 51,000 230,000 400,000 270,000 900,000 ....... ............. Excess (deficiency) of cash available over disbursements (20,000) 30,000 95,000 45,000 Financing: Borrowings. Repayments Interest* Total financing 50,000 50,000 (50,000) (50,000) (1,500) (1,500) 0 (51,500) ( 1,500) Cash balance, ending. . $ 30,000 $ 30,000 $ 43,500 $ 43,500 .......... 50,000 $50,000 x 1% x 3 = $1,500. BEGINNING BALANCE SHEET Royal Company Balance Sheet March 31 Current assets: Cash Accounts receivable.... $ 40,000 (a) 30,000 (b) 5,200 (c) 20,000 (d) $ 95,200 Raw materials inventory. Finished goods inventory. Plant and equipment: Land .. Buildings and equipment. Accumulated depreciation.. Total assets.... ............... 400,000 (e) 1,610,000 (f) (750,000) (g) 1,260,000 $1,355;200 Liabilities: Accounts payable... Stockholders' equity: Common stock.. Retained earnings. Total liabilities and stockholders' equity $ 12,000 (h) $ 200,000 (i) 1,143,200 (1) 1,343,200 $1,355,200 (a) Given (b) Given (f) Given (g) Given (h) See MATERIALS DISBURSE- MENTS (i) Given () Given Given (d) Given Given

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started