Question

Once Grant has established a value for perspective. Of course, investors will be an investment. They will also want to determine how much of the

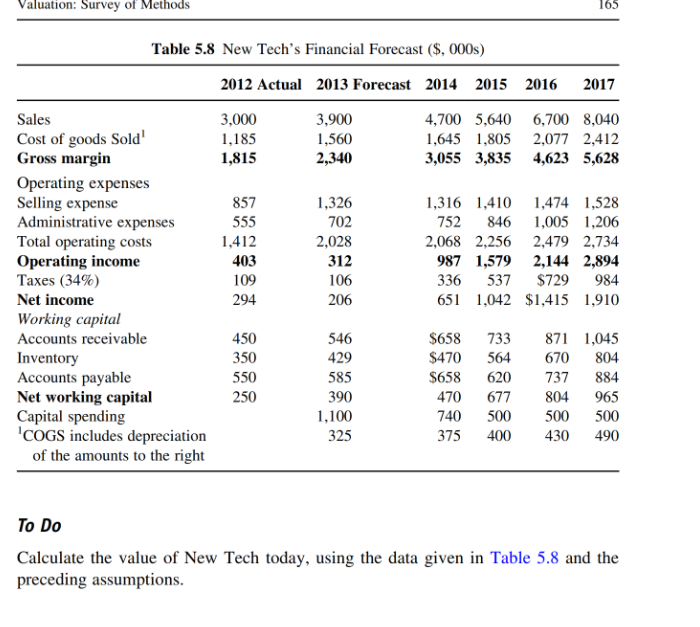

Once Grant has established a value for perspective. Of course, investors will be an investment. They will also want to determine how much of the firms shares they need to acquire to command that return. Grant expects that early-stage investors will want to earn a return of 30% to compensate for the risk. The rate of return reflects the investors perceptions of the economic, industry, and company-specific risk factors. It also accounts for the alternative investments available. Grant thinks that 30% will be adequate compensation for the risks associated with investing in a new, untried venture like New Techs growth plan. Grant explains that investors will evaluate the percentage of shares they require by looking at the potential return at exit, i.e., at the end of the investment period. This exit might be achieved through an IPO, a sale of the whole company, a buyback or redemption of the investors shares, or other means. The investor will be getting a percentage of the value of New Techs shares at the exit and will want to be sure that the percentage is high enough for them to hit their rate of return target of 30%. Grants initial assessment is that New Tech will fall short of an expected 30% after-tax return on investment for its investors. If that is so, they will need to alter their offering somehow to accommodate investor demands, possibly the percentage of shares they will offer. But first he explains how the calculations are done.

Grant starts with the assumption that potential investors would likely want to exit around 2017. 1. Assuming that the investors own 30% of New Techs shares at the time of exit and that the 2017 value would be three times the 2017 EBITDA, what would be the value of the firm in 2017? 2. What would be the investors share of the 2017 value?

3. What would be the return on a $1 million investment in the company today at that valuation?

4. Is your calculated return adequate? If not, how can it be made acceptable to investors?

4. Is your calculated return adequate? If not, how can it be made acceptable to investors?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started