Question

37 users unlocked this solution today!

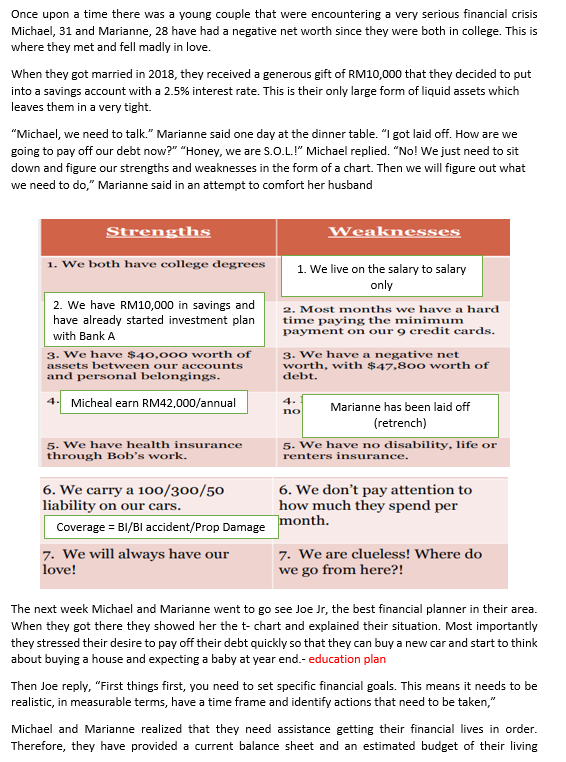

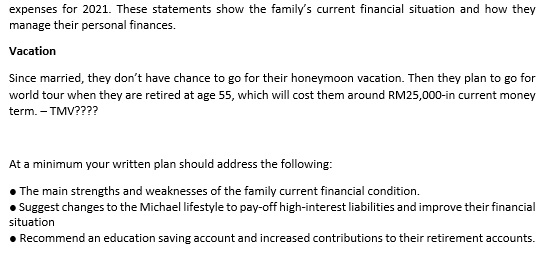

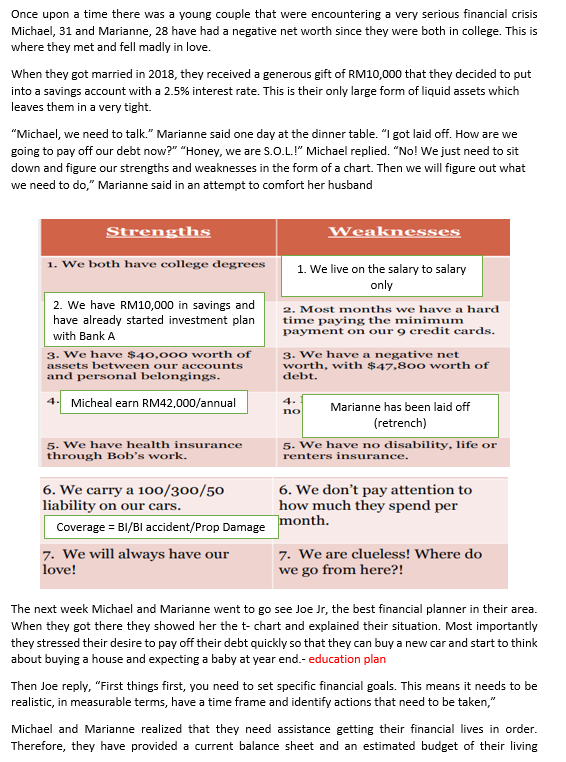

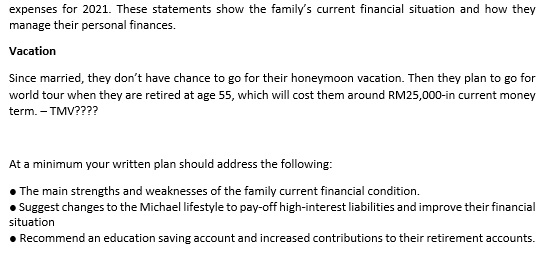

Once upon a time there was a young couple that were encountering a very serious financial crisis Michael, 31 and Marianne, 28 have had a negative net worth since they were both in college. This is where they met and fell madly in love. When they got married in 2018, they received a generous gift of RM10,000 that they decided to put into a savings account with a 2.5% interest rate. This is their only large form of liquid assets which leaves them in a very tight. "Michael, we need to talk." Marianne said one day at the dinner table. "I got laid off. How are we going to pay off our debt now?" "Honey, we are S.O.L.!" Michael replied. "No! We just need to sit down and figure our strengths and weaknesses in the form of a chart. Then we will figure out what we need to do," Marianne said in an attempt to comfort her husband Strengths Weaknesses 1. We both have college degrees 2. We have RM10,000 in savings and have already started investment plan with Bank A 3. We have $40,000 worth of assets between our accounts and personal belongings. 4. Micheal earn RM42.000/annual 1. We live on the salary to salary only 2. Most months we have a hard time paying the minimum payment on our 9 credit cards. 3. We have a negative net worth, with $47,800 worth of debt. no Marianne has been laid off (retrench) 5. We have no disability, life or renters insurance. 5. We have health insurance through Bob's work. 6. We carry a 100/300/50 6. We don't pay attention to liability on our cars. how much they spend per Coverage = BI/BI accident/Prop Damage month. 7. We will always have our 7. We are clueless! Where do love! we go from here?! The next week Michael and Marianne went to go see Joe Jr, the best financial planner in their area. When they got there they showed her the t-chart and explained their situation. Most importantly they stressed their desire to pay off their debt quickly so that they can buy a new car and start to think about buying a house and expecting a baby at year end.- education plan Then Joe reply, "First things first, you need to set specific financial goals. This means it needs to be realistic, in measurable terms, have a time frame and identify actions that need to be taken," Michael and Marianne realized that they need assistance getting their financial lives in order. Therefore, they have provided a current balance sheet and an estimated budget of their living expenses for 2021. These statements show the family's current financial situation and how they manage their personal finances. Vacation Since married, they don't have chance to go for their honeymoon vacation. Then they plan to go for world tour when they are retired at age 55, which will cost them around RM25,000-in current money term. - TMV???? At a minimum your written plan should address the following: The main strengths and weaknesses of the family current financial condition. Suggest changes to the Michael lifestyle to pay-off high-interest liabilities and improve their financial situation . Recommend an education saving account and increased contributions to their retirement accounts. Once upon a time there was a young couple that were encountering a very serious financial crisis Michael, 31 and Marianne, 28 have had a negative net worth since they were both in college. This is where they met and fell madly in love. When they got married in 2018, they received a generous gift of RM10,000 that they decided to put into a savings account with a 2.5% interest rate. This is their only large form of liquid assets which leaves them in a very tight. "Michael, we need to talk." Marianne said one day at the dinner table. "I got laid off. How are we going to pay off our debt now?" "Honey, we are S.O.L.!" Michael replied. "No! We just need to sit down and figure our strengths and weaknesses in the form of a chart. Then we will figure out what we need to do," Marianne said in an attempt to comfort her husband Strengths Weaknesses 1. We both have college degrees 2. We have RM10,000 in savings and have already started investment plan with Bank A 3. We have $40,000 worth of assets between our accounts and personal belongings. 4. Micheal earn RM42.000/annual 1. We live on the salary to salary only 2. Most months we have a hard time paying the minimum payment on our 9 credit cards. 3. We have a negative net worth, with $47,800 worth of debt. no Marianne has been laid off (retrench) 5. We have no disability, life or renters insurance. 5. We have health insurance through Bob's work. 6. We carry a 100/300/50 6. We don't pay attention to liability on our cars. how much they spend per Coverage = BI/BI accident/Prop Damage month. 7. We will always have our 7. We are clueless! Where do love! we go from here?! The next week Michael and Marianne went to go see Joe Jr, the best financial planner in their area. When they got there they showed her the t-chart and explained their situation. Most importantly they stressed their desire to pay off their debt quickly so that they can buy a new car and start to think about buying a house and expecting a baby at year end.- education plan Then Joe reply, "First things first, you need to set specific financial goals. This means it needs to be realistic, in measurable terms, have a time frame and identify actions that need to be taken," Michael and Marianne realized that they need assistance getting their financial lives in order. Therefore, they have provided a current balance sheet and an estimated budget of their living expenses for 2021. These statements show the family's current financial situation and how they manage their personal finances. Vacation Since married, they don't have chance to go for their honeymoon vacation. Then they plan to go for world tour when they are retired at age 55, which will cost them around RM25,000-in current money term. - TMV???? At a minimum your written plan should address the following: The main strengths and weaknesses of the family current financial condition. Suggest changes to the Michael lifestyle to pay-off high-interest liabilities and improve their financial situation . Recommend an education saving account and increased contributions to their retirement accounts

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

Order free textbooks.

Order free textbooks.

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!