Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following data is taken from a firm with several business units. Using the line of business information and the weightings provided, rate both

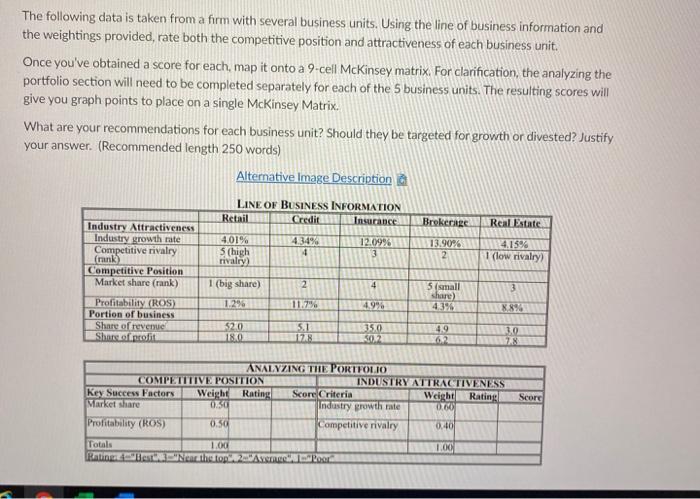

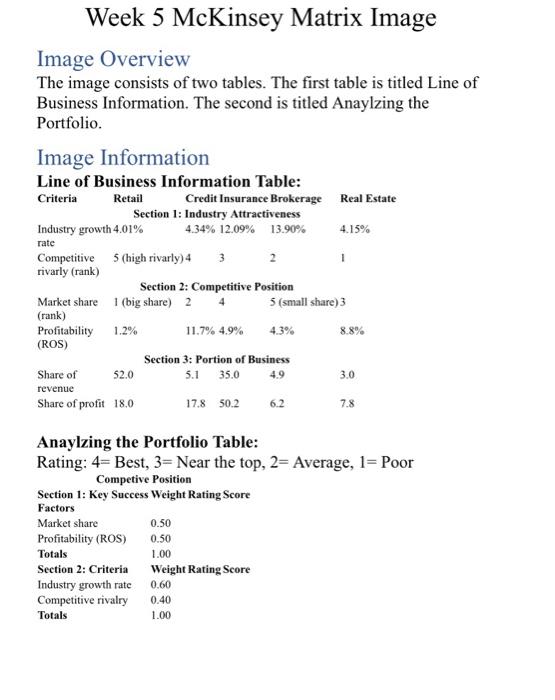

The following data is taken from a firm with several business units. Using the line of business information and the weightings provided, rate both the competitive position and attractiveness of each business unit. Once you've obtained a score for each, map it onto a 9-cell McKinsey matrix. For clarification, the analyzing the portfolio section will need to be completed separately for each of the 5 business units. The resulting scores will give you graph points to place on a single McKinsey Matrix. What are your recommendations for each business unit? Should they be targeted for growth or divested? Justify your answer. (Recommended length 250 words) Alternative Image Description LINE OF BUSINESS INFORMATION Retail Credit Insurance Brekerage Real Estate Industry Attractiveness Industry growth rate Competitive rivalry (rank) Competitive Position Market share (rank) 4.01% 5 (high rivalry) 4.34% 12.09% 13 13.90% 2 (low rivalry) 1 (big share) 5 (small share) 4.3% ALEK.8% 3. Profitability (ROS) Portion of business Share of revenue Share of profit 1.2% 11.7% 4.9% 52.0 18.0 S.1 17.8 35.0 30.2 1 49 62 UZS ANALYZING THE PORTFOLIO COMPETITIVE POSITION INDUSTRY ATTRACTIVENESS Key Success Factors Market share Weight Rating 0.50 Score Criteria Industry growth rate Rating Weight 0.60 Score Profitability (ROS) 0.50 Competitive rivalry 0.40 Totals Rating lest"."Near the top. 2Average" IPoor 1.00 1.00 Week 5 McKinsey Matrix Image Image Overview The image consists of two tables. The first table is titled Line of Business Information. The second is titled Anaylzing the Portfolio. Image Information Line of Business Information Table: Criteria Retail Credit Insurance Brokerage Real Estate Section 1: Industry Attractiveness 4.34% 12.09% Industry growth 4.01% 13.90% 4.15% rate Competitive 5 (high rivarly) 4 rivarly (rank) 3 Section 2: Competitive Position 5 (small share) 3 Market share 1 (big share) 2 (rank) Profitability (ROS) 1.2% 11.7% 4.9% 4.3% 8.8% Section 3: Portion of Business Share of 52.0 5.1 35.0 4.9 3.0 revenue Share of profit 18.0 17.8 50.2 6.2 7.8 Anaylzing the Portfolio Table: Rating: 4= Best, 3= Near the top, 2= Average, 1= Poor Competive Position Section 1: Key Success Weight Rating Score Factors Market share 0.50 Profitability (ROS) 0.50 Totals 1.00 Section 2: Criteria Weight Rating Score Industry growth rate Competitive rivalry Totals 0.60 0.40 1.00

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started