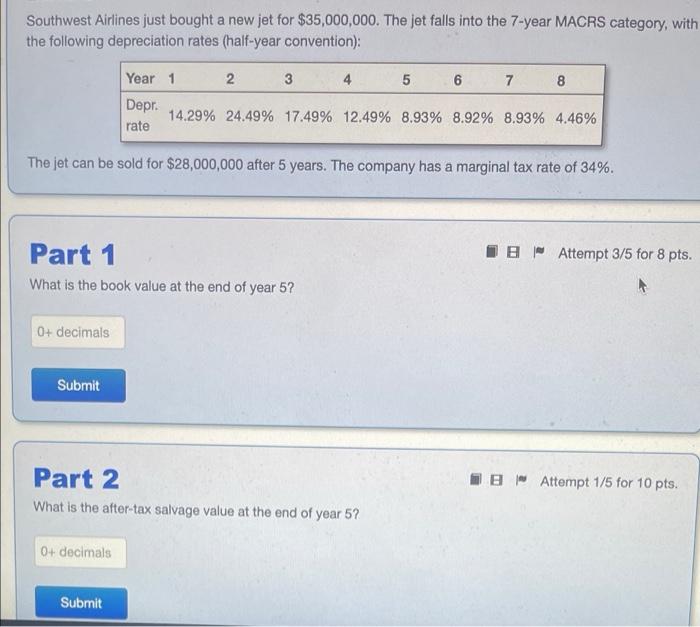

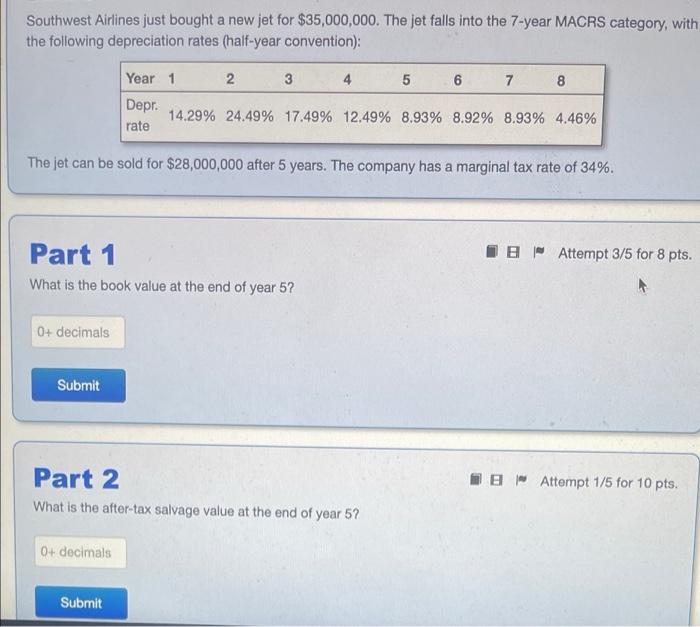

onder there tial. Wia Clamma theorgeton The com OSO Thes TN Two www . - The - The . Part 1 Part 2 Part 3 om Part 4 Part 5 Part 6 Part 7 Southwest Airlines just bought a new jet for $35,000,000. The jet falls into the 7-year MACRS category, with the following depreciation rates (half-year convention): Year 1 2 3 4 5 6 7 8 Depr. rate 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% The jet can be sold for $28,000,000 after 5 years. The company has a marginal tax rate of 34%. B Attempt 3/5 for 8 pts. Part 1 What is the book value at the end of year 5? 0+ decimals Submit B Attempt 1/5 for 10 pts. Part 2 What is the after-tax salvage value at the end of year 5? 0+ decimals Submit Southwest Airlines just bought a new jet for $35,000,000. The jet falls into the 7-year MACRS category, with the following depreciation rates (half-year convention): Year 1 2 3 4 5 6 7 8 Depr. 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% rate The jet can be sold for $28,000,000 after 5 years. The company has a marginal tax rate of 34%. B Attempt 3/5 for 8 pts. Part 1 What is the book value at the end of year 5? 0+ decimals Submit B Attempt 1/5 for 10 pts. Part 2 What is the after-tax salvage value at the end of year 5? 0+ decimals Submit onder there tial. Wia Clamma theorgeton The com OSO Thes TN Two www . - The - The . Part 1 Part 2 Part 3 om Part 4 Part 5 Part 6 Part 7 Southwest Airlines just bought a new jet for $35,000,000. The jet falls into the 7-year MACRS category, with the following depreciation rates (half-year convention): Year 1 2 3 4 5 6 7 8 Depr. rate 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% The jet can be sold for $28,000,000 after 5 years. The company has a marginal tax rate of 34%. B Attempt 3/5 for 8 pts. Part 1 What is the book value at the end of year 5? 0+ decimals Submit B Attempt 1/5 for 10 pts. Part 2 What is the after-tax salvage value at the end of year 5? 0+ decimals Submit Southwest Airlines just bought a new jet for $35,000,000. The jet falls into the 7-year MACRS category, with the following depreciation rates (half-year convention): Year 1 2 3 4 5 6 7 8 Depr. 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% rate The jet can be sold for $28,000,000 after 5 years. The company has a marginal tax rate of 34%. B Attempt 3/5 for 8 pts. Part 1 What is the book value at the end of year 5? 0+ decimals Submit B Attempt 1/5 for 10 pts. Part 2 What is the after-tax salvage value at the end of year 5? 0+ decimals Submit