Answered step by step

Verified Expert Solution

Question

1 Approved Answer

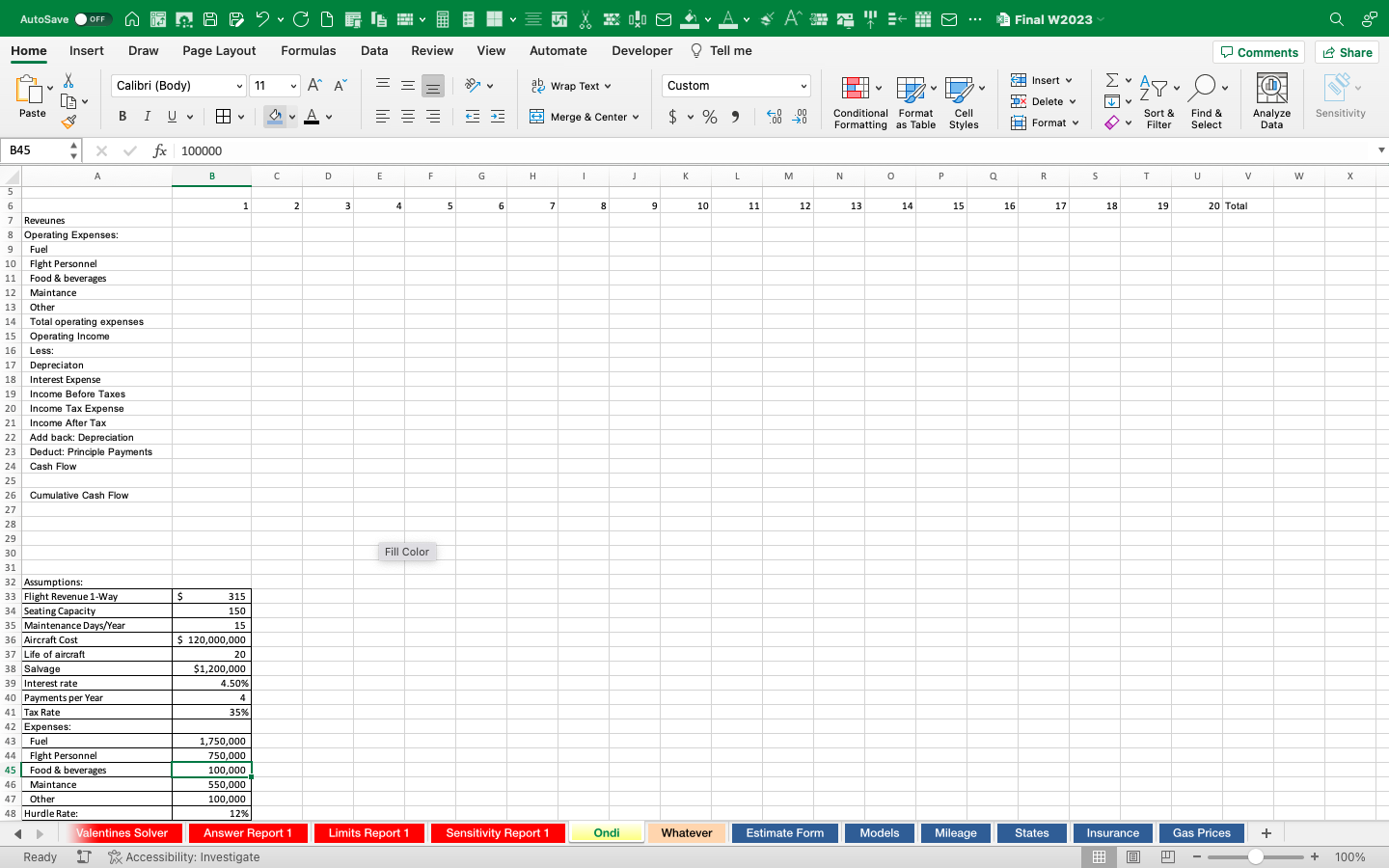

Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will

- Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will fly one round-trip daily except for scheduled maintenance days. There are 15 maintenance days scheduled each year. The seating capacity of the aircraft is 150. Flights are expected to be fully booked. The average revenue per passenger per flight (one-way) is $315. Annual operating costs are given in the Ondi worksheet. The aircraft will cost $120,000,000 and has an expected life of 20 years. The company can borrow the money at 4.5%. The company requires a hurdle rate of 12% return.

- Make the cash flow statements for the projected 20 years

- Calculate NPV given the company's hurdle rate. Should the aircraft be purchased?

- Calculate NPV given returns of 8% to 20%. At what rate of return is the purchase not viabl

- make a scatter chart of NPV values.

- Calculate IRR

- In what year does cumulative cash flow go from negative to positive (use formulas)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started