Answered step by step

Verified Expert Solution

Question

1 Approved Answer

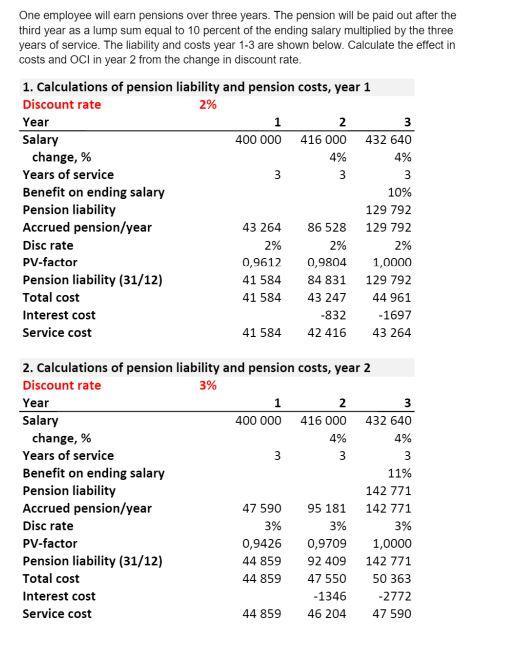

One employee will earn pensions over three years. The pension will be paid out after the third year as a lump sum equal to

One employee will earn pensions over three years. The pension will be paid out after the third year as a lump sum equal to 10 percent of the ending salary multiplied by the three years of service. The liability and costs year 1-3 are shown below. Calculate the effect in costs and OCI in year 2 from the change in discount rate. 1. Calculations of pension liability and pension costs, year 1 Discount rate 2% Year Salary change, % Years of service Benefit on ending salary Pension liability Accrued pension/year Disc rate PV-factor Pension liability (31/12) Total cost Interest cost Service cost change, % Years of service Benefit on ending salary Pension liability Accrued pension/year Disc rate PV-factor Pension liability (31/12) Total cost 1 400 000 Interest cost Service cost 3 43 264 2% 0,9612 41 584 41 584 41 584 1 400 000 3 47 590 3% 2. Calculations of pension liability and pension costs, year 2 Discount rate 3% Year Salary 0,9426 44 859 44 859 2 416 000 4% 3 44 859 86 528 2% 0,9804 84 831 43 247 -832 42 416 2 416 000 4% 3 95 181 3% 3 432 640 4% 3 0,9709 92 409 47 550 -1346 46 204 10% 129 792 129 792 2% 1,0000 129 792 44 961 -1697 43 264 3 432 640 4% 3 11% 142 771 142 771 3% 1,0000 142 771 50 363 -2772 47 590

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Discount rate 2 Year 1 Salary 400000 Change in salary 4 Years of service 3 Benefit on ending salary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started