One factor and the effect on the risk of material misstatement

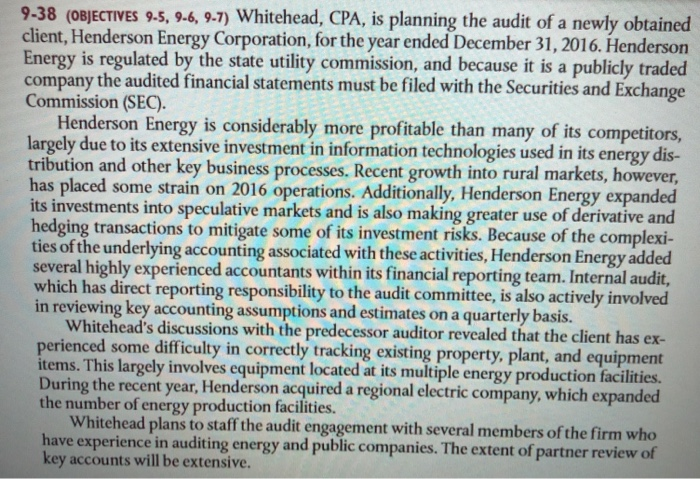

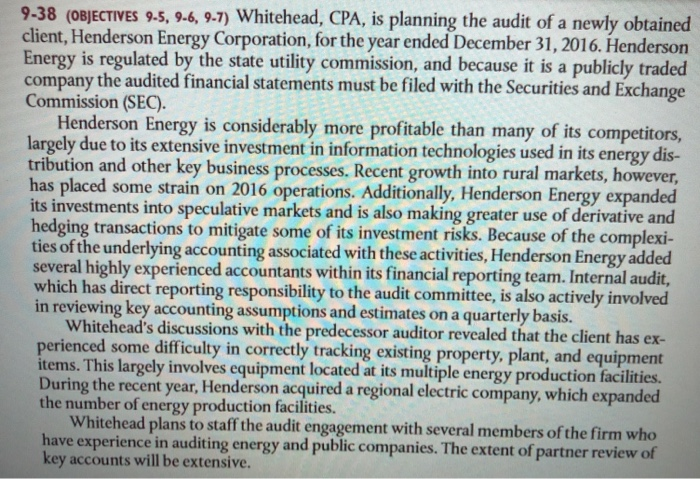

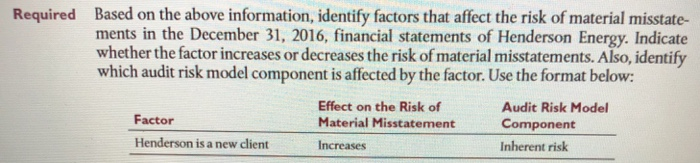

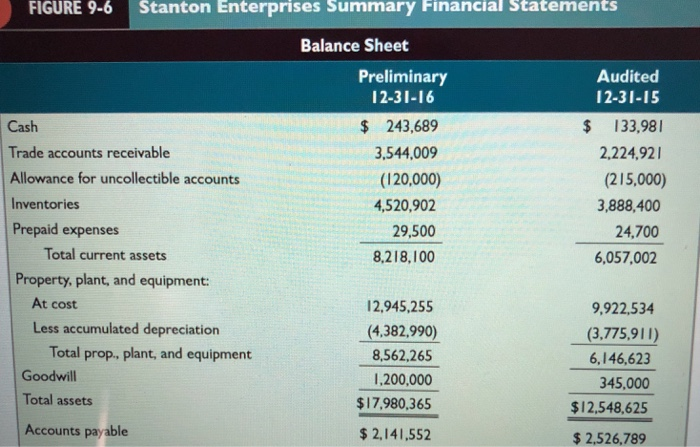

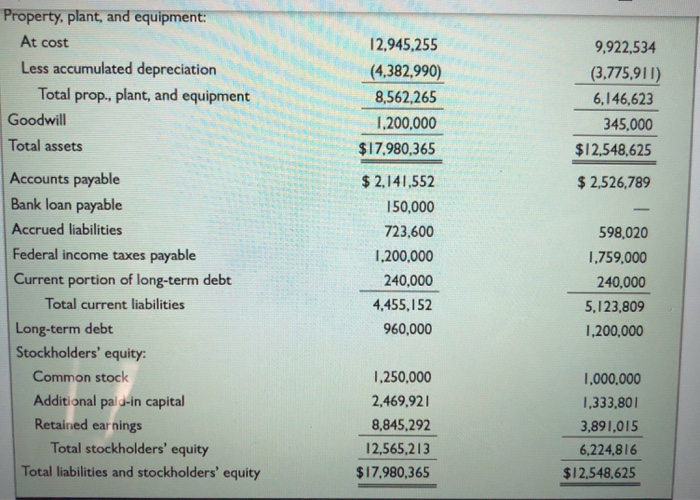

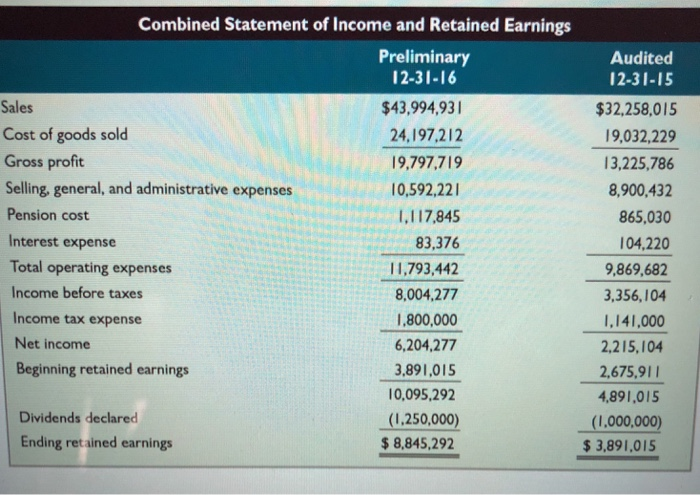

9-38 (oBJECTIVES 9.5,9-6, 9.7) Whitehead, CPA, is planning the audit of a newly obtained client, Henderson Energy Corporation, for the year ended December 31, 2016. Henderson Energy is regulated by the state utility commission, and because it is a publicly traded company the audited financial statements must be filed with the Securities and Exchange Commission (SEC). Henderson Energy is considerably more profitable than many of its competitors argely due to its extensive investment in information technologies used in its energy dis- tribution and other key business processes. Recent growth into rural markets, however, has placed some strain on 2016 operations. Additionally, Henderson Energy expanded its investments into speculative markets and is also making greater use of derivative and hedging transactions to mitigate some of its investment risks. Because of the complexi- ties of the underlying accounting associated with these activities, Henderson Energy added several highly experienced accountants within its financial reporting team. Internal audit, which has direct reporting responsibility to the audit committee, is also actively involved in reviewing key accounting assumptions and estimates on a quarterly basis. Whitehead's discussions with the predecessor auditor revealed that the client has ex- perienced some difficulty in correctly tracking existing property, plant, and equipment tems. This largely involves equipment located at its multiple energy production facilities. During the recent year, Henderson acquired a regional electric company, which the number of energy production facilities. Whitehead plans to staff the audit engagement with several members of the firm who e experience in auditing energy and public companies. The extent of partner review of key accounts will be extensive Based on the above information, identify factors that affect the risk of material misstate- ments in the December 31, 2016, financial statements of Henderson Energy. Indicate whether the factor increases or decreases the risk of material misstatements. Also, identify which audit risk model component is affected by the factor. Use the format below: Required Effect on the Risk of Material Misstatement Increases Audit Risk Model Factor Henderson is a new client Inherent risk FIGURE 9-6 Stanton Enterprises Summary Financial Statements Balance Sheet Audited 12-31-15 $ 133,98 2,224,921 Preliminary 12-31-16 $243,689 3,544.009 (120,000) 4,520,902 Cash Trade accounts receivable Allowance for uncollectible accounts Inventories Prepaid expenses (215,000) 3,888,400 24,700 6,057,002 29,500 Total current assets 8,218,100 Property, plant, and equipment: At cost 2,945,255 (4,382,990) 8,562,265 1,200,000 $17,980,365 $ 2,141,552 9,922,534 (3,775,911) 6,146,623 345,000 $12,548,625 $2,526,789 Less accumulated depreciation Total prop., plant, and equipment Goodwill Total assets Accounts payable Property, plant, and equipment At cost 2,945,255 (4,382,990) 8,562,265 1,200,000 $17,980,365 $2,141,552 150,000 723,600 1,200,000 240,000 4.455,152 960,000 9,922,534 Less accumulated depreciation (3.775,91I) Total prop., plant, and equipment Goodwill Total assets Accounts payable Bank loan payable Accrued liabilities Federal income taxes payable Current portion of long-term debt 6,146,623 345,000 $12,548,625 $ 2,526,789 598,020 759,000 240,000 5,123,809 1,200,000 Total current liabilities Long-term debt Stockholders' equity: Common stock Additional pald-in capital Retained earnings ,250,000 2.469,92 8,845,292 12,565,213 $17,980,365 1000,000 1,333,801 3,891,015 6,224,816 $12,548,625 Total stockholders' equity Total liabilities and stockholders' equity