Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maxima Co. is considering two independent projects, S and L, whose costs, cash inflows and the internal rate of return (IRR) of the two

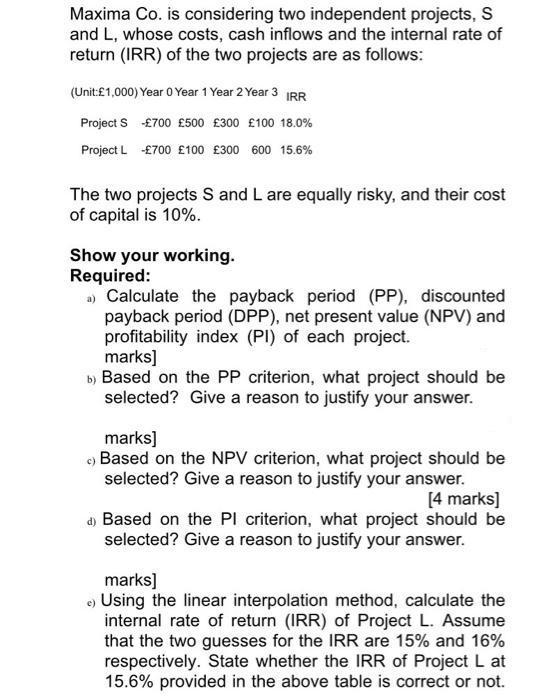

Maxima Co. is considering two independent projects, S and L, whose costs, cash inflows and the internal rate of return (IRR) of the two projects are as follows: (Unit:1,000) Year 0 Year 1 Year 2 Year 3 IRR Project S 700 500 300 100 18.0% Project L -700 100 300 600 15.6 % The two projects S and L are equally risky, and their cost of capital is 10%. Show your working. Required: a) Calculate the payback period (PP), discounted payback period (DPP), net present value (NPV) and profitability index (PI) of each project. marks] b) Based on the PP criterion, what project should be selected? Give a reason to justify your answer. marks] Based on the NPV criterion, what project should be selected? Give a reason to justify your answer. [4 marks] d) Based on the PI criterion, what project should be selected? Give a reason to justify your answer. marks] e) Using the linear interpolation method, calculate the internal rate of return (IRR) of Project L. Assume that the two guesses for the IRR are 15% and 16% respectively. State whether the IRR of Project L at 15.6% provided in the above table is correct or not.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the payback period PP discounted payback period DPP net present value NPV and profitabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started