Question

One of the current administration's plans is to expand the Earned Income Tax Credit (EITC) to older workers (65 years old or older) in the

One of the current administration's plans is to "expand the Earned Income Tax Credit (EITC) to older workers" (65 years old or older) in the hope of "helping low-wage workers achieve a living wage"

i) Explain how an EITC works.

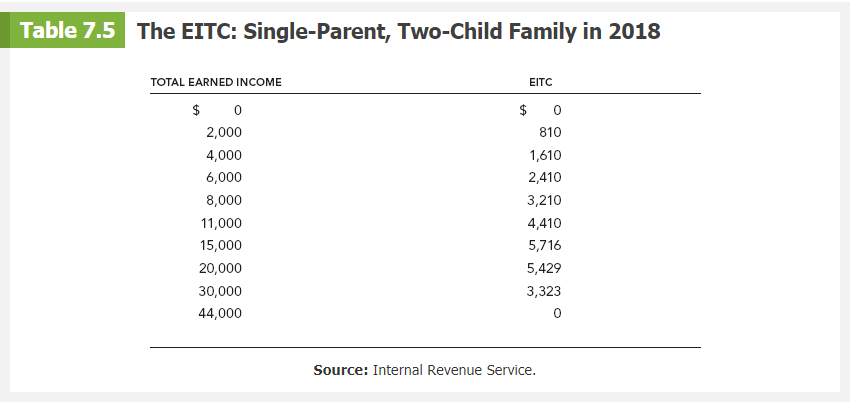

Make a graph, using the Table 7.5 of textbook to highlight its effects on the income of the poor. (Have the annual earned income to the horizontal axis & annual disposable income to the vertical axis.)

ii) How would this expansion of the EITC affect workers? What would be the effect relative to a simple stipend or a negative income tax (NIT)?

Explain the EITC's effects on work incentives. Compare and contrast the EITC to those alternatives.

Table 7.5 The EITC: Single-Parent, Two-Child Family in 2018 TOTAL EARNED INCOME EITC $ 0 $ 0 2,000 810 4,000 1,610 6,000 2,410 8,000 3,210 11,000 4,410 15,000 5,716 20,000 5,429 30,000 3,323 44,000 Source: Internal Revenue Service.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i The Earned Income Tax Credit EITC is a refundable tax credit designed to provide financial assistance to lowincome workers and families It is primarily targeted at individuals or families with earne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started