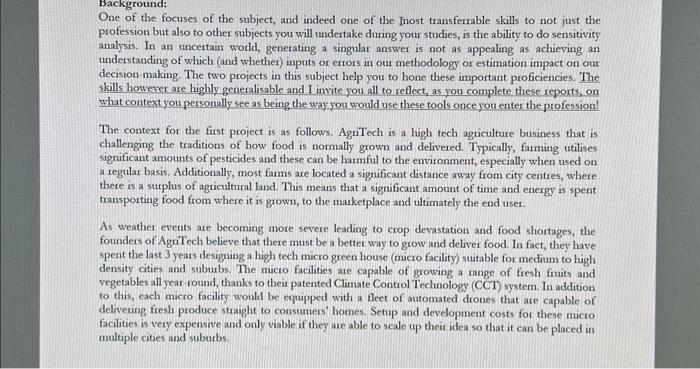

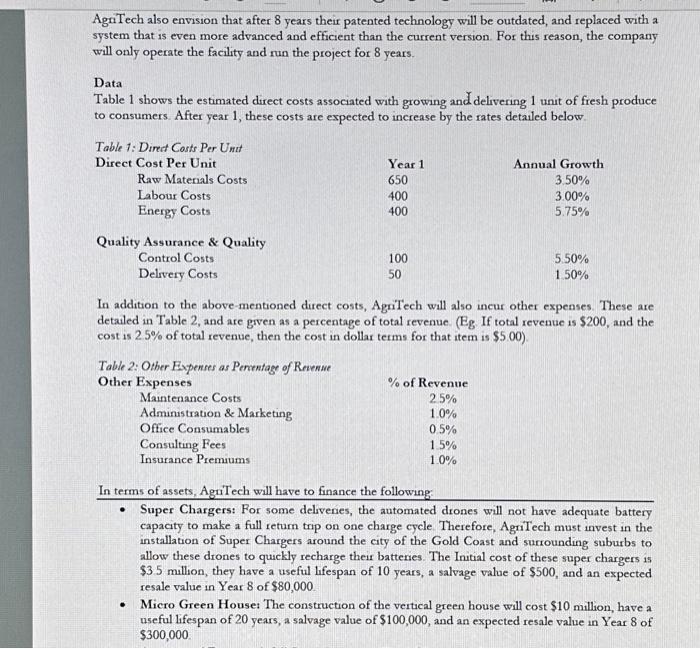

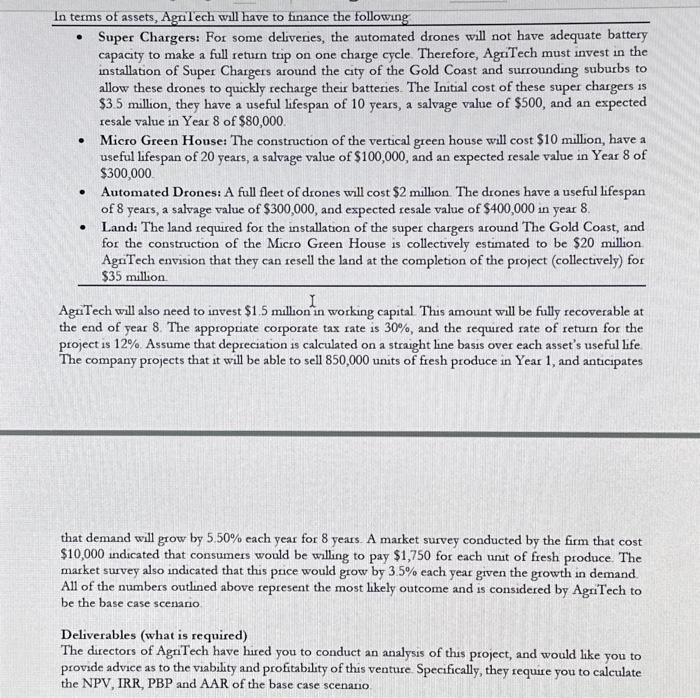

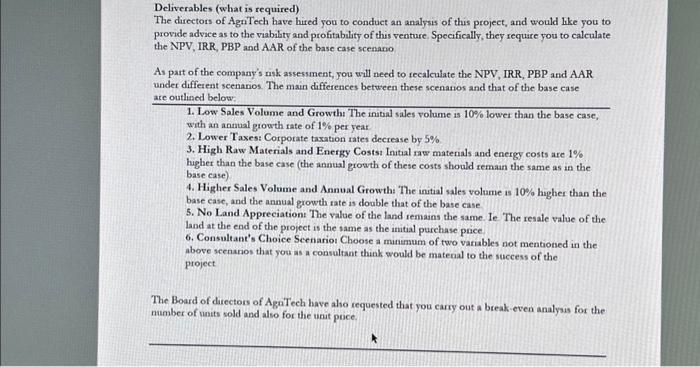

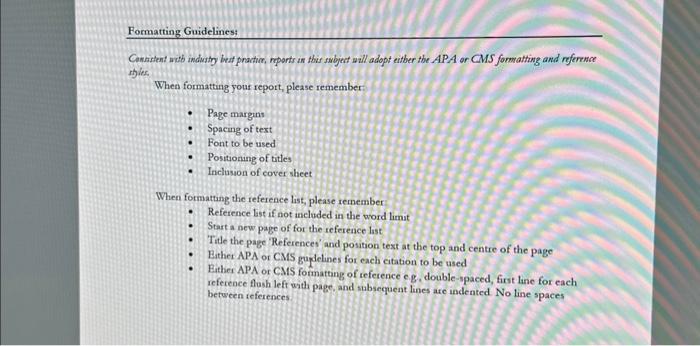

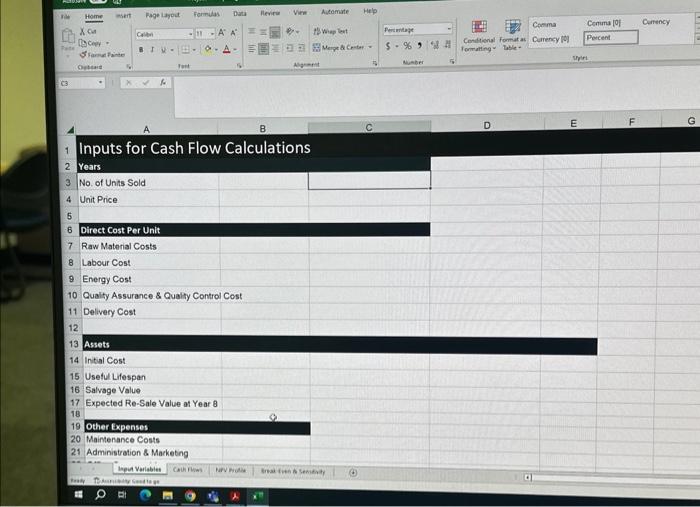

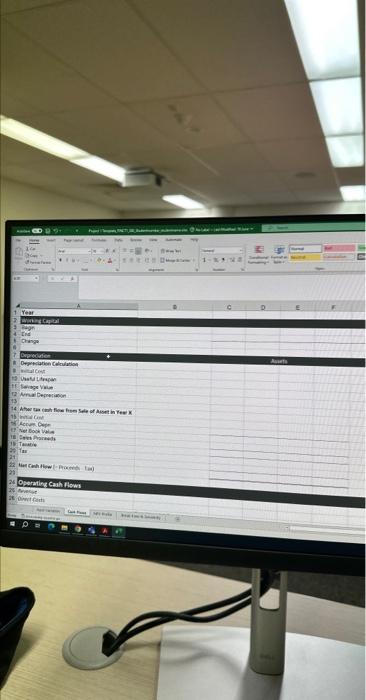

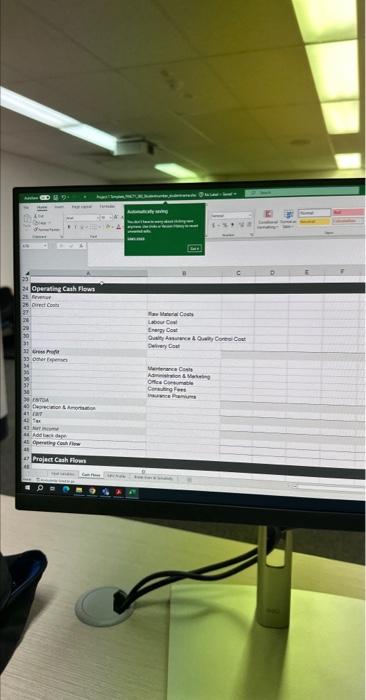

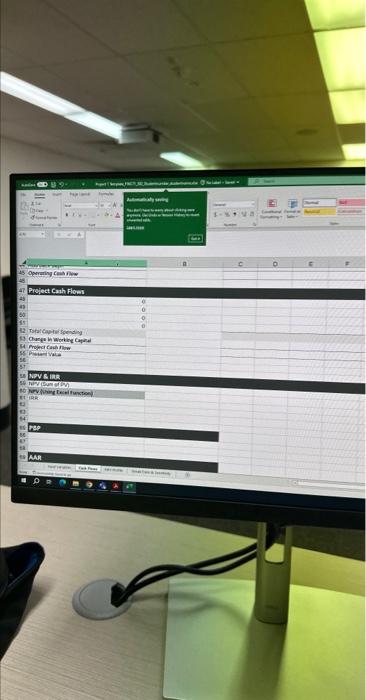

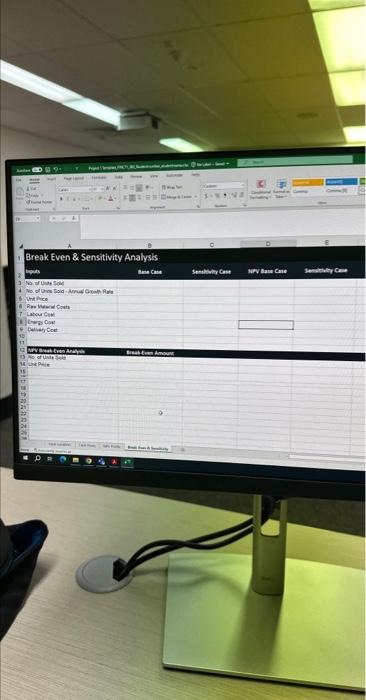

One of the focuses of the subject, and indeed one of the Inost transferrable skills to not just the profession but also to other subjects you will undertake during your studies, is the ability to do sensitivity analysis. In an uncertain world, generating a singular answer is not as appealing as achieving an understanding of which (and whether) inputs or errors in our methodology or estimation impact on our decision-making. The two projects in this subject help you to hone these important proficiencies. The skills however are highly generalisable and I invite you all to reflect, as you complete these reports, on what context you personally see as being the way you would use these tools once you enter the profession! The context for the first project is as follows. AgriTech is a ligh tech agriculture business that is challenging the traditions of how food is normally grown and delivered. Typically, farming utilises significant amounts of pesticides and these can be harmful to the environment, especially when used on a regular basis. Additionally, most fams are located a significant distance away from city centres, where there is a surplus of agricultural land. This means that a significant amount of time and energy is spent transporting food from where it is grown, to the maketplace and ultimately the end user. As weather events are becoming more severe leading to crop devastation and food shortages, the founders of AgriTech believe that there must be a better way to grow and deliver food. In fact, they have spent the last 3 years designing a high tech micro green house (micro facility) suitable for medium to high density cities and suburbs. The micro facilities are capable of growing a range of fresh fruits and vegetables all year-round, thanks to their patented Climate Control Technology (CCT) system. In addition to this, each micro facility would be equipped with a fleet of automated drones that are capable of delivering fresh produce straight to consumers' homes. Setup and development costs for these micro facilities is very expensive and only viable if they are able to scale up their idea so that it can be placed in multiple cities and suburbs. AgrTech also envision that after 8 years their patented technology will be outdated, and replaced with a system that is even more advanced and efficient than the current version. For this reason, the company will only operate the facility and run the project for 8 years. Data Table 1 shows the estimated direct costs associated with growing and delivering 1 unit of fresh produce to consumers. After year 1 , these costs are expected to increase by the rates detaled below. In addition to the above-mentioned direct costs, Agrilech will also incur other expenses. These are detaled in Table 2, and are given as a percentage of total revenue. (Eg. If total revenue is $200, and the cost is 2.5% of total revenue, then the cost in dollar terms for that item is $5.00 ). In terms of assets, Agr'Tech will have to finance the following: - Super Chargers: For some deliveries, the automated drones will not have adequate battery capacity to make a full return trip on one charge cycle. Therefore, AgriTech must invest in the installation of Super Chargers around the city of the Gold Coast and surrounding suburbs to allow these drones to quickly recharge their batteries. The Initial cost of these super chargers is $3.5 million, they have a useful hifespan of 10 years, a salvage value of $500, and an expected resale value in Year 8 of $80,000. - Micro Green Houset The construction of the vertical green house will cost $10 million, have a useful lifespan of 20 years, a salvage value of $100,000, and an expected resale value in Year 8 of $300,000 - Super Chargers: For some deliveries, the automated drones will not have adequate battery capacity to make a full return trip on one charge cycle. Therefore, AgriTech must invest in the installation of Super Chargers around the city of the Gold Coast and surrounding suburbs to allow these drones to quickly recharge their batteries. The Initial cost of these super chargers is $3.5 million, they have a useful lifespan of 10 years, a salvage value of $500, and an expected resale value in Year 8 of $80,000. - Micro Green House: The construction of the vertical green house will cost $10 million, have a useful lifespan of 20 years, a salvage value of $100,000, and an expected resale value in Year 8 of $300,000 - Automated Drones: A full fleet of drones will cost $2 million. The drones have a useful lifespan of 8 years, a salvage value of $300,000, and expected resale value of $400,000 in year 8 . - Land: The land required for the installation of the super chargers around The Gold Coast, and for the construction of the Micro Green House is collectively estimated to be $20 million Agriech envision that they can resell the land at the completion of the project (collectively) for $35 million. AgriTech will also need to invest $1.5 million in working capital. This amount will be fully recoverable at the end of year 8 . The appropriate corporate tax rate is 30%, and the required rate of return for the project is 12%. Assume that depreciation is calculated on a straight line basis over each asset's useful life The company projects that it will be able to sell 850,000 units of fresh produce in Year 1 , and anticipates that demand will grow by 5.50% each year for 8 years. A market survey conducted by the firm that cost $10,000 indicated that consumers would be willing to pay $1,750 for each unit of fresh produce. The market survey also indicated that this price would grow by 3.5% each year given the growth in demand All of the numbers outlined above represent the most likely outcome and is considered by AgriTech to be the base case scenario Deliverables (what is required) The directors of AgriTech have hired you to conduct an analysis of this project, and would like you to provide advice as to the viability and profitability of this venture. Specifically, they require you to calculate the NPV, IRR, PBP and AAR of the base case scenano. Deliverables (what is required) The directors of AgrTech have hired you to conduct an analysis of this project, and would hke you to provide advice as to the viability and profitabality of this venture. Specifically, they requare you to calculate the NPV, IRR, PBP and AAR of the base case scenario As part of the company's nik assessment, you will need to recalculate the NPV, IRR, PBP and AAR under different scenamos. The main differences between these scenamos and that of the base case are outhined below: 1. Low Sales Volume and Growth The initial sales volume is 10% lowet than the base case, with an anmual growth rate of 1% per year 2. Lower Taxes: Corporate taxation rates decrease by 5% 3. High Raw Materials and Energy Costsi Inital raw materials and energy costs are 1% higher than the base case (the annual growth of these costs should reman the same as in the base case) 4. Higher Sales Volume and Annual Growth: The initial sales volame is 10% hagher than the base case, and the annual growth rate is double that of the base case 5. No Land Appreciation: The value of the land remasns the same. Ie. The resale value of the land at the end of the project is the same as the initial purchase prace. 6. Consultant's Choice Seenariot Choose a munimum of two variables not mentioned in the above scenarios that you as a consultant think would be materal to the success of the Project The Board of directors of AgrTech have alio requested that you carry out a break-even analyas for the number of units sold and also for the urut pace. Hint: Simply incease each wariable by 1% from the base case and recaleulate the NPV wnder this dhange. 1. NPV Brak-Euen Analysi: Cam out a NPV Brak-Eirn Analysis for the Number of Unit Sold and the Unat Price. 2. Srenario Anabris: Using Seenario Manager in Epel, nalrulate the NPV. IRR, PBP and ALR and projent rash flows for years 0 to 8 for the folloning scenanis. Ensure that your variables and summany ontpwt cells have been named appropriately. 1. Low Sales Volume and Growth i. Lower Taves ii. Higber Raw Material and Enemy Casts w. Higher Sales Volume and Annual Grouth 1. No Land Appreviation 1i. Conswltant's Choice Sernario 2. Essay Submigsiont As part of your submission, you will need to provide a short report discussing your analysis. (SOo words MAXIMUM) 6. Cmate a Bar Cbant shar ullustrates fbe Pryent Canb Flasx for all the semanios in Y iar 8 . and indude ter following in yasr dienumin: 2. Showld Agrited proved with the project? i. What armar past the kighest nik to the surere of the promet? wi. Any atber majer mommendatient that jour belieer jowid meananably uspnev the pryect't tialility or pongitabilis: Cennistent nitb induaty bet practuc, mports in this sabject will adopt eitber the APA or CMS formatting and referme stive. When formatting your report, please remember - Page margins - Spacing of test - Font to be used - Positioning of titles - Inclusion of cover sheet When formatting the reference list, please remember - Reference list if not incloded in the word limat - Start a new page of for the reference list - 'Title the page 'References' and position text at the top and centre of the page - Either APA or CMS gudelines for each citation to be used - Euther APA or CMS formatting of reference eg. double-spaced, first line for each reference Alush left with page, and subsequent lines are indented No line spaces between references