Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One of the purposes of a cost accounting system is to fumish managers with estimates of product costs. Costing systems aid such managerial functions

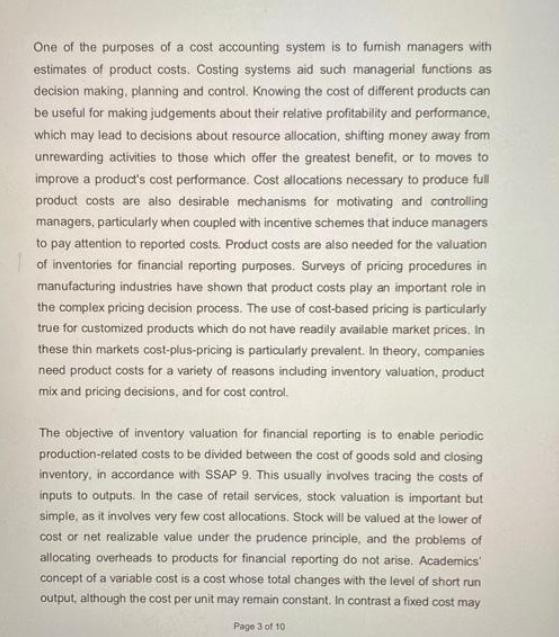

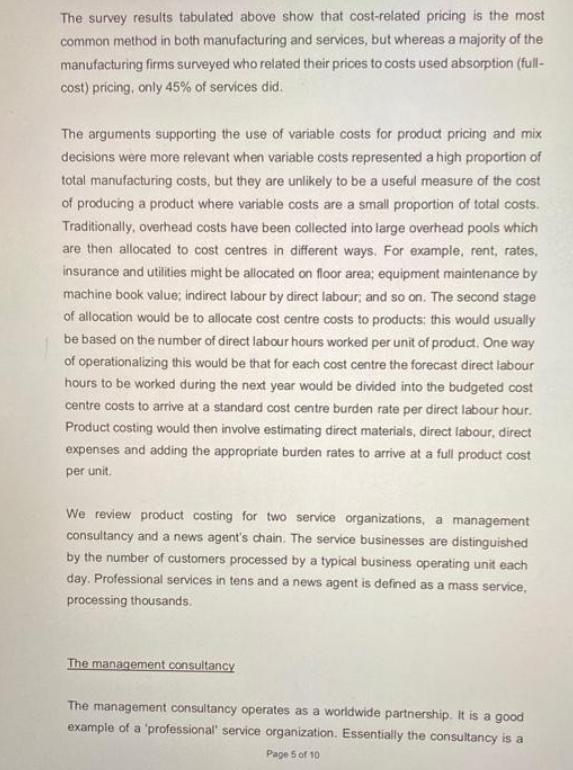

One of the purposes of a cost accounting system is to fumish managers with estimates of product costs. Costing systems aid such managerial functions as decision making, planning and control. Knowing the cost of different products can be useful for making judgements about their relative profitability and performance, which may lead to decisions about resource allocation, shifting money away from unrewarding activities to those which offer the greatest benefit, or to moves to improve a product's cost performance. Cost allocations necessary to produce full product costs are also desirable mechanisms for motivating and controlling managers, particularly when coupled with incentive schemes that induce managers to pay attention to reported costs. Product costs are also needed for the valuation of inventories for financial reporting purposes. Surveys of pricing procedures in manufacturing industries have shown that product costs play an important role in the complex pricing decision process. The use of cost-based pricing is particularly true for customized products which do not have readily available market prices. In these thin markets cost-plus-pricing is particularly prevalent. In theory, companies need product costs for a variety of reasons including inventory valuation, product mix and pricing decisions, and for cost control. The objective of inventory valuation for financial reporting is to enable periodic production-related costs to be divided between the cost of goods sold and closing inventory, in accordance with SSAP 9. This usually involves tracing the costs of inputs to outputs. In the case of retail services, stock valuation is important but simple, as it involves very few cost allocations. Stock will be valued at the lower of cost or net realizable value under the prudence principle, and the problems of allocating overheads to products for financial reporting do not arise. Academics concept of a variable cost is a cost whose total changes with the level of short run output, although the cost per unit may remain constant. In contrast a fixed cost may Page 3 of 10 vary per unit but remains constant in total irrespective of the volume of activity in the short run, usually interpreted as a year but more correctly as a period in which the firm's productive capacity will not change, recognizing that in the long term all costs are variable. To measure product costs, practitioners tend to use full costs, where all costs are allocated to products; full cost represents variable cost plus a share of fixed overheads which will have been allocated to the product on a variety of bases. Academic argument has been that the company has incurred certain fixed costs to provide basic operating capacity. These costs will remain fixed in the short term whatever future decisions are taken. In the long term, of course, the company must cover both its variable and fixed costs if it is to survive. To conventional academics, variable costs therefore represent short run costs and are the only costs relevant to the making of short run pricing and product mix decisions. Surveys of current product costing practice have shown that practitioners reject this short term view. For pricing decisions their preference is to use full cost plus a margin related to what the market will bear, whose size will be determined by market conditions. Table 1: Pricing decisions in practise Basic methods: Cost related Market determined Combination Cost related: Absorption Contribution Return on investment Other Source: Mills and Sweeting (1988) Manufacturing (%) Page 4 of 10 71 17 12 59 27 12 2 Services (10%) 68 11 21 4227 45 28 20 The survey results tabulated above show that cost-related pricing is the most common method in both manufacturing and services, but whereas a majority of the manufacturing firms surveyed who related their prices to costs used absorption (full- cost) pricing, only 45% of services did. The arguments supporting the use of variable costs for product pricing and mix decisions were more relevant when variable costs represented a high proportion of total manufacturing costs, but they are unlikely to be a useful measure of the cost of producing a product where variable costs are a small proportion of total costs. Traditionally, overhead costs have been collected into large overhead pools which are then allocated to cost centres in different ways. For example, rent, rates, insurance and utilities might be allocated on floor area; equipment maintenance by machine book value; indirect labour by direct labour, and so on. The second stage of allocation would be to allocate cost centre costs to products: this would usually be based on the number of direct labour hours worked per unit of product. One way of operationalizing this would be that for each cost centre the forecast direct labour hours to be worked during the next year would be divided into the budgeted cost centre costs to arrive at a standard cost centre burden rate per direct labour hour. Product costing would then involve estimating direct materials, direct labour, direct expenses and adding the appropriate burden rates to arrive at a full product cost per unit. We review product costing for two service organizations, a management consultancy and a news agent's chain. The service businesses are distinguished by the number of customers processed by a typical business operating unit each day. Professional services in tens and a news agent is defined as a mass service, processing thousands. The management consultancy The management consultancy operates as a worldwide partnership. It is a good example of a 'professional service organization. Essentially the consultancy is a Page 5 of 10 single product firm, the product being a project or job. However, each project will be a customized package depending on the problem tackled and the client's requirements. Great effort is placed on defining the specification of the project with the client before commencement. This helps clients to define the degree of quality needed in order to ensure that they will be satisfied with the final outcome. For the management consultancy, a high proportion of costs were readily traceable to products or jobs. This involved the use of a diary system for charging labour costs to jobs. Revenue Job A Less labour costs Less allocated overheads Profit Job A The newsagents chain Revenue Job 8 Less labour costs Less allocated overheads Profit Job B Manangement Consultant Total Profit Revenue Job C Less labour costs Less allocated overheads Profit Job B The news agents chain (a mass service) sells tobacco, confectionery and newspapers through a network of shops. Retail operations are split territorially and each region has a regional manager. Shop managers report to area managers, who in turn report to regional managers. profitability of various products means that product pricing and mix decisions are informed by other criteria. There are two strategies to achieve and sustain competitive advantage, namely cost leadership or competition on price and product/service differentiation. If either of these strategies is applied to a closely defined target segment of the market the resulting strategy is called 'focus'. According to Porter firms normally have to choose one strategy as they cannot do both successfully. Porter's 'value chain analysis' (VCA) encourages managers to look at the costs of the five core activities that make up the value chain. The value chain is a descriptive term for how the firm adds value in each of the core activities through the processes of designing. producing and delivering a service that customers will pay for. Differences in the way in which competitors perform these activities are sources of competitive success or failure, so the study of costs in each of the activities (VCA) is of vital importance, no matter what type of strategy is being followed. Whilst companies following a cost leadership strategy tend to concentrate on controlling production costs, companies using a differentiation strategy concentrate on the costs of differentiating themselves in the marketplace: transaction costs with suppliers and customers, linkages with other Strategic Business Units and inter-relationships of costs among the value activities. The kinds of strategies adopted by organizations are conditioned (but not wholly determined) by the type of market environment in which they operate and the type of business they are in. The interaction of these three contingent variables (strategy, environment and business type) will in tum affect the costing systems adopted by service organizations. Neither the management company nor the news agent compete on price, they all follow some form of differentiation strategy. The management consultancy believes it has two major sources of competitive advantage. Firstly, the ability to achieve deadlines with the necessary backup to put things right if the project falls behind schedule. Secondly, the company provides its consultants with exposure to wider business issues as well as specialized technical details. The news agents organization competes on geographical location, as the shops are community-based. As these two companies are not competing on price, full product costing for pricing decisions may not be appropriate. Whether a cost leadership or product/service differentiation strategy is followed, the planning and control of costs will still be needed. But with a differentiation strategy it may not be appropriate to effect planning and control via products: it may be more appropriate to plan and control via responsibility centres tied to the value chain. For these two companies, full product costs were not used for pricing decisions. Two explanations were offered to explain this. First in terms of the difficulty in tracing costs; second in terms of the competitive strategies adopted by the organizations. The management consultancy, a professional service organization, produced heterogeneous, customized services for its clients, the cost of the service being dependent on the mix and type of resources used. A detailed record of resources used was required for billing clients. There was a high traceability of labour costs and no problem of joint, inseparable products, thus product costing was relatively straightforward. However, while product costing and its use in pricing was more highly developed in this professional service, the presence of a high proportion of professional staff, the heterogeneity of tasks and the fuzziness of means: ends relationships meant that their staff were given greater autonomy than those in non-professional services. The other company, which was non- professional services, did not produce full product costs. Analysing all costs by products did not seem to be considered a sufficiently informative aid to decision- making as to justify the costs of doing so. The cost of tracing costs to products was not justified by the potential benefits of doing so. However, while learning more about what drives cost incurred and cost behaviour in services is obviously important, because companies compete on non-price variables as well such activities should not dominate managerial time and attention. 3) From the details in the case study, as a business analyst, prepare a report in the form of a memo to your manager, using the rubric provided. Incorporate the answers to the three criteria (a), (b) and (c) as well as (d) and (e) below on the two service operations: a) Traceability of costs and revenues b) Allocation base of overheads c) Decision on pricing and product mix From the analysis of (a), (b) and (c) above on the two service companies, advise for each of the two companies: d) The necessity of stock valuation e) Costing method

Step by Step Solution

★★★★★

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Answer A A traceable cost is a cost for which there is a direct causeandeffect relationship with a process product customer geographical area or other cost object If the cost object goes away then the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started