Answered step by step

Verified Expert Solution

Question

1 Approved Answer

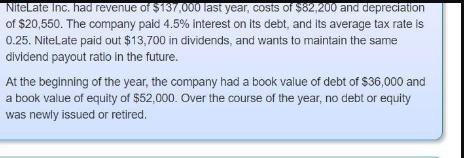

NiteLate Inc. had revenue of $137,000 last year, costs of $82,200 and depreciation of $20,550. The company paid 4.5% interest on its debt, and

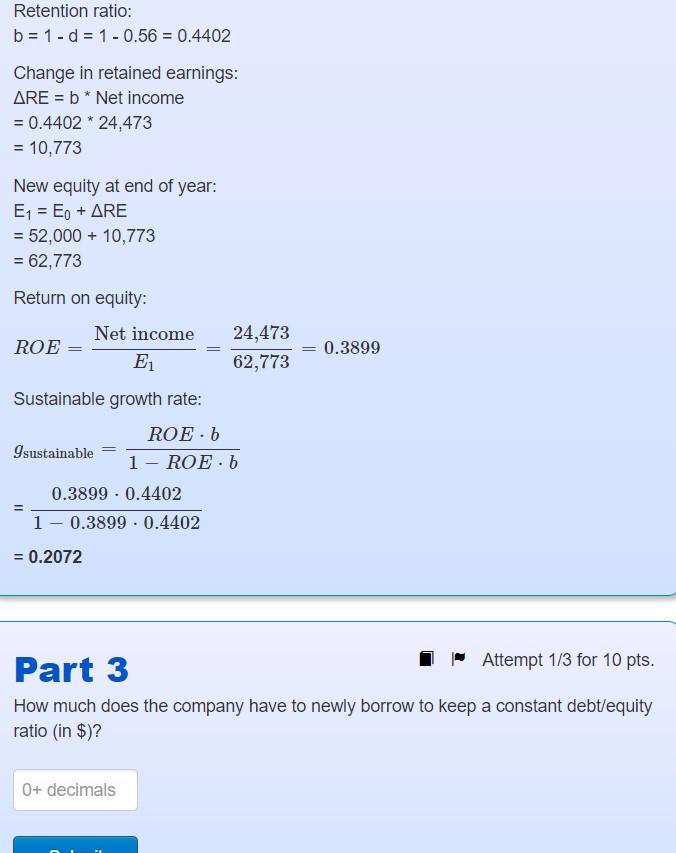

NiteLate Inc. had revenue of $137,000 last year, costs of $82,200 and depreciation of $20,550. The company paid 4.5% interest on its debt, and its average tax rate is 0.25. NiteLate paid out $13,700 in dividends, and wants to maintain the same dividend payout ratio in the future. At the beginning of the year, the company had a book value of debt of $36,000 and a book value of equity of $52,000. Over the course of the year, no debt or equity was newly issued or retired. Retention ratio: b = 1- d = 1-0.56 = 0.4402 Change in retained earnings: ARE = b * Net income = 0.4402 * 24,473 = 10,773 New equity at end of year: E = E + ARE = 52,000 + 10,773 = 62,773 Return on equity: Net income E Sustainable growth rate: ROE b 1- ROE b ROE = 9sustainable = 0.3899 0.4402 1 0.3899 0.4402 = 0.2072 24,473 62,773 = 0+ decimals = 0.3899 Attempt 1/3 for 10 pts. Part 3 How much does the company have to newly borrow to keep a constant debt/equity ratio (in $)? BAttempt 1/3 for 10 pts. Part 4 What rate of growth is sustainable without any additional borrowing (internal growth rate)? 3+ decimals Submit

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution Part 3 De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started