Answered step by step

Verified Expert Solution

Question

1 Approved Answer

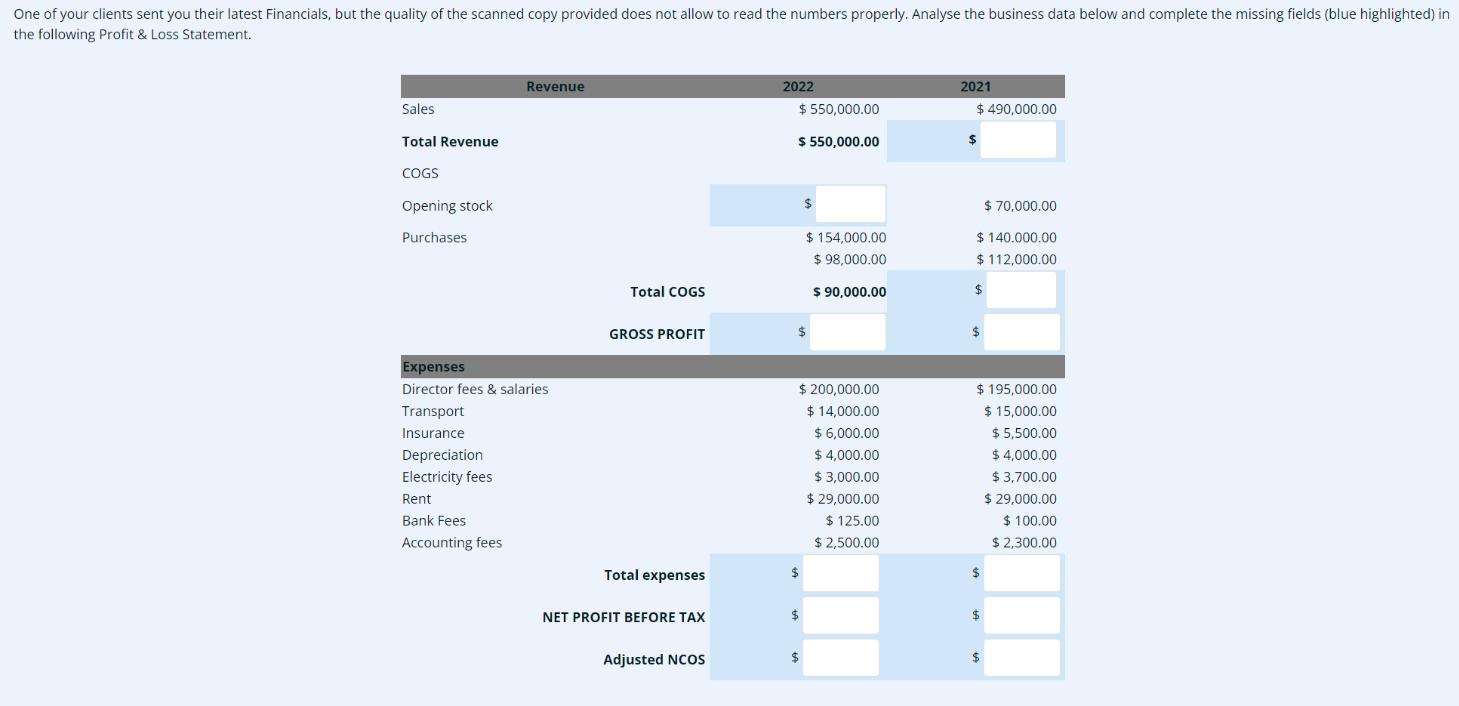

One of your clients sent you their latest Financials, but the quality of the scanned copy provided does not allow to read the numbers

One of your clients sent you their latest Financials, but the quality of the scanned copy provided does not allow to read the numbers properly. Analyse the business data below and complete the missing fields (blue highlighted) in the following Profit & Loss Statement. Sales Total Revenue COGS Opening stock Purchases Expenses Director fees & salaries Transport Insurance Depreciation Electricity fees Revenue Rent Bank Fees Accounting fees Total COGS GROSS PROFIT Total expenses NET PROFIT BEFORE TAX Adjusted NCOS 2022 $ 550,000.00 $ 550,000.00 $ $ $ $ 200,000.00 $ 14,000.00 $ 6,000.00 $4,000.00 $3,000.00 $ 29,000.00 $125.00 $2,500.00 $ $ 154,000.00 $98,000.00 $ 90,000.00 2021 $ 490,000.00 $ $70,000.00 $140.000.00 $112,000.00 $ $ $ 195,000.00 $ 15,000.00 $ 5,500.00 $4,000.00 $ 3,700.00 $ 29,000.00 $ $ $ 100.00 $ 2,300.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started