Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently being assembled at your plant. The supplier

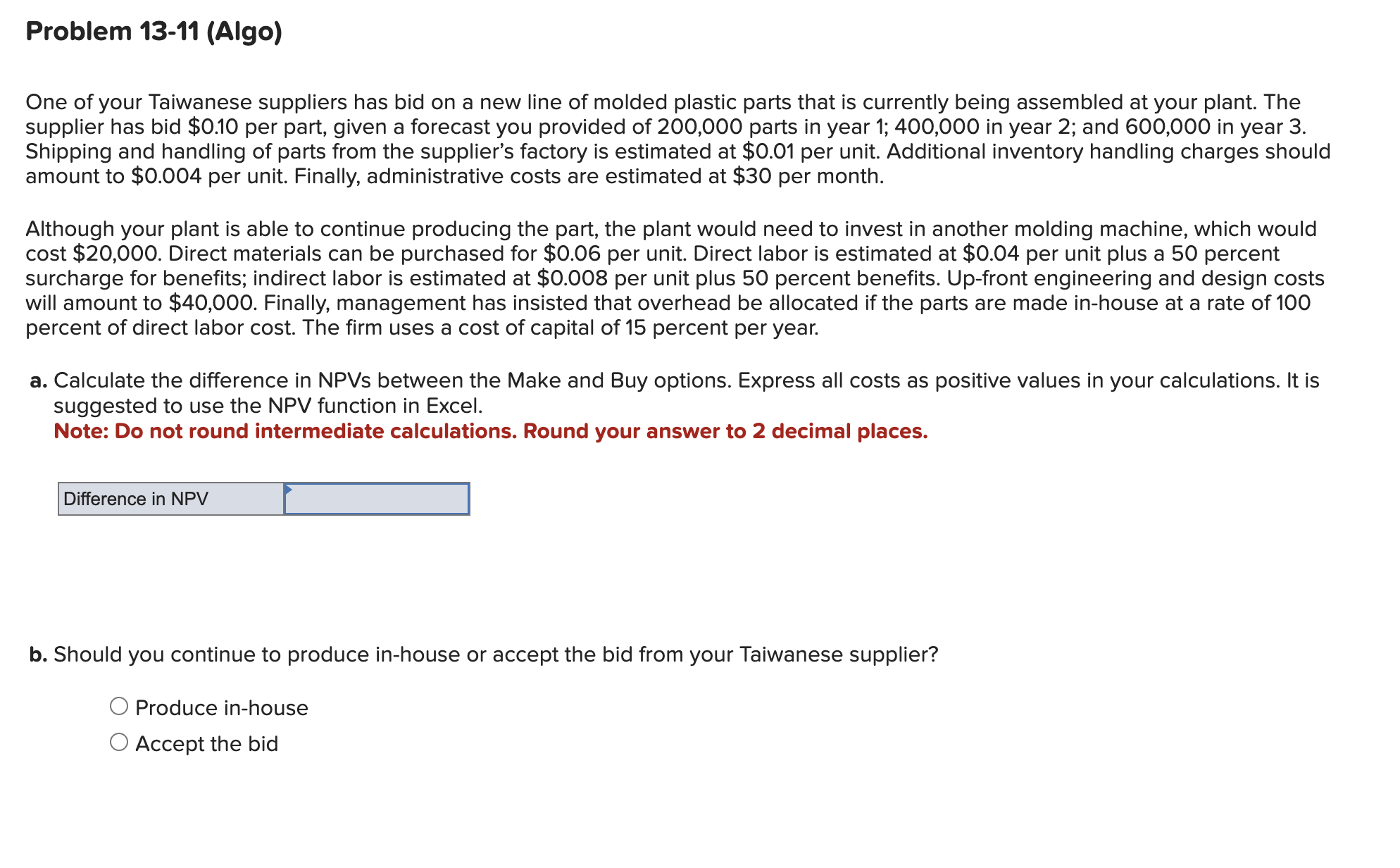

One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently being assembled at your plant. The supplier has bid $0.10 per part, given a forecast you provided of 200,000 parts in year 1; 400,000 in year 2; and 600,000 in year 3 . Shipping and handling of parts from the supplier's factory is estimated at $0.01 per unit. Additional inventory handling charges should amount to $0.004 per unit. Finally, administrative costs are estimated at $30 per month. Although your plant is able to continue producing the part, the plant would need to invest in another molding machine, which would cost $20,000. Direct materials can be purchased for $0.06 per unit. Direct labor is estimated at $0.04 per unit plus a 50 percent surcharge for benefits; indirect labor is estimated at $0.008 per unit plus 50 percent benefits. Up-front engineering and design costs will amount to $40,000. Finally, management has insisted that overhead be allocated if the parts are made in-house at a rate of 100 percent of direct labor cost. The firm uses a cost of capital of 15 percent per year. a. Calculate the difference in NPVs between the Make and Buy options. Express all costs as positive values in your calculations. It is suggested to use the NPV function in Excel. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Difference in NPV b. Should you continue to produce in-house or accept the bid from your Taiwanese supplier? Produce in-house Accept the bid

One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently being assembled at your plant. The supplier has bid $0.10 per part, given a forecast you provided of 200,000 parts in year 1; 400,000 in year 2; and 600,000 in year 3 . Shipping and handling of parts from the supplier's factory is estimated at $0.01 per unit. Additional inventory handling charges should amount to $0.004 per unit. Finally, administrative costs are estimated at $30 per month. Although your plant is able to continue producing the part, the plant would need to invest in another molding machine, which would cost $20,000. Direct materials can be purchased for $0.06 per unit. Direct labor is estimated at $0.04 per unit plus a 50 percent surcharge for benefits; indirect labor is estimated at $0.008 per unit plus 50 percent benefits. Up-front engineering and design costs will amount to $40,000. Finally, management has insisted that overhead be allocated if the parts are made in-house at a rate of 100 percent of direct labor cost. The firm uses a cost of capital of 15 percent per year. a. Calculate the difference in NPVs between the Make and Buy options. Express all costs as positive values in your calculations. It is suggested to use the NPV function in Excel. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Difference in NPV b. Should you continue to produce in-house or accept the bid from your Taiwanese supplier? Produce in-house Accept the bid Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started