Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One period replicating portfolios. (a) Suppose a stock (which pays no dividends) is trading at 100. Next period the stock will either go up

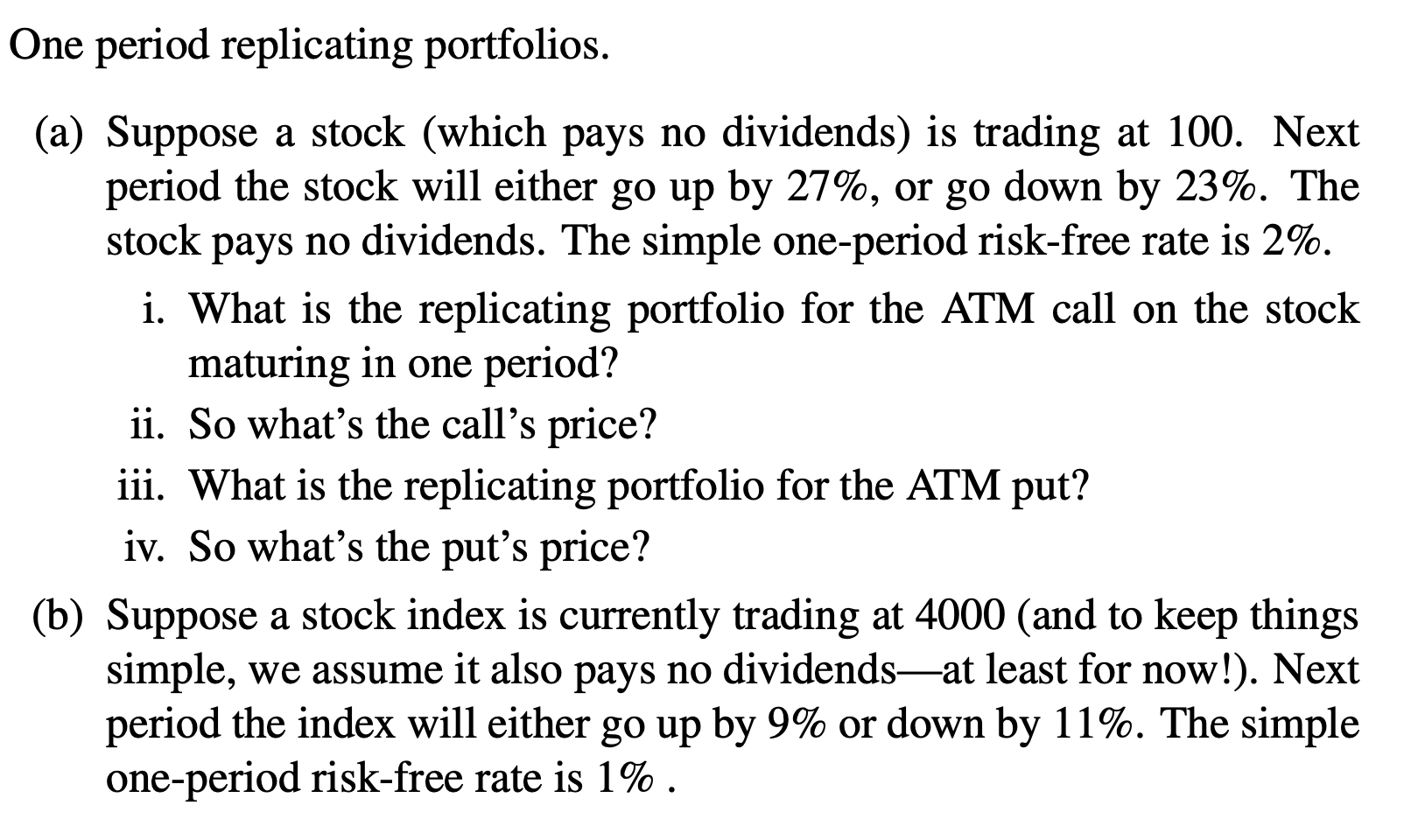

One period replicating portfolios. (a) Suppose a stock (which pays no dividends) is trading at 100. Next period the stock will either go up by 27%, or go down by 23%. The stock pays no dividends. The simple one-period risk-free rate is 2%. i. What is the replicating portfolio for the ATM call on the stock maturing in one period? ii. So what's the call's price? iii. What is the replicating portfolio for the ATM put? iv. So what's the put's price? (b) Suppose a stock index is currently trading at 4000 (and to keep things simple, we assume it also pays no dividends-at least for now!). Next period the index will either go up by 9% or down by 11%. The simple one-period risk-free rate is 1%. i. What are the replicating portfolios for the one-period calls on the index struck at K = 3800 and K = 4200? ii. So what are these calls' price? iii. What are the replicating portfolios for the one-period puts with the same two strikes? iv. So what are these puts' price?

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a i To construct a replicating portfolio for an atthemoney ATM call option we need to find the weights of the stock and riskfree asset that replicate the options payoff Since the stock can either go u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started