Answered step by step

Verified Expert Solution

Question

1 Approved Answer

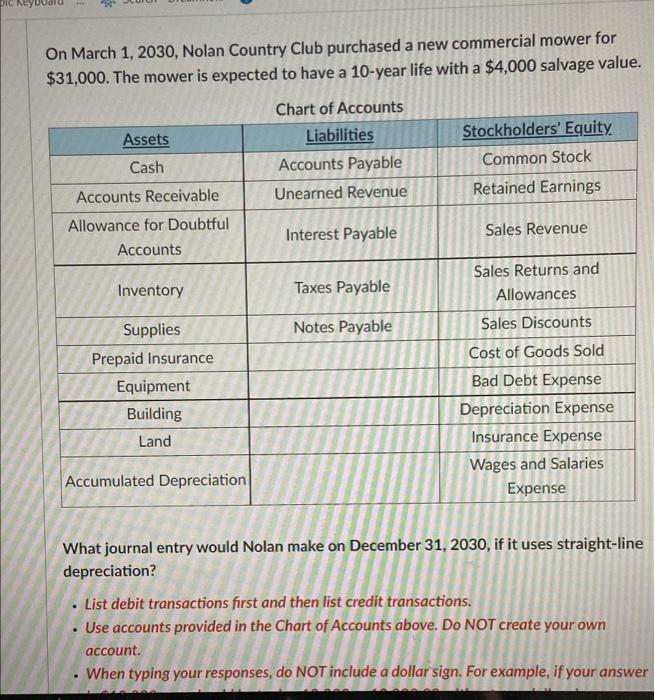

one Question DIC On March 1, 2030, Nolan Country Club purchased a new commercial mower for $31,000. The mower is expected to have a 10-year

one Question

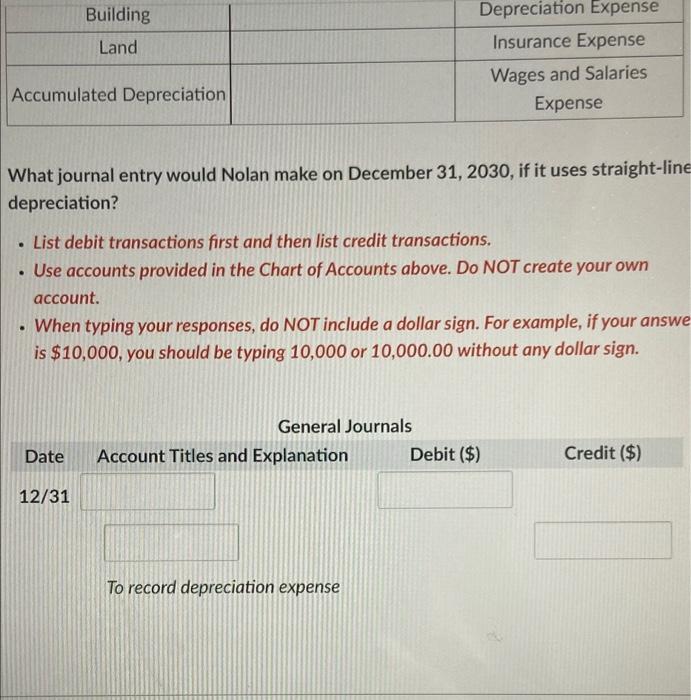

DIC On March 1, 2030, Nolan Country Club purchased a new commercial mower for $31,000. The mower is expected to have a 10-year life with a $4,000 salvage value. Assets Chart of Accounts Liabilities Accounts Payable Unearned Revenue Stockholders' Equity Common Stock Retained Earnings Cash Accounts Receivable Allowance for Doubtful Accounts Interest Payable Sales Revenue Inventory Taxes Payable Sales Returns and Allowances Sales Discounts Notes Payable Cost of Goods Sold Supplies Prepaid Insurance Equipment Building Land Bad Debt Expense Depreciation Expense Insurance Expense Wages and Salaries Expense Accumulated Depreciation What journal entry would Nolan make on December 31, 2030, if it uses straight-line depreciation? List debit transactions first and then list credit transactions. Use accounts provided in the Chart of Accounts above. Do NOT create your own account. When typing your responses, do NOT include a dollar sign. For example, if your answer Building Land Depreciation Expense Insurance Expense Wages and Salaries Expense Accumulated Depreciation What journal entry would Nolan make on December 31, 2030, if it uses straight-line depreciation? . List debit transactions first and then list credit transactions. Use accounts provided in the Chart of Accounts above. Do NOT create your own account. When typing your responses, do NOT include a dollar sign. For example, if your answe is $10,000, you should be typing 10,000 or 10,000.00 without any dollar sign. General Journals Account Titles and Explanation Debit ($) Date Credit ($) 12/31 To record depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started