Answered step by step

Verified Expert Solution

Question

1 Approved Answer

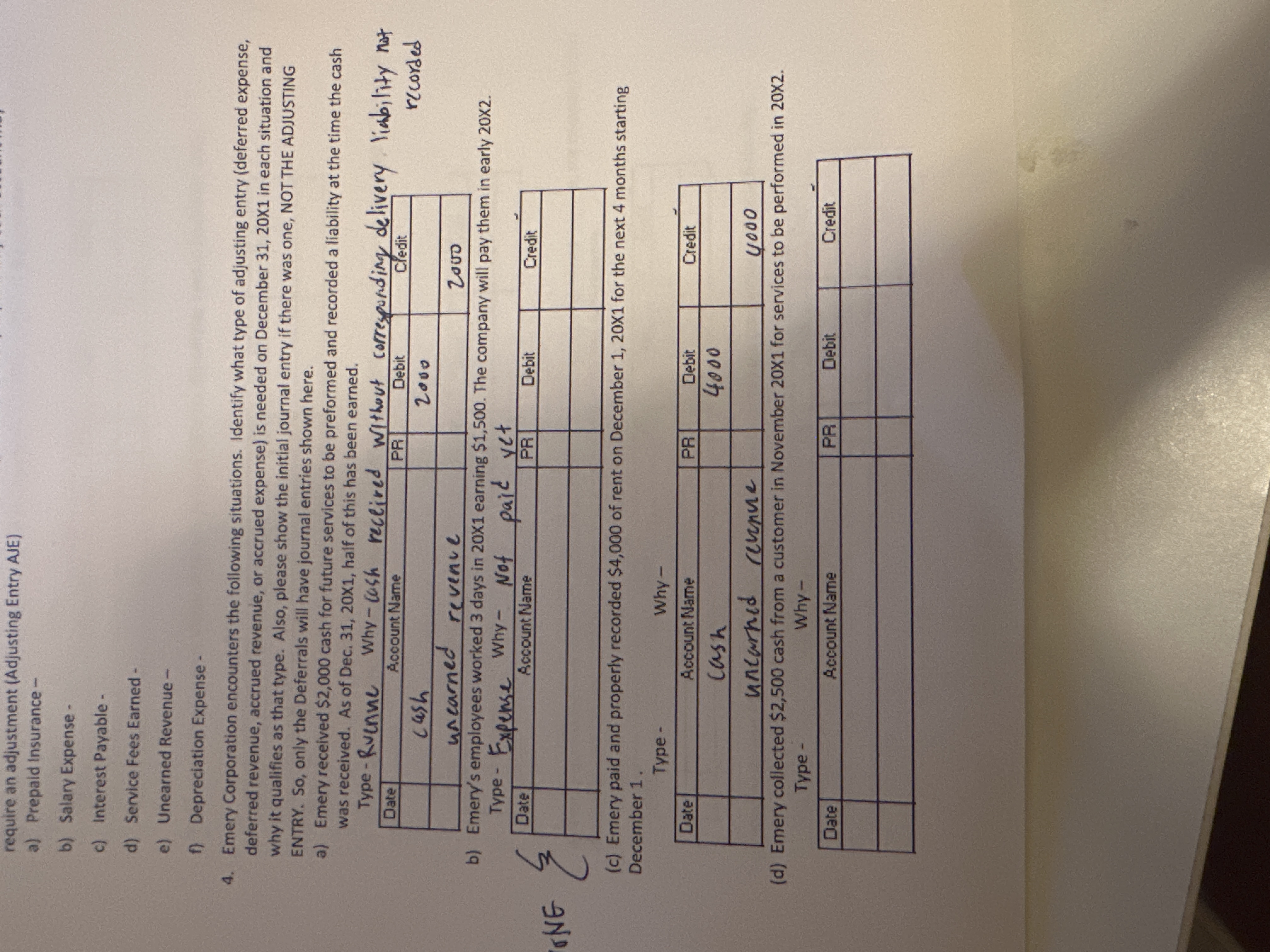

ONE require an adjustment (Adjusting Entry AJE) a) Prepaid Insurance b) Salary Expense - c) Interest Payable - d) Service Fees Earned - e)

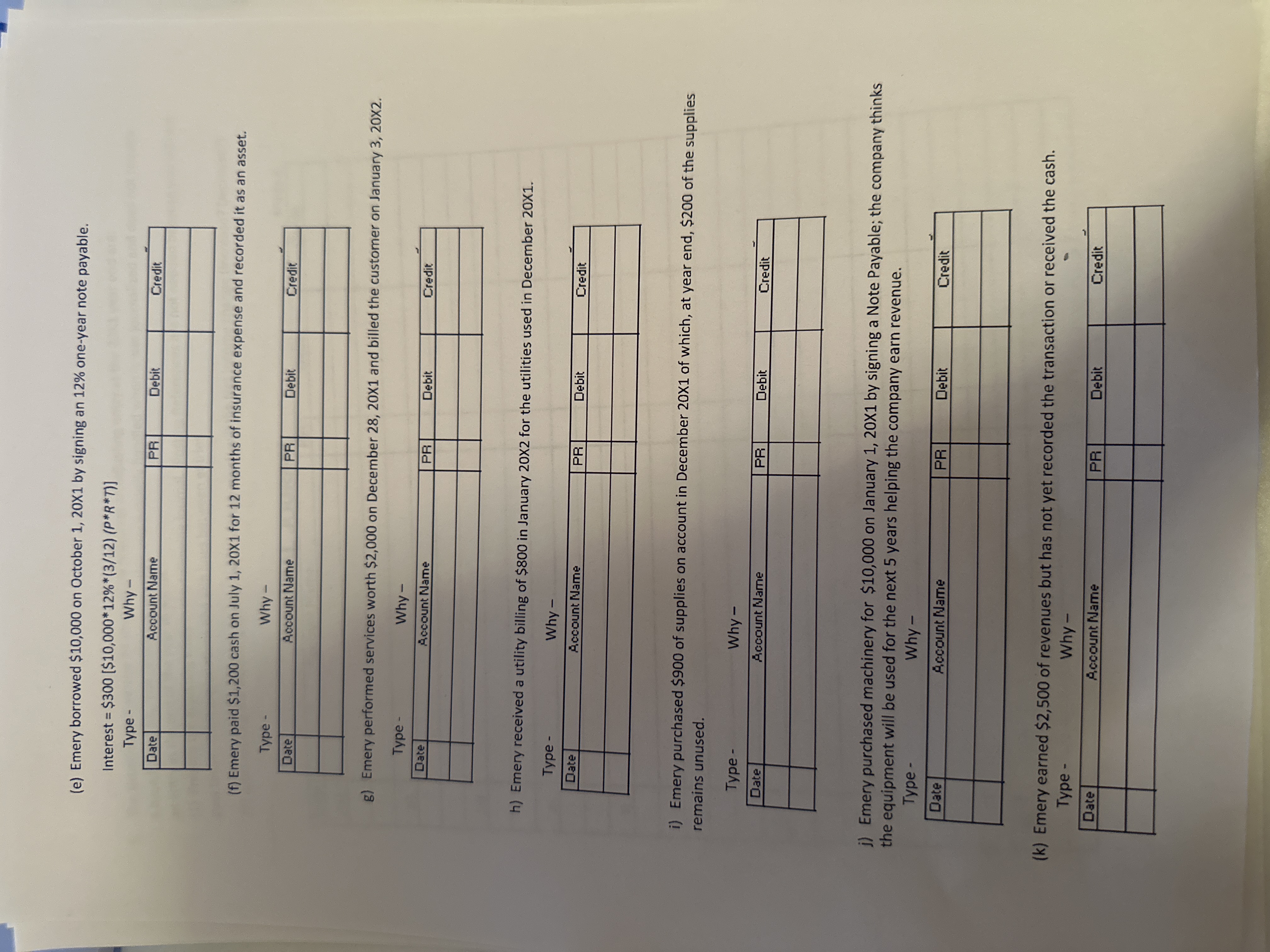

ONE require an adjustment (Adjusting Entry AJE) a) Prepaid Insurance b) Salary Expense - c) Interest Payable - d) Service Fees Earned - e) Unearned Revenue - f) Depreciation Expense - 4. Emery Corporation encounters the following situations. Identify what type of adjusting entry (deferred expense, deferred revenue, accrued revenue, or accrued expense) is needed on December 31, 20X1 in each situation and why it qualifies as that type. Also, please show the initial journal entry if there was one, NOT THE ADJUSTING ENTRY. So, only the Deferrals will have journal entries shown here. a) Emery received $2,000 cash for future services to be preformed and recorded a liability at the time the cash was received. As of Dec. 31, 20X1, half of this has been earned. Type-Ruenne Why-cash received Without corresponding delivery liability not Account Name PR recorded Date cash un earned revenue 2000 b) Emery's employees worked 3 days in 20X1 earning $1,500. The company will pay them in early 20X2. Type - Expense Why - Not paid Date Account Name Date yet PR Why - Date Debit (c) Emery paid and properly recorded $4,000 of rent on December 1, 20X1 for the next 4 months starting December 1 Type - PR 2000 PR Debit Account Name cash unearned revenue 4000 (d) Emery collected $2,500 cash from a customer in November 20X1 for services to be performed in 20X2. Type - Why - Account Name Credit Debit 4000 Debit Credit Credit (e) Emery borrowed $10,000 on October 1, 20X1 by signing an 12% one-year note payable. Interest = $300 [$10,000* 12% *(3/12) (P*R*T)] Type- Why- Account Name Date - (f) Emery paid $1,200 cash on July 1, 20X1 for 12 months of insurance expense and recorded it as an asset. Type - Date Why- Account Name Type - Date - Date PR 1 1 PR Why- Account Name g) Emery performed services worth $2,000 on December 28, 20X1 and billed the customer on January 3, 20X2. Type - Date Why- Account Name PR PR Debit h) Emery received a utility billing of $800 in January 20X2 for the utilities used in December 20X1. Type - Date Why- Account Name PR Debit PR Debit i) Emery purchased $900 of supplies on account in December 20X1 of which, at year end, $200 of the supplies remains unused. PR Debit Credit Debit Credit Debit Credit j) Emery purchased machinery for $10,000 on January 1, 20X1 by signing a Note Payable; the company thinks the equipment will be used for the next 5 years helping the company earn revenue. Type - Date Why - Account Name Debit 1 Credit Credit (k) Emery earned $2,500 of revenues but has not yet recorded the transaction or received the cash. Type - Why - Account Name Credit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information here are the adjusting entries AJEs that need to be made a Prepaid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started