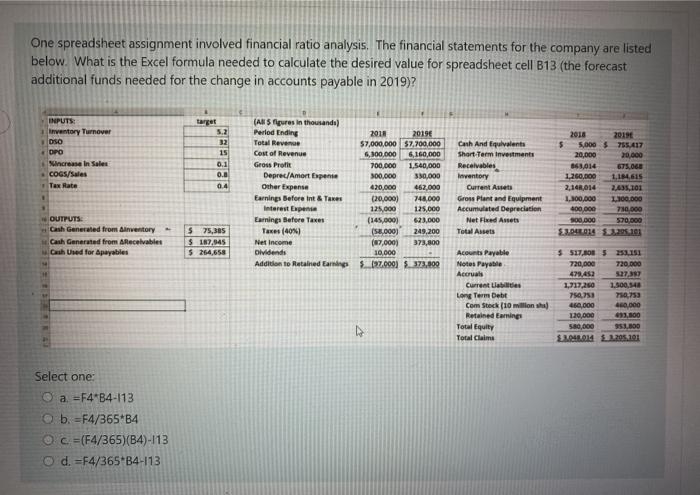

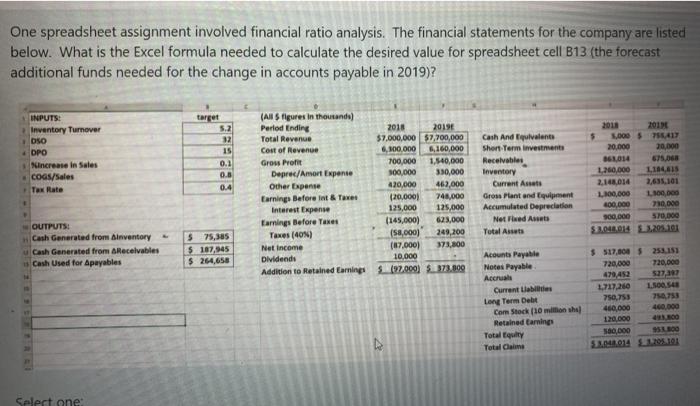

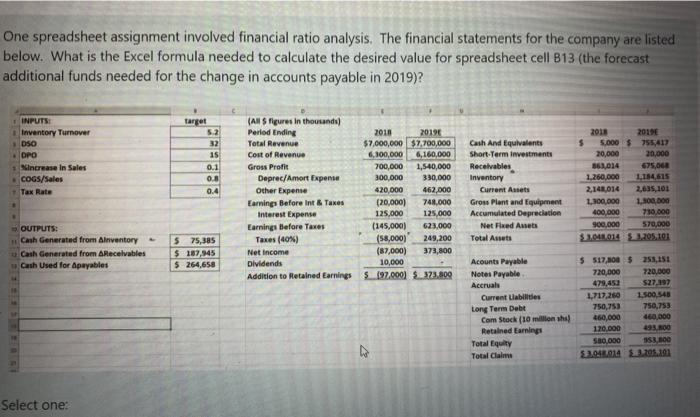

One spreadsheet assignment involved financial ratio analysis. The financial statements for the company are listed below. What is the Excel formula needed to calculate the desired value for spreadsheet cell B13 (the forecast additional funds needed for the change in accounts payable in 2019)? target 5.2 INPUTS: ventory Turnover DSO OPO increase in Sales COGS/Sales Tax Rate 15 0.1 0.0 0.4 (ABS figures in thousandu) Perlod Ending 2018 2019 Total Revenue 57,000,000 57.700.000 Cost of Revenue 6,300.000 6,160,000 Gross Prot 700.000 1,540,000 Deprec/Amort Expense 300.000 330,000 Other Expense 420,000 462,000 Earnings Before Int & Takes (20,000) 744.000 Interest Expense 125.000 125,000 Earnings Before Taxes (145,000 623,000 Tax (403 (3.000) 249, Net Income (7,000) 373,800 Olvidends 10,000 Addition to Retained Earnings 5.127.000) .373.000 Cash And Equivalenta Short Term Investments Receivables Inventory Current Anet Gross Plant and Equipment Accumulated Depreciation Net Fixed Assets tal Assets 2016 20196 5,000 $755.417 20,000 20,000 893,014 675,060 1.260.000 1.144,615 2,14,014 2,435.101 1.300.000 100.000 400.000 700.000 300.000 570,000 LEA 2.3.205.10 OUTPUTS Cash Generated from Anventory Cash Generated from Receivables Cash Used for Apayables $ 75,385 $ 167.945 $ 264,658 Acounts Payable Notes Payable Accruals Current Lab Long Term Debt Com Stock (10 million Retained Earnings Total Equity Total Claims $ 517,8085 251151 720,000 720.000 479.452 327.397 1717,20 1.500,548 750.750 710,753 460,000 40,000 120,000 61,300 580,000 351,300 14.014 1.205.101 Select one: a =F4 B4-113 O b. =F4/365 B4 Oc=(F4/365)(B4)-113 d. =F4/365 B4-113 One spreadsheet assignment involved financial ratio analysis. The financial statements for the company are listed below. What is the Excel formula needed to calculate the desired value for spreadsheet cell B13 (the forecast additional funds needed for the change in accounts payable in 2019)? target INPUTS: Inventory Turnover DSO DPO Nincrease in Sales COGS/Sales Tax Rate 32 15 0.1 0.8 0.4 (Alls figures in thousands) Period Ending Total Revenue Cost of Revenue Gross Profit Deprec/Amort pente Other Expense Earnings Before it & Taxes Interest Expense Earnings Before Taxes Taxes (40N) Net Income Dividends Addition to retained Gaming 2018 2019 $7,000,000 $7,700,000 6,100.000 6.160,000 700,000 1.540.000 300,000 350,000 420,000 462,000 (20,000) 748,000 125,000 125,000 (145,000) 623,000 158,000) 249,200 (87.000) 373,800 10,000 $197.000) $_373.800 Cash And Equivalent Short Term investments Receivables Inventory Current Assets Gross Plant and Equipment Accumulated Depreciation Net Fixed Asset Total Assets 2011 10005 20.000 20,000 161014 675.00 1260,000 2.148,014 2,635,101 1,100,000 L100,000 100,000 230,000 900.000 570,000 $2.044014 1.205.101 OUTPUTS: Cash Generated from inventory u Cash Generated from Receivables Cash Used for Apayables $ 75,305 $ 187,945 $ 264,658 Acounts Payabile Notes Payable Accu Current Labs Long Term Debt Com Stock 10 milion shal Retained Earnings Total Equity Total Cale $ $17.00 $ 253.151 720,000 720.000 479,452 1.717,260 1. SOOS 750, 753 71753 460,000 460,000 120,000 500.000 1.041014 1208.101 Select one: One spreadsheet assignment involved financial ratio analysis. The financial statements for the company are listed below. What is the Excel formula needed to calculate the desired value for spreadsheet cell B13 (the forecast additional funds needed for the change in accounts payable in 2019)? INPUTS: Inventory Turnover OSO OPO Nincrease in Sales COGS/Sales Tax Rate 52 32 15 0.1 0.0 0.4 (All $ figures in thousands) Period Ending Total Revenue Cost of Revenue Gross Profit Deprec/Amort Expense Other Expense Earnings Before Int & Taxes Interest Expense Earnings Before Taxes Taxes (40%) Net Income Dividends Addition to retained Earnings 2018 2019 $7,000,000 $7,700,000 6,100,000 6,160,000 700,000 1,540,000 300,000 390,000 420,000 462,000 (20,000) 748.000 125,000 125,000 (145,000) 623,000 (58,000) 249,200 (87,000) 373,800 10,000 $197.000) S 373.809 Cash And Equivalents Short-Term investments Receivables Inventory Current Assets Gross Plant and Equipment Accumulated Depreciation Net Fixed Amets Total Assets 2011 2018 5.000$ 755417 20,000 20,000 861,014 675,000 1.260.000 1,154,615 2,141,014 2.635, 101 1,300,000 1.300.000 400,000 730.000 900.000 570,000 33041014 3.205.10 OUTPUTS: Cash Generated from Alnventory Cash Generated from recevables Cash Used for Apayables $ 75,385 $ 187,945 5 264,658 Acounts Payable Notes Payable Accruals Current Liabilities Long Term Debt Com Stock (10 million sha! Retained Earning Total Equity Total Claims $ 517.00 $ 255,151 720,000 720,000 479,452 527-197 1,717,260 1.500,545 750,753 750,753 460,000 460,000 120,000 291,00 580,000 153, BOO 13.04.0141205101 Select one