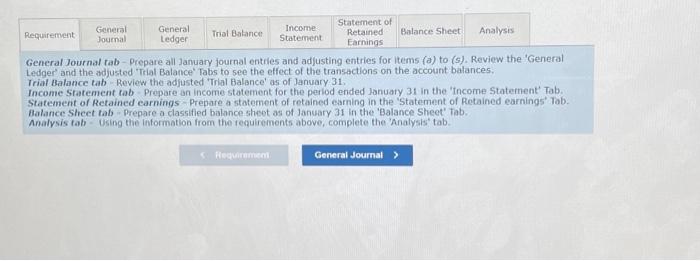

One Tuck Pony (OIP) incorpocated and began operntions near the end of the yeat resulting in the following post-closing balances at Decentser 31 The following intormation is felevant to the first month of operations in the following yeat: - OrP wit sell inventory at $160 per unit OTP's Janoary 1 inventony balance conssts of 50 unts at a total cost of $2.500.01P s policy Is to use the FFO method, recorded using a perpetual irventory system. - In December, OTP recelved a $6,400 payment for 40 units OTP is to deliver in lanuary this obligation was recorded in Defened Hevenue. Rent of 51080 was unpoid and recorded in Accounts Payoble at December 31. - Orps notes payabte ibature in three yeais, and acerue interest at it 1006 arnual rate Jonwary Transoctions a. Inctuded in OTP's January 1 Accounts. Receivable bahance ts a $3,600 balance due from Jeff Letrotski. Jeff is having casht flow problems and cannot pay the $3,600 baiance at this time, On 0101, OTP arranges with Jeff to corvert the $3,600 balance to a sixmonth note, at 10% annual interest Jeff signs the promissory note. which indicates the principal and all interest will be due and payable to OTP on July i of this year. b. OTP paid a $310 insurance premium on 0102. covering the month of January the payment is recorded directly as an expense. c. OIP purchased an additional 200 units of inventory from a supplier on account on 01/05 at a total cost of $8,000, with terms n/30. d. OTP paid a courler $400 cash on 01/05 for same day dellvery of the 200 units of inventory. e. The 40 units that OrP's customer paid for in advance in December are detvered to the customer on 01/06 f On 0107, OTP received a putchase allowance of $1,200 on account, and then pald the amount necessary to seitie the balance owsd to the supplier for the 105 purchase of inventory (in c). 9. Sales of 60 units of inventory occurring during the petiod of 01/07-01/10 are recorded on 01/10. The sales terms are n/30. h. Collected payments on 01/4 from sales to customers recorded on 01/0. 1, OTP paid the first 2 weeks' wages to the employees on OYH6. The total paid is 54,800. f. Wrote off a $890 customer's account balance on 9118 OTP uses the allowance method, not the direct write-off method. k. Paid \$2,160 on 01/19 for Decemberand Jartuty rent. See the carlier bulets fegarding the December portion. The January portion will expire soon, so itis charged directly to experise. LOTP recovered 530 cash on 01/26 from the customer whose account had pteviousty been written off on 01/18. m. An unrecorded 5140 utility bill for January arrived on 01/27 it is due on 02/15 and will be paid then. n. Sales of 70 unils of itiventory during the period of 01/10-01/28, with term n/30, are recorded on 01/28. o. Of the sales recotded on 0128, 10 inits are tetamed to OTP on OV/30. The irventory is not damaged and can be resold. OTP charges sales feturns to a contra revenue account . On 01/31, OTP records the $4,800 employee salary that is owed but will be paid Februaty 1. q. GTP uses the aging method to estimate and acjust for uncolectible accounts on 01/1 All of OTP's accounts recelvabie fall into a single aging categoty, for whels 10 is estimated to be uncollectible: (Update the balances of both relevant accounts prior to detertining the approptiate ad justrment.) f. Accrue interest for January on the notes payable on 01/31 5. Accrue interest for January on Jetf Letrotskis fote on Ot/31 (See a). General Journal rab - Prepare all January journal entiles and adjusting entries for items (a) to (s). Review the 'General Ledger' and the adjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. Trial Balance tab-Review the adjusted 'Trial Balance' as of January 31 . Income Sratement tab - Prepare an income statement for the perlod ended January 31 in the 'Tncome Statement' Tab. Statement of Retained earnings - Prepare a stotement of retained earning in the 'Statement of Retained earnings' Tob. Balance Sheet tab - Prepare a classified balance sheet as of January 31 in the 'Balance Sheet' Tab. Analysis tab - Using the information from the tequirements above, complete the 'Analysis' tab