Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Facts: Jim and his wife Jane live in North Sydney. They are both Australian residents for tax purposes. Jim is employed full-time as an

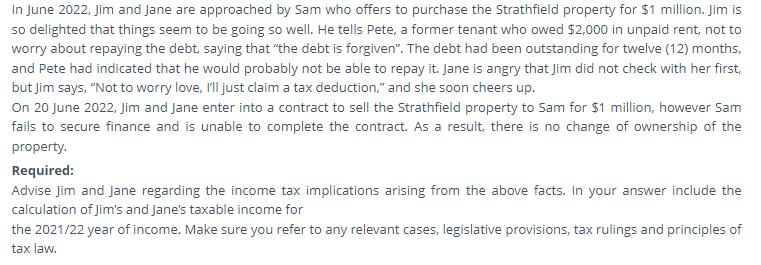

Facts: Jim and his wife Jane live in North Sydney. They are both Australian residents for tax purposes. Jim is employed full-time as an air traffic controller and receives a salary of $210,000 per year. Jim also owns shares in a prominent technology company, CorpCo Ltd. CorpCo Ltd is an Australian resident company for tax purposes. During the 2021/22 year, he received one dividend from CorpCo Ltd. The dividend was $2,000 franked at 75%. Jane is a librarian and receives a salary of $90,000 per year. A few years ago Jane also wrote a cookbook which turned out to be very successful, and since then she has been invited to appear on numerous television cooking programs to perform cooking demonstrations. In 2021/22 Jane receives $30,000 from performing cooking demonstrations on television. She also entered a television cooking competition 'MasterCook' where she won $3000 in Westfield shopping gift cards. Jim and Jane own, as joint tenants, an investment property in Strathfield. They purchased the investment property in October 2015 for $500,000. (They paid a 10% down payment and borrowed the balance of the purchase price from BigBank at market rates.) They also incurred legal fees, transfer (stamp) duty and other incidental costs in relation to the acquisition, of a total of $30,000. After purchasing the property, Jim discovered there was a pre-existing hole in the roof, which he had not noticed prior to purchase, as the inspection had been quite rushed. Jane was very annoyed when she heard about this and told Jim that he should have negotiated a reduction in the purchase price of the property and now it was too late. Jim quickly arranged for a builder to fix the hole in the roof in order to bring the property up to market standards so that it could be rented out. Jim paid the builder $12,000 for the work. Jim told Jane not to worry about the expense as he was planning to claim a deduction for it in his next tax return. Since the roof was fixed, Jim and Jane have rented the investment property out to tenants at market rates. One weekend in June 2021, Jim and Jane caught up with their friend Timmy who was studying tax law at the "University of New Principles". Timmy told Jim and Jane that in relation to their investment property, they should agree to allocate all of the losses to Jim, and most of the profits to Jane. Jim and Jane decided to take Timmy's advice and in June 2021 they entered into an agreement entitled "Partnership Agreement" which provides that Jim is entitled to 10% of any profits from the property, and Jane is entitled to 90% of profits from the property. The agreement also provides that Jim is entitled to 100% of any loss from the property. During the 2021/22 year of income, the rent received from the investment property was $40,000. In July 2021, the tenants complained that the lock on the front door was broken due to rusting, and the carpet had become very dirty as a result of wear and tear. In August 2021, Jim arranged for a locksmith to replace the lock for $380. For extra protection, Jim also installed a new mesh security door which cost $500. Jim obtained a quote regarding how much it would cost to have the carpet cleaned professionally with carpet shampoo. The amount quoted was quite high ($2000), so jim decided instead to replace the carpet for $3000 with a carpet of a similar quality. The carpet was replaced in September 2021. Jim and Jane also incurred expenses of $3,000 for insurance, $2,700 for council rates, $2,000 for agent's fees, and $35,000 interest on the BigBank loan, in relation to the property during the 2021/22 year of income. Jim and Jane also used the Strathfield property themselves for four (4) weeks during the income year when they needed to get away from a dust storm in their local area. In June 2022, Jim and Jane are approached by Sam who offers to purchase the Strathfield property for $1 million. Jim is so delighted that things seem to be going so well. He tells Pete, a former tenant who owed $2,000 in unpaid rent, not to worry about repaying the debt, saying that "the debt is forgiven". The debt had been outstanding for twelve (12) months, and Pete had indicated that he would probably not be able to repay it. Jane is angry that Jim did not check with her first, but Jim says, "Not to worry love, I'll just claim a tax deduction," and she soon cheers up. On 20 June 2022, Jim and Jane enter into a contract to sell the Strathfield property to Sam for $1 million, however Sam fails to secure finance and is unable to complete the contract. As a result, there is no change of ownership of the property. Required: Advise Jim and Jane regarding the income tax implications arising from the above facts. In your answer include the calculation of Jim's and Jane's taxable income for the 2021/22 year of income. Make sure you refer to any relevant cases, legislative provisions, tax rulings and principles of tax law.

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Jims taxable income for the 202122 year of income will be Income from employment 210000 Dividend fro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started