Question

One year ago, Metropolitan Memorial expanded its operations into a rural community located approximated a hundred miles from its main facility. The clinic offers a

One year ago, Metropolitan Memorial expanded its operations into a rural community located approximated a hundred miles from its main facility. The clinic offers a wide array of outpatient services. As the Senior Accountant, you are reviewing the clinic'soperating budget from the previous year. You have been asked by the hospital's chief administrator to create a new six-month operations budget for the clinic.

Using an Excel spreadsheet, create a new six-month budget for the clinic that includes the following revenue and expense projections:

- The clinic's revenue is projected to grow by approximately 3% as a result of a new managed care contract.

- The cost of expenses is expected to increase to 1.5%.

- The clinic will also be adding a new roof to the facility at a projected cost of $50,000.

Then prepare for the chief administrator. The memo should include a review of the previous year's budget, an analysis of the upcoming changes, and a discussion about the impacts that these changes will have on the budget for the upcoming year

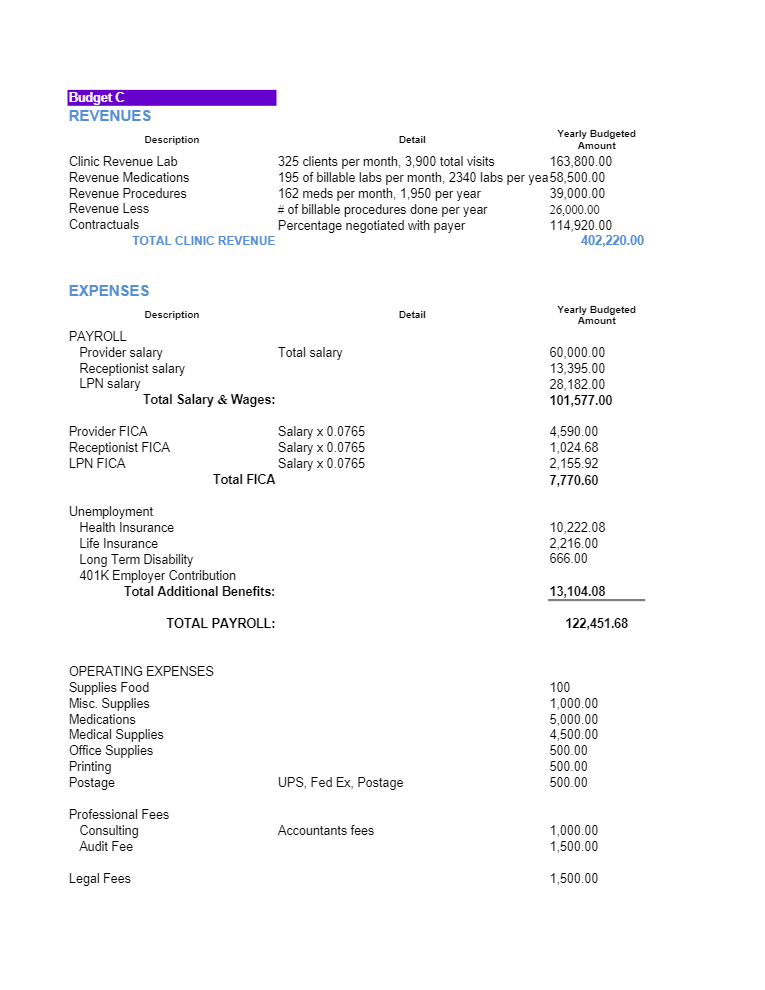

Budget C REVENUES Description Clinic Revenue Lab Revenue Medications Detail Yearly Budgeted Amount 325 clients per month, 3,900 total visits 163,800.00 195 of billable labs per month, 2340 labs per yea 58,500.00 Revenue Procedures Revenue Less 162 meds per month, 1,950 per year Contractuals # of billable procedures done per year Percentage negotiated with payer TOTAL CLINIC REVENUE 39,000.00 26,000.00 114,920.00 402,220.00 EXPENSES Description Detail Yearly Budgeted Amount PAYROLL Provider salary Total salary 60,000.00 Receptionist salary LPN salary 13,395.00 28,182.00 Total Salary & Wages: 101,577.00 Provider FICA Salary x 0.0765 4,590.00 Receptionist FICA Salary x 0.0765 1,024.68 LPN FICA Salary x 0.0765 2,155.92 Total FICA 7,770.60 Unemployment Health Insurance Life Insurance Long Term Disability 401K Employer Contribution Total Additional Benefits: TOTAL PAYROLL: 10,222.08 2,216.00 666.00 13,104.08 122,451.68 OPERATING EXPENSES Supplies Food 100 Misc. Supplies 1,000.00 Medications 5,000.00 Medical Supplies 4,500.00 Office Supplies 500.00 Printing 500.00 Postage UPS, Fed Ex, Postage 500.00 Professional Fees Consulting Accountants fees Audit Fee 1,000.00 1,500.00 Legal Fees 1,500.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I can help you create a sixmonth operations budget for the Metropolitan Memorial clinic and a memo to the chief administrator summarizing the findings SixMonth Operations Budget Based on the provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started