Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One year ago, Vegemite Ventures LP invested $8 million into Toast Technologies Inc, a private company, representing 10% of its equity ownership, with the

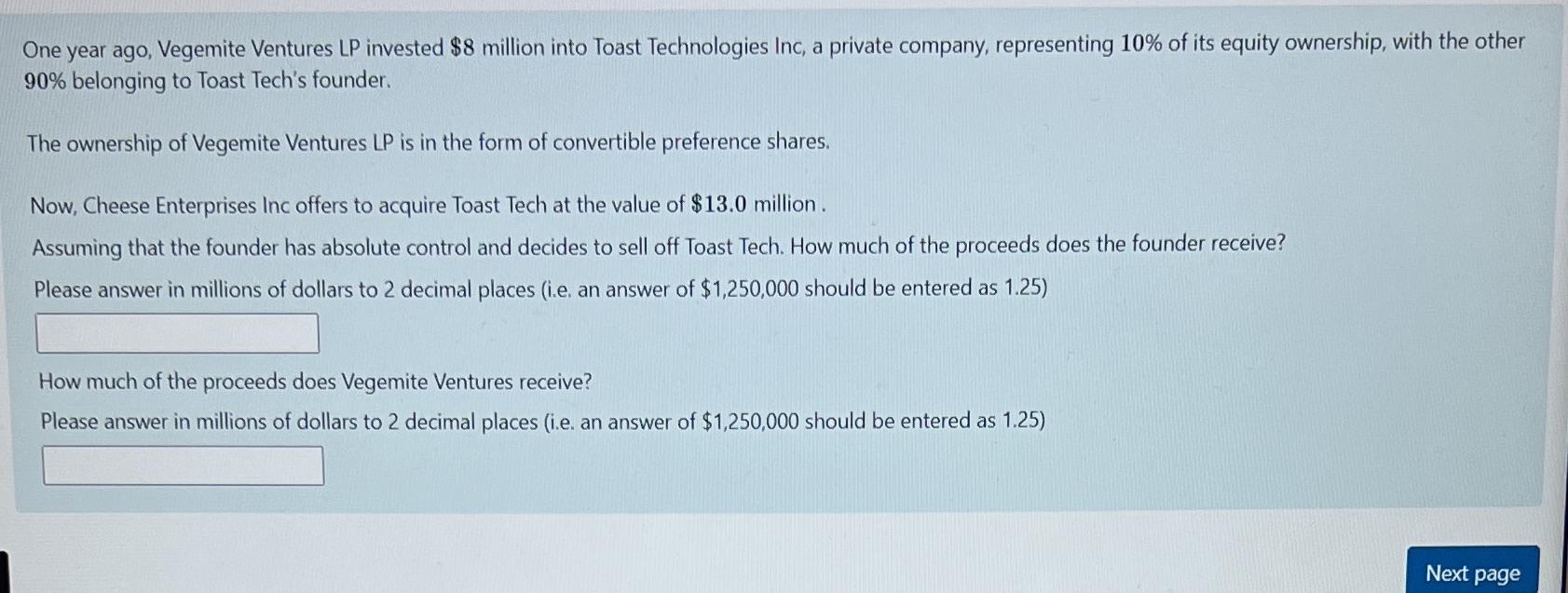

One year ago, Vegemite Ventures LP invested $8 million into Toast Technologies Inc, a private company, representing 10% of its equity ownership, with the other 90% belonging to Toast Tech's founder. The ownership of Vegemite Ventures LP is in the form of convertible preference shares. Now, Cheese Enterprises Inc offers to acquire Toast Tech at the value of $13.0 million. Assuming that the founder has absolute control and decides to sell off Toast Tech. How much of the proceeds does the founder receive? Please answer in millions of dollars to 2 decimal places (i.e. an answer of $1,250,000 should be entered as 1.25) How much of the proceeds does Vegemite Ventures receive? Please answer in millions of dollars to 2 decimal places (i.e. an answer of $1,250,000 should be entered as 1.25) Next page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Proceeds for Toast Tech Acquisition Founders Share The fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started