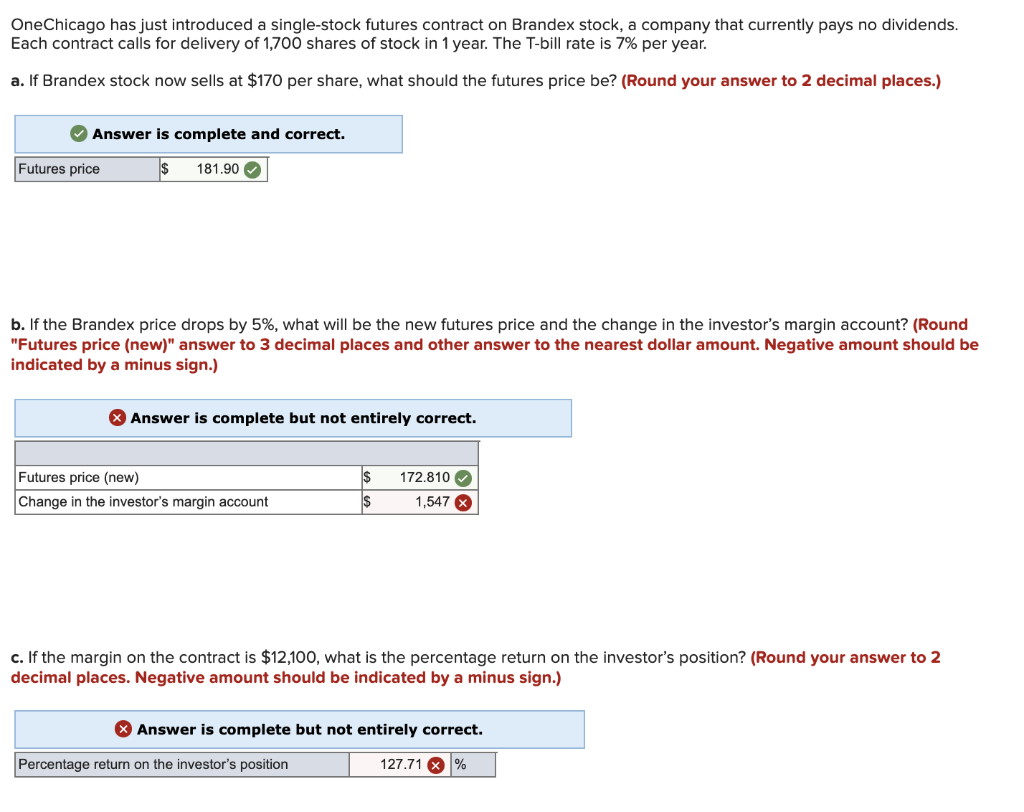

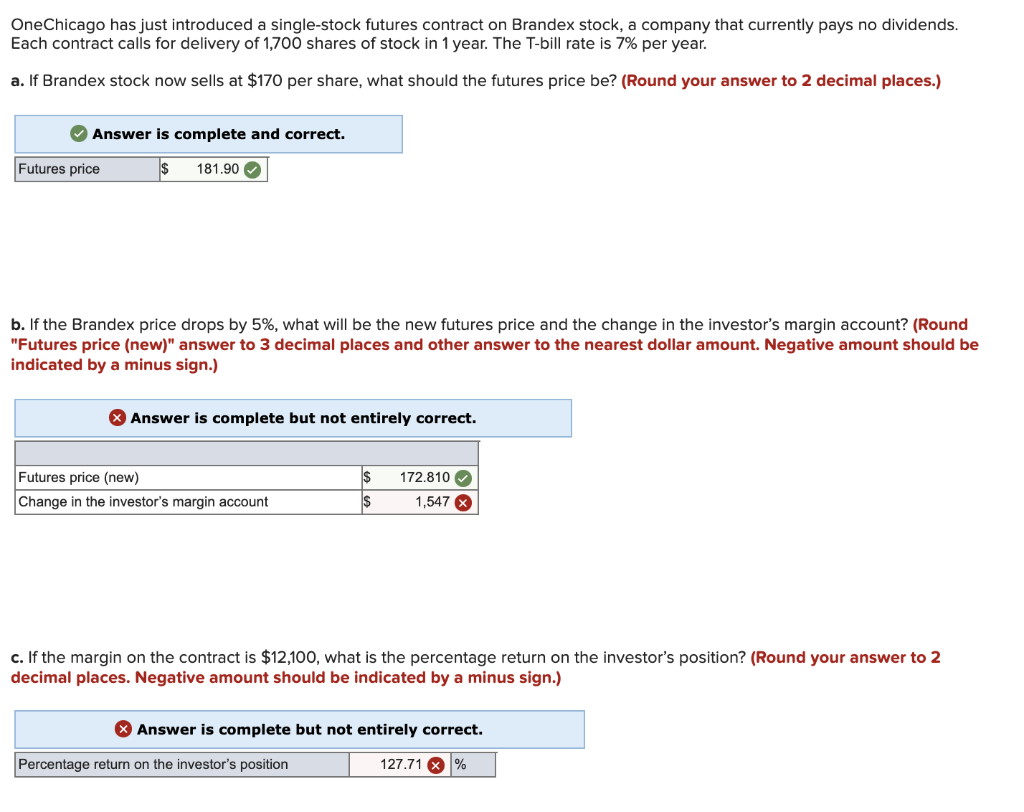

OneChicago has just introduced a single-stock futures contract on Brandex stock, a company that currently pays no dividends. Each contract calls for delivery of 1,700 shares of stock in 1 year. The T-bill rate is 7% per year. a. If Brandex stock now sells at $170 per share, what should the futures price be? (Round your answer to 2 decimal places.) Answer is complete and correct. Futures price $ 181.90 b. If the Brandex price drops by 5%, what will be the new futures price and the change in the investor's margin account? (Round "Futures price (new)" answer to 3 decimal places and other answer to the nearest dollar amount. Negative amount should be indicated by a minus sign.) Answer is complete but not entirely correct. $ Futures price (new) Change in the investor's margin account 172.810 1,547 X $ c. If the margin on the contract is $12,100, what is the percentage return on the investor's position? (Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Answer is complete but not entirely correct. Percentage return on the investor's position 127.71 % OneChicago has just introduced a single-stock futures contract on Brandex stock, a company that currently pays no dividends. Each contract calls for delivery of 1,700 shares of stock in 1 year. The T-bill rate is 7% per year. a. If Brandex stock now sells at $170 per share, what should the futures price be? (Round your answer to 2 decimal places.) Answer is complete and correct. Futures price $ 181.90 b. If the Brandex price drops by 5%, what will be the new futures price and the change in the investor's margin account? (Round "Futures price (new)" answer to 3 decimal places and other answer to the nearest dollar amount. Negative amount should be indicated by a minus sign.) Answer is complete but not entirely correct. $ Futures price (new) Change in the investor's margin account 172.810 1,547 X $ c. If the margin on the contract is $12,100, what is the percentage return on the investor's position? (Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Answer is complete but not entirely correct. Percentage return on the investor's position 127.71 %