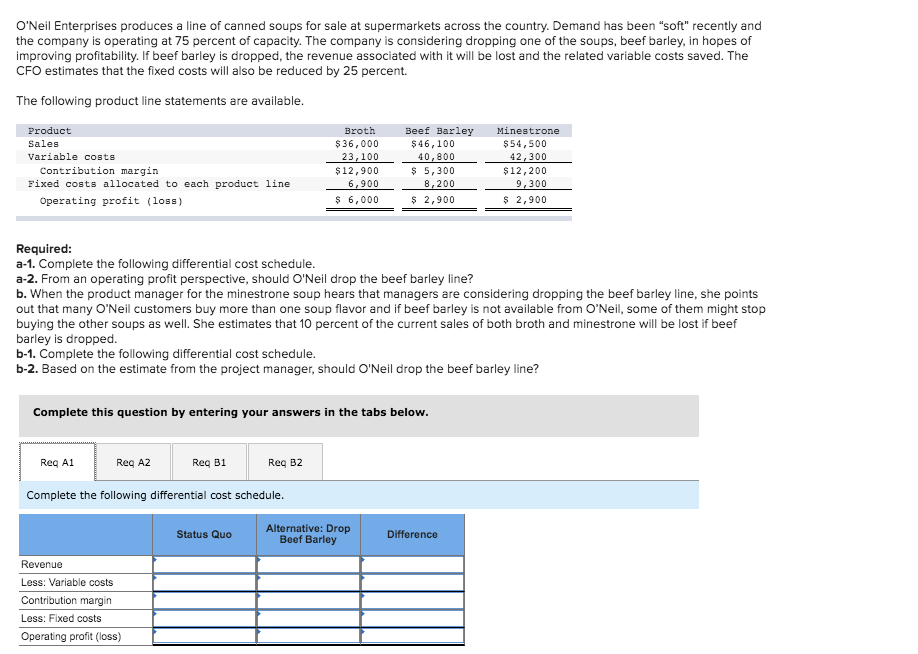

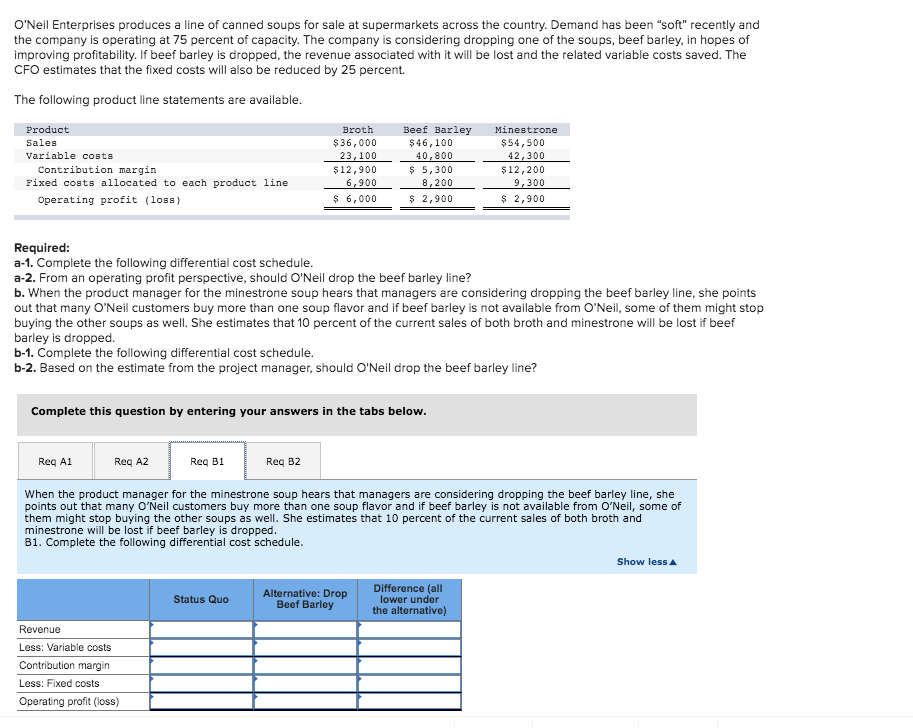

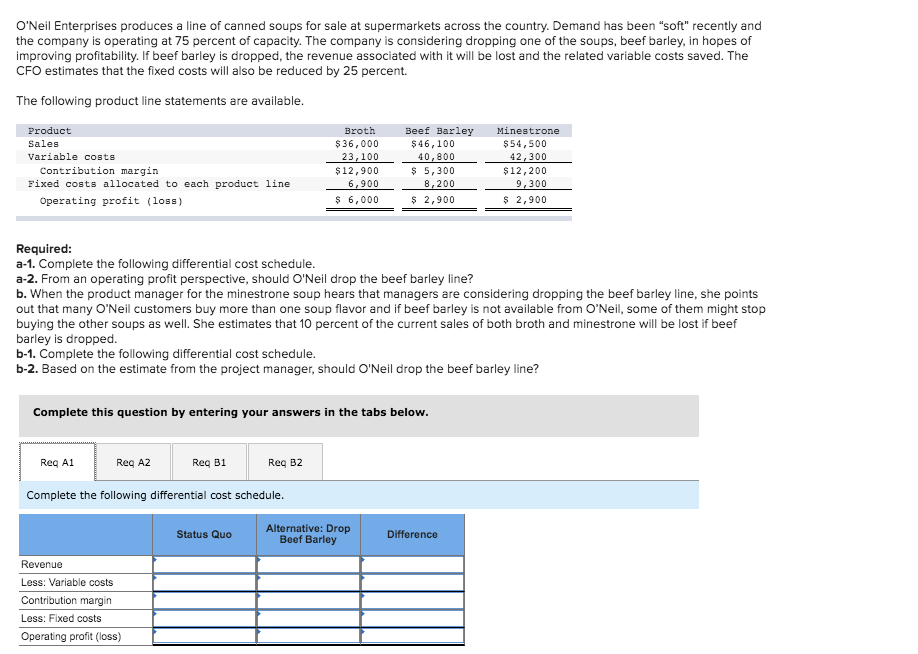

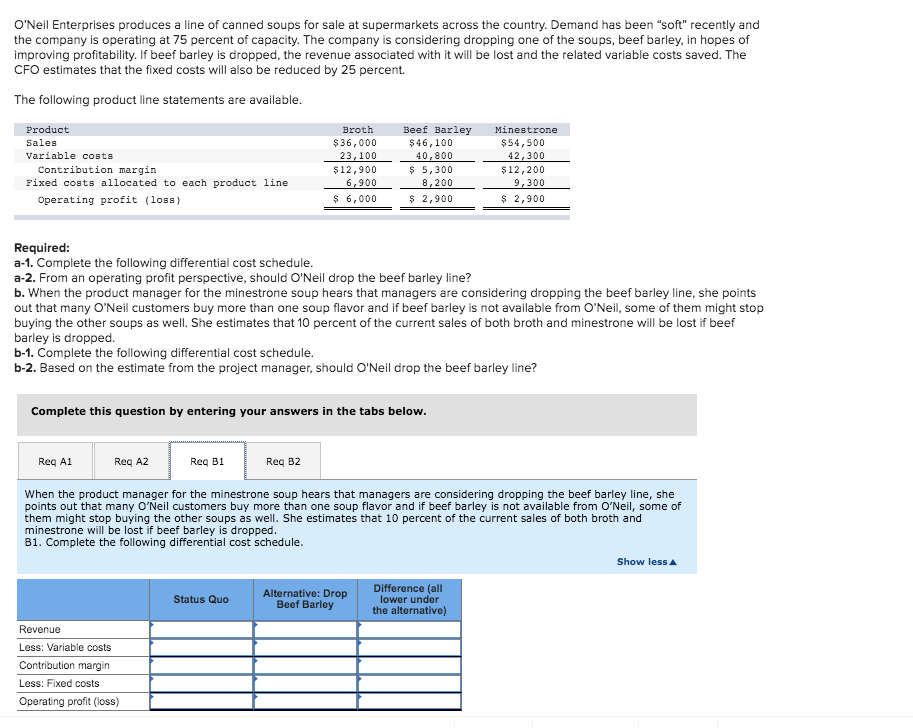

O'Neil Enterprises produces a line of canned soups for sale at supermarkets across the country. Demand has been "soft" recently and the company is operating at 75 percent of capacity. The company is considering dropping one of the soups, beef barley, in hopes of improving profitability. If beef barley is dropped, the revenue associated with it will be lost and the related variable costs saved. The CFO estimates that the fixed costs will also be reduced by 25 percent The following product line statements are available Beef Barley Product Broth Minestrone Sales $36,000 $46,100 $54,500 Variable costs 40,800 $ 5,300 8,200 $ 2,900 42,300 $12,200 23,100 $12,900 6,900 Contribution margin Fixed costs allocated to each product line 9,300 6,000 $2,900 Operating profit (loss) Required: a-1. Complete the following differential cost schedule. a-2. From an operating profit perspective, should O'Neil drop the beef barley line? b. When the product manager for the minestrone soup hears that managers are considering dropping the beef barley line, she points out that many O'Neil customers buy more than one soup flavor and if beef barley is not available from O'Neil, some of them might stop buying the other soups as well. She estimates that 10 percent of the current sales of both broth and minestrone will be lost if beef barley is dropped b-1. Complete the following differential cost schedule. b-2. Based on the estimate from the project manager, should O'Neil drop the beef barley line? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Complete the following differential cost schedule Alternative: Drop Beef Barley Status Quo Difference Revenue Less: Variable costs Contribution margin Less: Fixed costs Operating profit (loss) O'Neil Enterprises produces a line of canned soups for sale at supermarkets across the country. Demand has been "soft" recently and the company is operating at 75 percent of capacity. The company is considering dropping one of the soups, beef barley, in hopes of improving profitability. If beef barley is dropped, the revenue associated with it will be lost and the related variable costs saved. The CFO estimates that the fixed costs will also be reduced by 25 percent The following product line statements are available. Beef Barley Product Broth Minestrone $54,500 Sales $36,000 $46,100 23,100 Variable costs 40,800 42,300 $ 5,300 Contribution margin $12,900 $12,200 9,300 $ 2,900 Fixed costs allocated to each product line 6,900 8,200 $ 2,900 6,000 Operating profit (loss) Required: a-1. Complete the following differential cost schedule. a-2. From an operating profit perspective, should O'Neil drop the beef barley line? b. When the product manager for the minestrone soup hears that managers are considering dropping the beef barley line, she points out that many O'Neil customers buy more than one soup flavor and if beef barley is not available from O'Neil, some of them might stop buying the other soups as well. She estimates that 10 percent of the current sales of both broth and minestrone will be lost if beef barley is dropped. b-1. Complete the following differential cost schedule. b-2. Based on the estimate from the project manager, should O'Neil drop the beef barley line? Complete this question by entering your answers in the tabs below. Req B2 Req A1 Req A2 Req B1 When the product manager for the minestrone soup hears that managers are considering dropping the beef barley line, she points out that many O'Neil customers buy more than one soup flavor and if beef barley is not available from O'Neil, some of them might stop buying the other soups as well. She estimates that 10 percent of the current sales of both broth and minestrone will be lost if beef barley is dropped. B1. Complete the following differential cost schedule Show less Difference (all lower under the alternative) Alternative: Drop Beef Barley Status Quo Revenue Less: Variable costs Contribution margin Less: Fixed costs Operating profit (loss)