Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are working in the finance department and your manager ask you answer the below questions. Sainsbury is financed by both debt and equity.

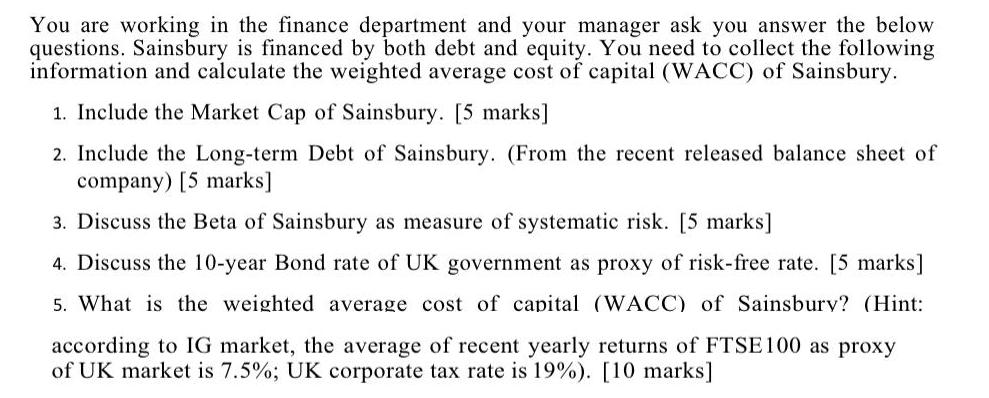

You are working in the finance department and your manager ask you answer the below questions. Sainsbury is financed by both debt and equity. You need to collect the following information and calculate the weighted average cost of capital (WACC) of Sainsbury. 1. Include the Market Cap of Sainsbury. [5 marks] 2. Include the Long-term Debt of Sainsbury. (From the recent released balance sheet of company) [5 marks] 3. Discuss the Beta of Sainsbury as measure of systematic risk. [5 marks] 4. Discuss the 10-year Bond rate of UK government as proxy of risk-free rate. [5 marks] 5. What is the weighted average cost of capital (WACC) of Sainsbury? (Hint: according to IG market, the average of recent yearly returns of FTSE 100 as proxy of UK market is 7.5%; UK corporate tax rate is 19%). [10 marks]

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 The market cap of Sainsbury is 221 billion 2 The longterm debt of Sain...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started