Answered step by step

Verified Expert Solution

Question

1 Approved Answer

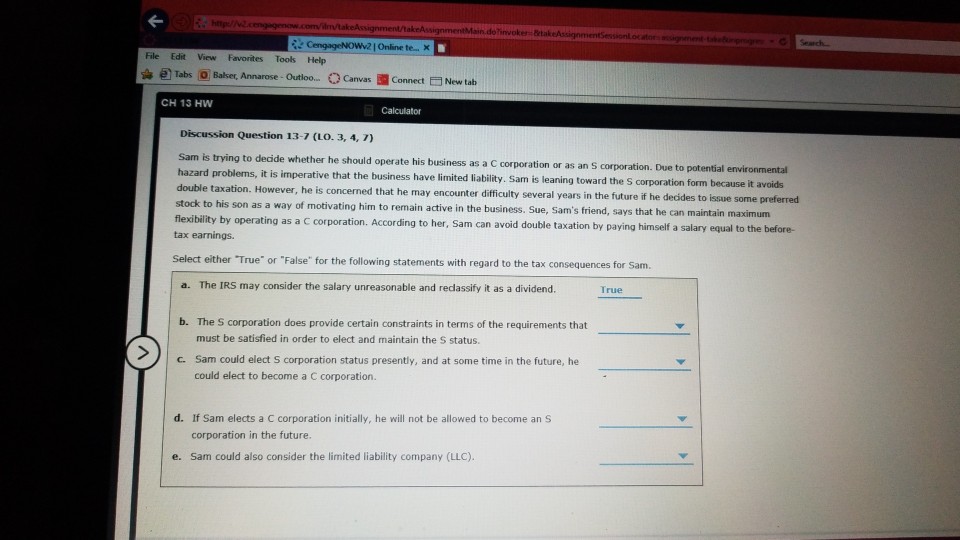

Online te- X File Edit View Favorites Tools Help TabsOBalser, Annarose- Outloo....CanvasConnect New tab CH 13 HWw Calculator Discussion Question 13-7 (LO. 3, 4, 7)

Online te- X File Edit View Favorites Tools Help TabsOBalser, Annarose- Outloo....CanvasConnect New tab CH 13 HWw Calculator Discussion Question 13-7 (LO. 3, 4, 7) Sam is trying to decide whether he should operate double taxation. However, he his business as a C corporation or as an S corporation. Due to potential environmental hazard problems, it is imperative that the business have limited liability. Sam is leaning toward the S corporation form because it flexibility by operating as a C corporation. According to her, Sam can avoid double taxation by paying himself a salary equal to the before- Select either True" or "False" for the following statements with regard to the tax consequences for Sam is concerned that he may encounter difficulty several years in the future if he decides to issue some preferred stock to his son as a way of motivating him to remain active in the business. Sue, Sam's friend, says that he can maintain maximum tax earnings. True a. The IRS may consider the salary unreasonable and redassify it as a dividend. b. The S corporation does provide certain constraints in terms of the requirements that must be satisfied in order to elect and maintain the S status Sam could elect S corporation status presently, and at some time in the future, he could elect to become a C corporation c. d. If Sam elects a C corporation initially, he will not be allowed to become an S corporation in the future. e. Sam could also consider the limited liability company (LLC)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started