Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only Accounting treatment with respect to relevant International financial reporting standards is required. How each of the issues should be accounted for. Question is complete

Only Accounting treatment with respect to relevant International financial reporting standards is required. How each of the issues should be accounted for. Question is complete and there is no extra info other than this.

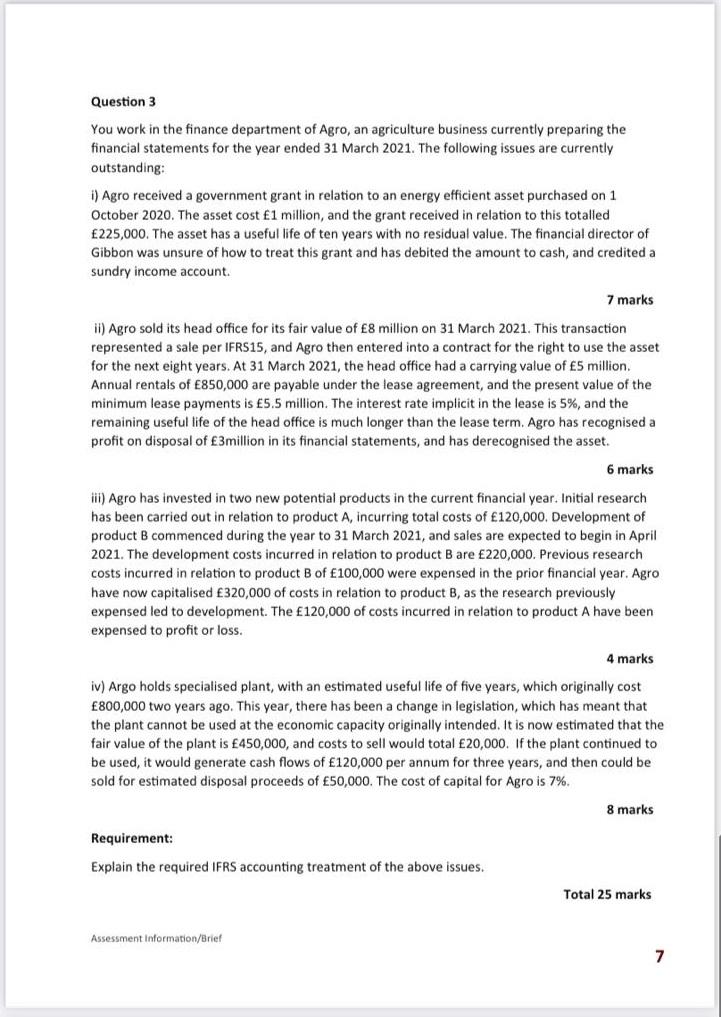

Question 3 You work in the finance department of Agro, an agriculture business currently preparing the financial statements for the year ended 31 March 2021. The following issues are currently outstanding: i) Agro received a government grant in relation to an energy efficient asset purchased on 1 October 2020. The asset cost $1 million, and the grant received in relation to this totalled 225,000. The asset has a useful life of ten years with no residual value. The financial director of Gibbon was unsure of how to treat this grant and has debited the amount to cash, and credited a sundry income account. 7 marks ii) Agro sold its head office for its fair value of 8 million on 31 March 2021. This transaction represented a sale per IFRS15, and Agro then entered into a contract for the right to use the asset for the next eight years. At 31 March 2021, the head office had a carrying value of 5 million. Annual rentals of 850,000 are payable under the lease agreement, and the present value of the minimum lease payments is 5.5 million. The interest rate implicit in the lease is 5%, and the remaining useful life of the head office is much longer than the lease term. Agro has recognised a profit on disposal of 3million in its financial statements, and has derecognised the asset. 6 marks iii) Agro has invested in two new potential products in the current financial year. Initial research has been carried out in relation to product A, incurring total costs of 120,000. Development of product B commenced during the year to 31 March 2021, and sales are expected to begin in April 2021. The development costs incurred in relation to product B are 220,000. Previous research costs incurred in relation to product B of 100,000 were expensed in the prior financial year. Agro have now capitalised 320,000 of costs in relation to product B, as the research previously expensed led to development. The 120,000 of costs incurred in relation to product A have been expensed to profit or loss. 4 marks iv) Argo holds specialised plant, with an estimated useful life of five years, which originally cost 800,000 two years ago. This year, there has been a change in legislation, which has meant that the plant cannot be used at the economic capacity originally intended. It is now estimated that the fair value of the plant is 450,000, and costs to sell would total 20,000. If the plant continued to be used, it would generate cash flows of 120,000 per annum for three years, and then could be sold for estimated disposal proceeds of 50,000. The cost of capital for Agro is 7%. 8 marks Requirement: Explain the required IFRS accounting treatment of the above issues. Total 25 marks Assessment Information/Brief 7 Question 3 You work in the finance department of Agro, an agriculture business currently preparing the financial statements for the year ended 31 March 2021. The following issues are currently outstanding: i) Agro received a government grant in relation to an energy efficient asset purchased on 1 October 2020. The asset cost $1 million, and the grant received in relation to this totalled 225,000. The asset has a useful life of ten years with no residual value. The financial director of Gibbon was unsure of how to treat this grant and has debited the amount to cash, and credited a sundry income account. 7 marks ii) Agro sold its head office for its fair value of 8 million on 31 March 2021. This transaction represented a sale per IFRS15, and Agro then entered into a contract for the right to use the asset for the next eight years. At 31 March 2021, the head office had a carrying value of 5 million. Annual rentals of 850,000 are payable under the lease agreement, and the present value of the minimum lease payments is 5.5 million. The interest rate implicit in the lease is 5%, and the remaining useful life of the head office is much longer than the lease term. Agro has recognised a profit on disposal of 3million in its financial statements, and has derecognised the asset. 6 marks iii) Agro has invested in two new potential products in the current financial year. Initial research has been carried out in relation to product A, incurring total costs of 120,000. Development of product B commenced during the year to 31 March 2021, and sales are expected to begin in April 2021. The development costs incurred in relation to product B are 220,000. Previous research costs incurred in relation to product B of 100,000 were expensed in the prior financial year. Agro have now capitalised 320,000 of costs in relation to product B, as the research previously expensed led to development. The 120,000 of costs incurred in relation to product A have been expensed to profit or loss. 4 marks iv) Argo holds specialised plant, with an estimated useful life of five years, which originally cost 800,000 two years ago. This year, there has been a change in legislation, which has meant that the plant cannot be used at the economic capacity originally intended. It is now estimated that the fair value of the plant is 450,000, and costs to sell would total 20,000. If the plant continued to be used, it would generate cash flows of 120,000 per annum for three years, and then could be sold for estimated disposal proceeds of 50,000. The cost of capital for Agro is 7%. 8 marks Requirement: Explain the required IFRS accounting treatment of the above issues. Total 25 marks Assessment Information/Brief 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started