only anser the yellow shaded boxes

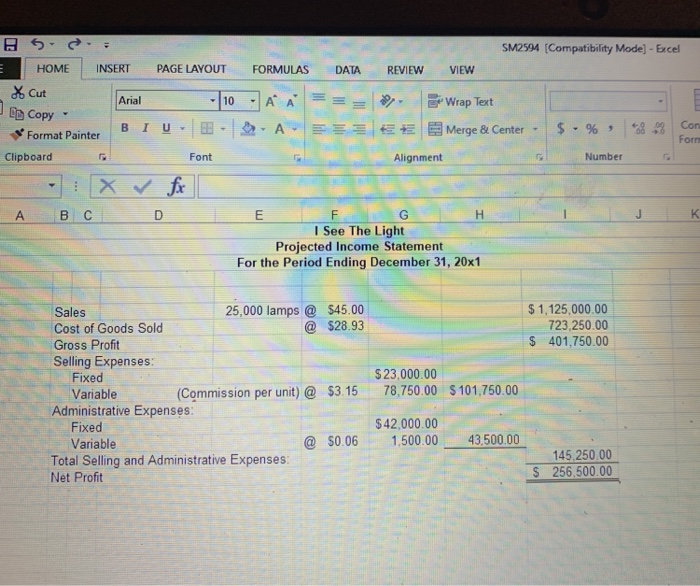

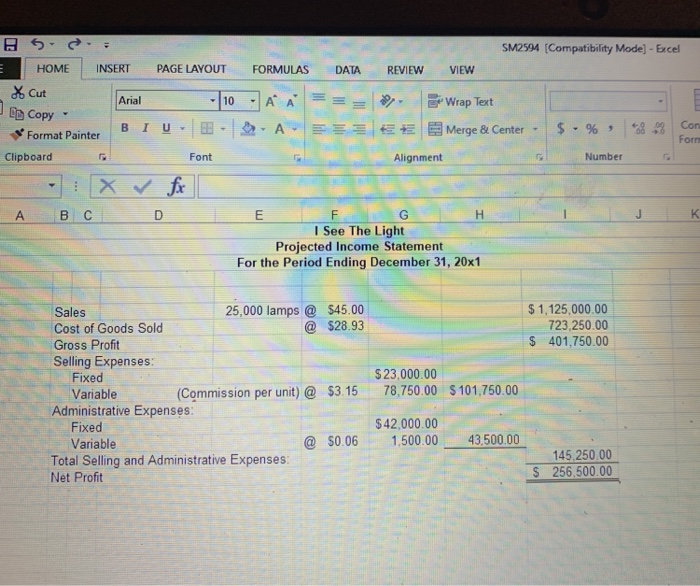

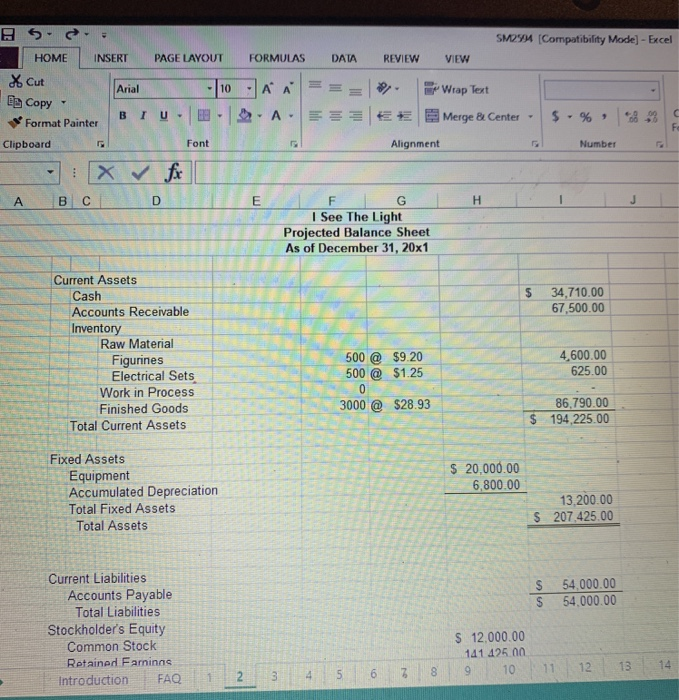

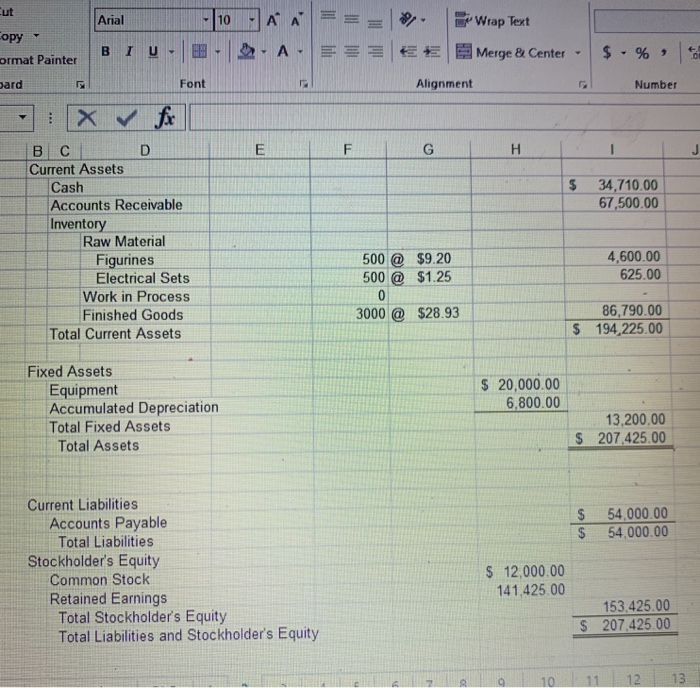

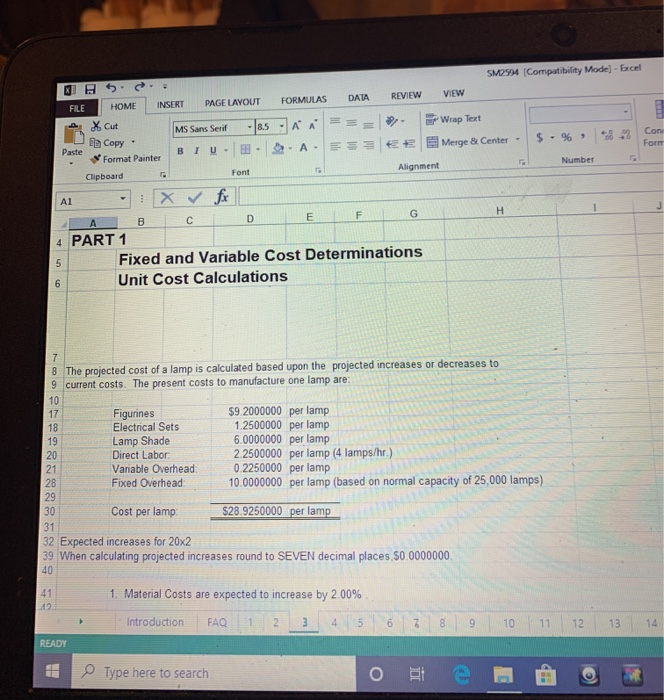

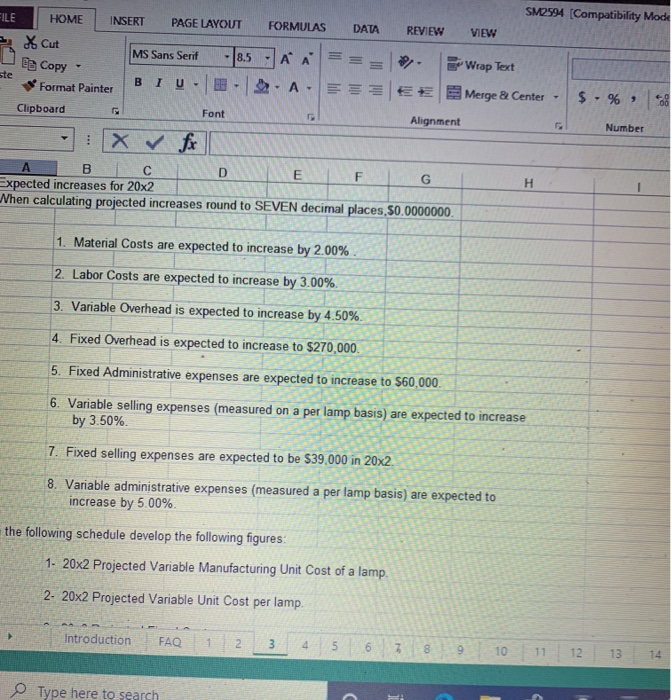

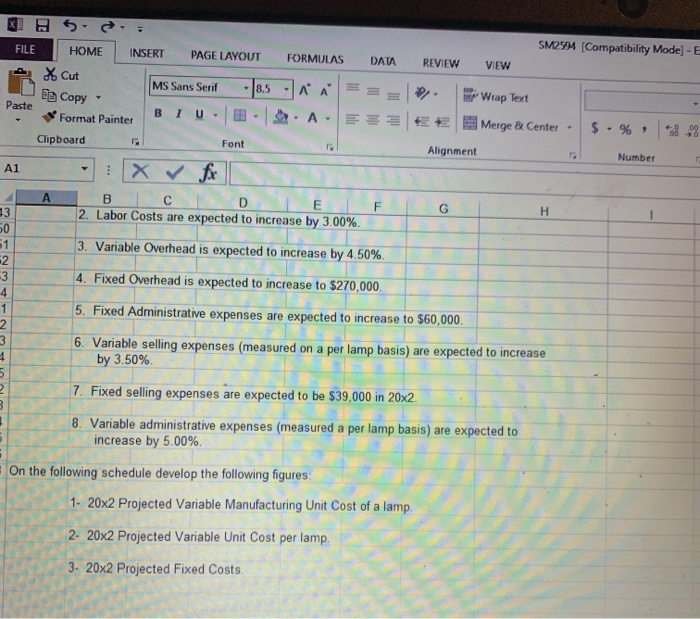

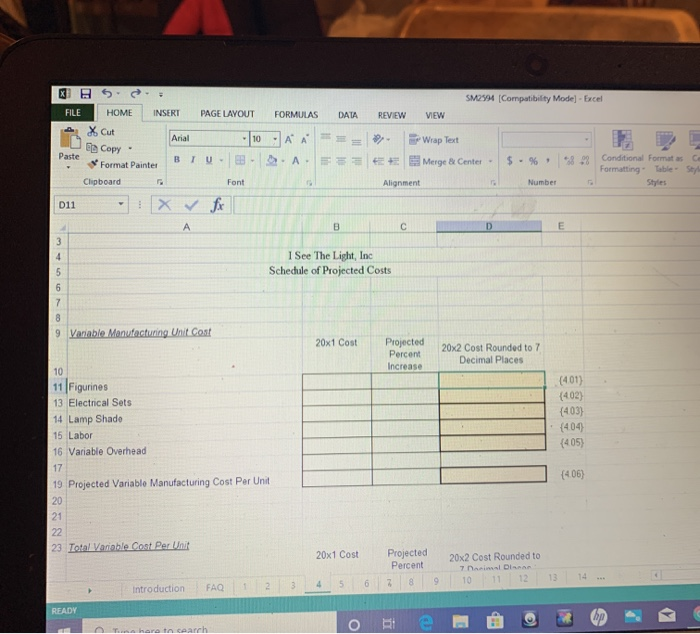

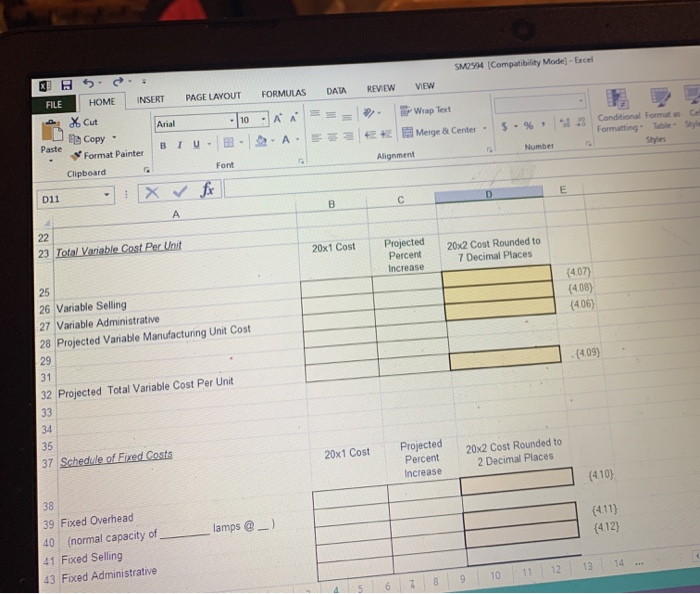

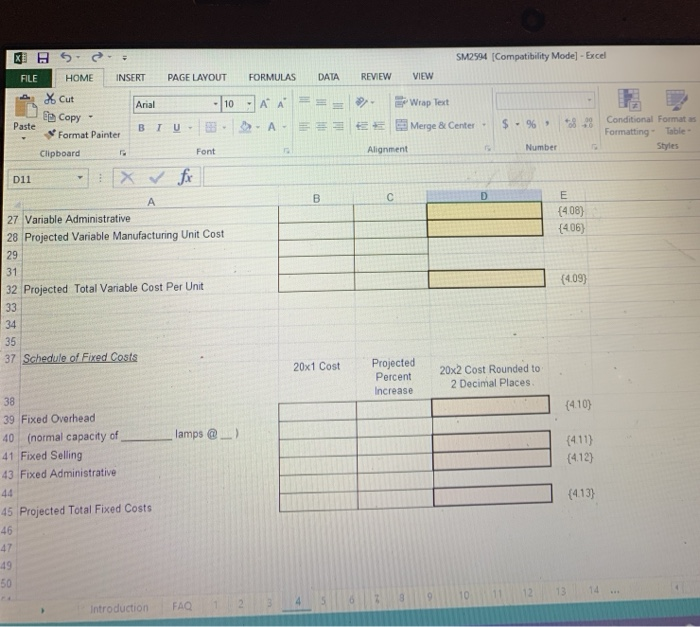

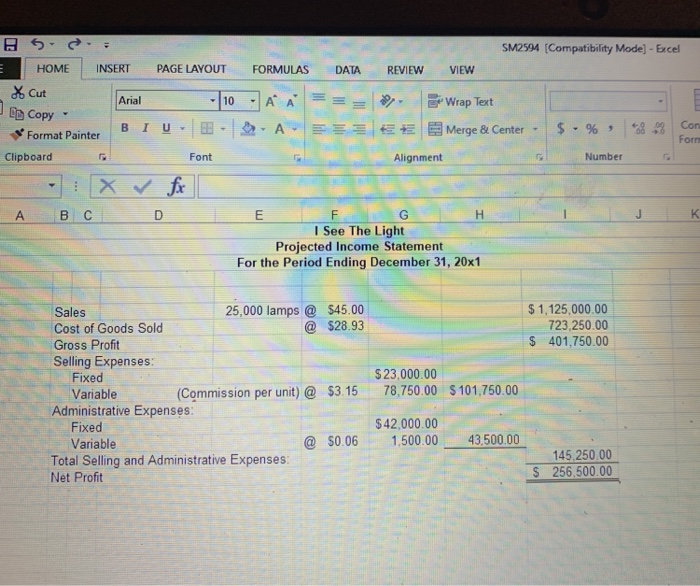

Arial B92. SM2594 [Compatibility Mode] - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW X Cut -10A A = = = Wrap Text En Copy - BIU - 2 - Et Merge & Center - $ - % , Format Painter 8. Con Fom Clipboard Font E l Alignment Number Num - X for ABC I See The Light Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 723,250.00 $ 401,750.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $28.93 Gross Profit Selling Expenses Fixed Variable (Commission per unit) @ $3.15 Administrative Expenses Fixed Variable @ $0.06 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 78.750.00 $ 101,750.00 $42.000.00 1.500.00 43,500.00 145.250.00 256,500.00 $ 5. S. HOME INSERT PAGE LAYOUT * Cut Arial - 10 Copy BIU - - Format Painter Clipboard Font FORMULAS DATA REVIEW AA ===> - A. E E SMDYM (Compatibility Mode] - Excel VIEW Wrap Tent Merge & Center - $ %, 83 Alignment Number m ol E H I F G ALE I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets $9.20 $1.25 4,600.00 625.00 500 @ 500 @ 0 3000 @ $28.93 $ 86,790.00 194,225.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 13.200.00 207.425.00 $ $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Introduction FAQ S 12,000.00 141 425.00 9 10 4 5 6 7 8 11 12 13 14 9. Wrap Text Copy ormat Painter bard Arial BIU. 10 . AA = A Merge & Center - $ - % , Font Alignment Number FGTH $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets 500 @ 500 @ $9.20 $1.25 4,600.00 625.00 3000 @ $28.93 86,790.00 194,225.00 $ $ 20,000.00 6,800.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 13,200.00 207,425.00 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 141.425.00 153,425.00 $ 207.425.00 o 10 11 12 13 SM2.994 (Compatibility Mode] - Excel DATA FORMULAS REVIEW VIEW WH5.. FILE HOME INSERT PAGE LAYOUT 4. Cut MS Sans Serif -8.5 Format Painter BIU . Clipboard Font : A a Copy A A J Paste $ . % E 85% Wrap Text E Merge & Center - Alignment S Con For on A B C D 4 PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: Figurines Electrical Sets Lamp Shade Direct Labor Vanable Overhead: Fixed Overhead: $92000000 per lamp 1.2500000 per lamp 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp $28.9250000 per lamp 32 Expected increases for 20x2 39 When calculating projected increases round to SEVEN decimal places $0.0000000 41 19 1. Material Costs are expected to increase by 2.00% Introduction FAQ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 READY I Type here to search o e O E SMO 594 (Compatibility Mode REVIEW VIEW - Wrap Text HOME INSERT PAGE LAYOUT FORMULAS DATA 2 X Cut MS Sans Serif -8.5 AA= Copy * Format Painter inter BIU. A.EE Clipboard Font E Merge & Center - $ . % 88 Alignment Number A B C D E F G xpected increases for 20x2 When calculating projected increases round to SEVEN decimal places 500000000 1. Material Costs are expected to increase by 2.00% 2. Labor Costs are expected to increase by 3.00% 3. Variable Overhead is expected to increase by 4.50%. 4. Fixed Overhead is expected to increase to $270,000 5. Fixed Administrative expenses are expected to increase to $60,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 7. Fixed selling expenses are expected to be $39,000 in 20x2. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 5.00%. the following schedule develop the following figures: 1. 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp Introduction FAQ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 SMOSA (Compatibility Mode) - E DAN REVIEW VIEW FILE HOME INSERT PAGE LAYOUT 4 % Cut MS Sans Serif -8.5 Eb Copy Paste Format Painter B T U - DE : Clipboard Font FORMULAS A * = : A = Wrap Text Merge & Center - # $ -% Alignment Number A F G H B C D E 2. Labor Costs are expected to increase by 3.00% 3. Variable Overhead is expected to increase by 4.50%. NAWNOWN 4. Fixed Overhead is expected to increase to $270,000. 5. Fixed Administrative expenses are expected to increase to $60,000 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50% 7. Fixed selling expenses are expected to be $39.000 in 20x2. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 5.00%. increase by 5.00% On the following schedule develop the following figures: 1. 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2. 20x2 Projected Variable Unit Cost per lamp - 20x2 Projected Fixed Costs X 6 FILE HOME AX Cut . INSERT SM2594 [Compatibility Mode] - Excel PAGE LAYOUT FORMULAS DATA REVIEW NEW U Copy 10 - . . A. Wrap Text E Merge & Center - $ - % - 3,99 Conditional Format as a Formatting Table Style Paste Format Painter BTU. Clipboard Font 011 : XV Alignment Number 1 See The Light, Inc Schedule of Projected Costs 9 Vanable Manufacturing Unit Cost 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places 11 Figurines 13 Electrical Sets 14 Lamp Shade 15 Labor 16 Variable Overhead (401) (402) (403) {404 (405) / / / 17 (406) 19 Projected Variable Manufacturing Cost Per Unit 23 Total Variable Cost Per Unit 20x1 Cost Projected Percent 7 8 20x2 Cost Rounded to in D AR 10 11 12 Introduction FAQ 13 4 9 2 1 14 ... 5 3 6 READY T hare to each SM2594 [Compatibility Mode) - Excel DATA REVIEW VIEW 05 FILE HOME X Cut Wrap Text 3 $ - % Merge & Center - INSERT PAGE LAYOUT FORMULAS Arial - 10 A i BLUE-A- Font Conditional Formats Formatting Table Style Styles J Paste Copy Format Painter Alignment Clipboard D11 23 Total Variable Cost Per Unit 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 7 Decimal Places {4.07) (4.08) (4.06) 26 Variable Selling 27 Variable Administrative 28 Projected Variable Manufacturing Unit Cost - (409) 32 Projected Total Variable Cost Per Unit 20x1 Cost 37 Schedule of Fixed Costs Projected Percent Increase 02 Cast Rounded to 2 Decimal Places {4.103 4.11) (4.12} lamps @_) 39 Fixed Overhead 40 (normal capacity of 41 Fixed Selling 43 Fixed Administrative 12 13 14 ... 11 10 6 7 8 9 SM2594 (Compatibility Mode] - Excel DATA REVIEW VIEW 2 XB5- FILE HOME INSERT PAGE LAYOUT FORMULAS A X Cut Arial :10A A e Copy Paste BTU- . A - E Format Painter Clipboard Font D11 fr Ep Wrap Text Merge & Center . = $. % 3 8 Conditional Format as Formatting - Table Alignment Number Styles 27 Variable Administrative 28 Projected Variable Manufacturing Unit Cost {4.08) {406) 31 {4.09) 32 Projected Total Variable Cost Per Unit 37 Schedule of Fixed Costs 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places 38 {4.10) lamps @ ) 39 Fixed Overhead 40 (normal capacity of 41 Fixed Selling 43 Fixed Administrative {4.11) {4.12) {4.13) 45 Projected Total Fixed Costs :85 Introduction FAQ 1 2