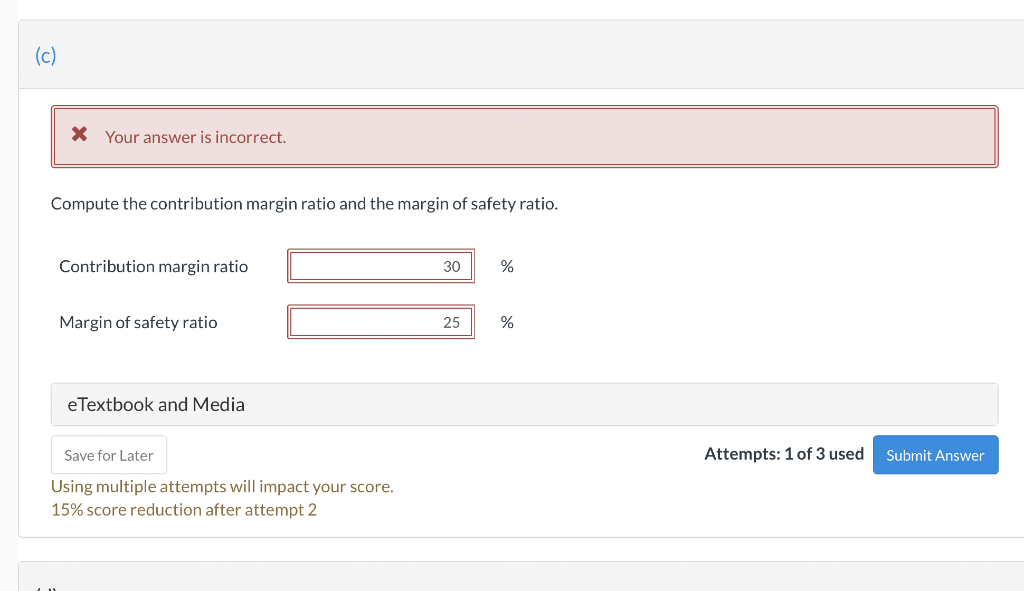

only answer part c please

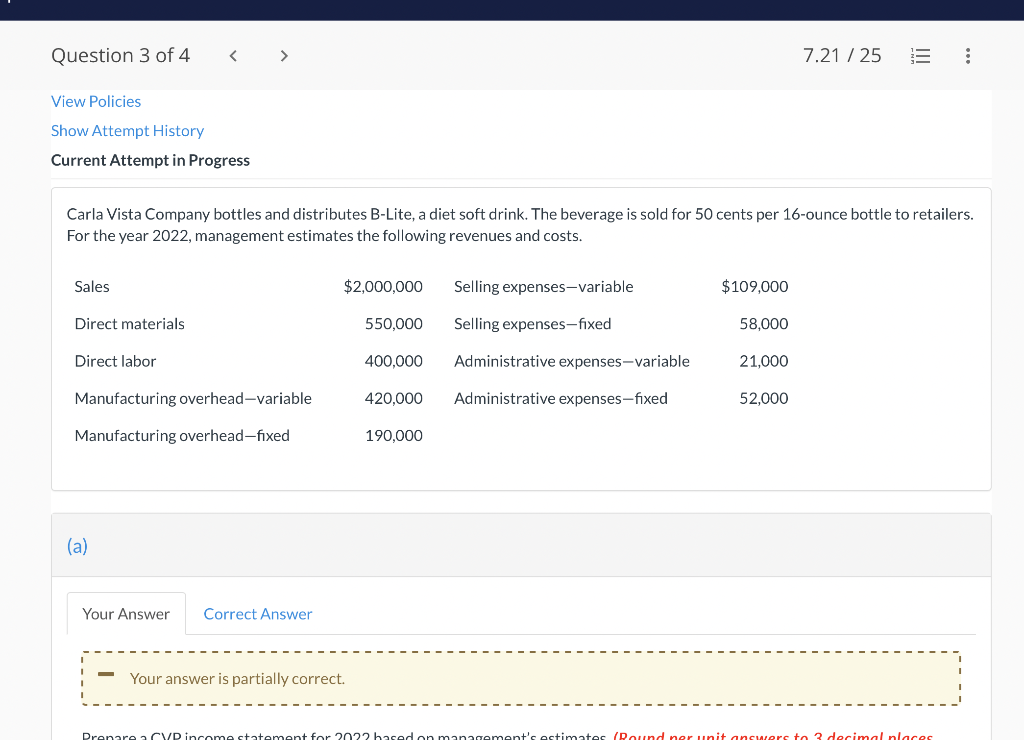

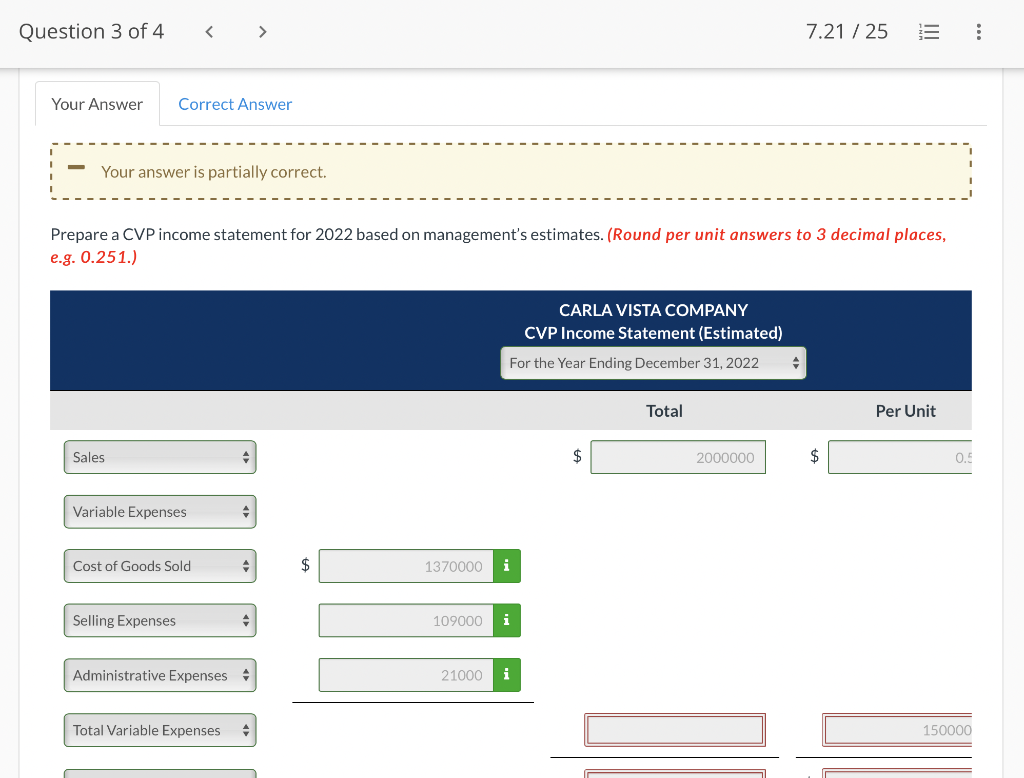

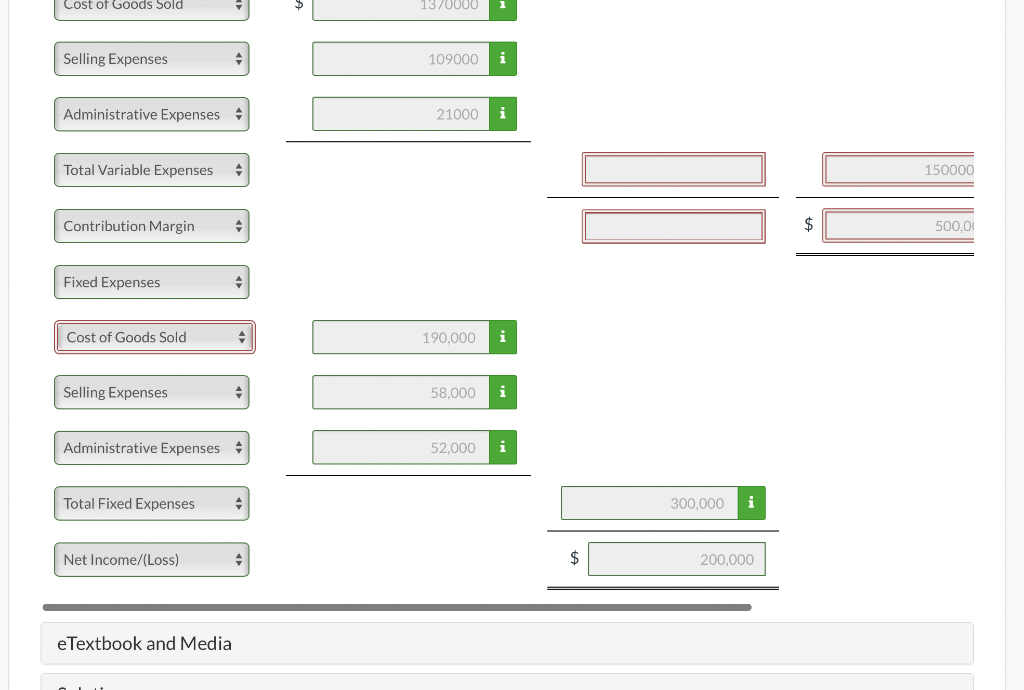

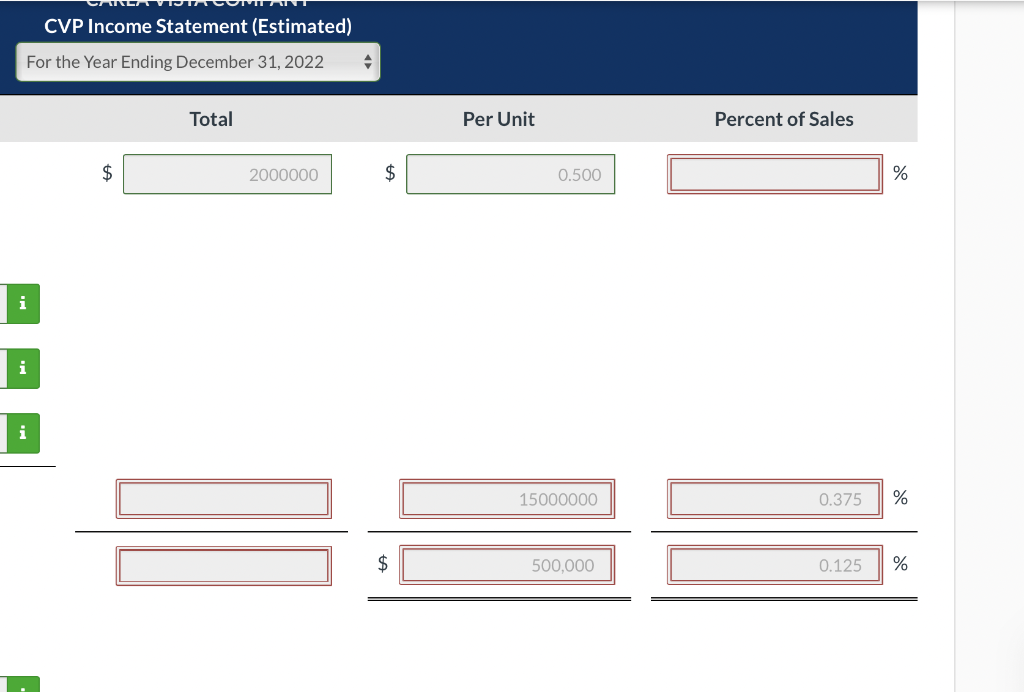

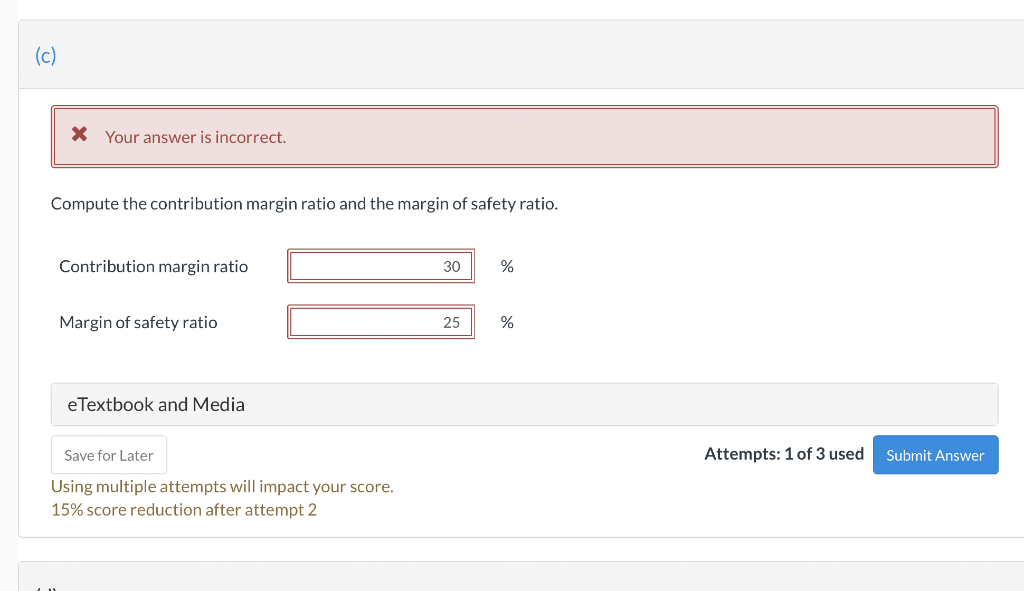

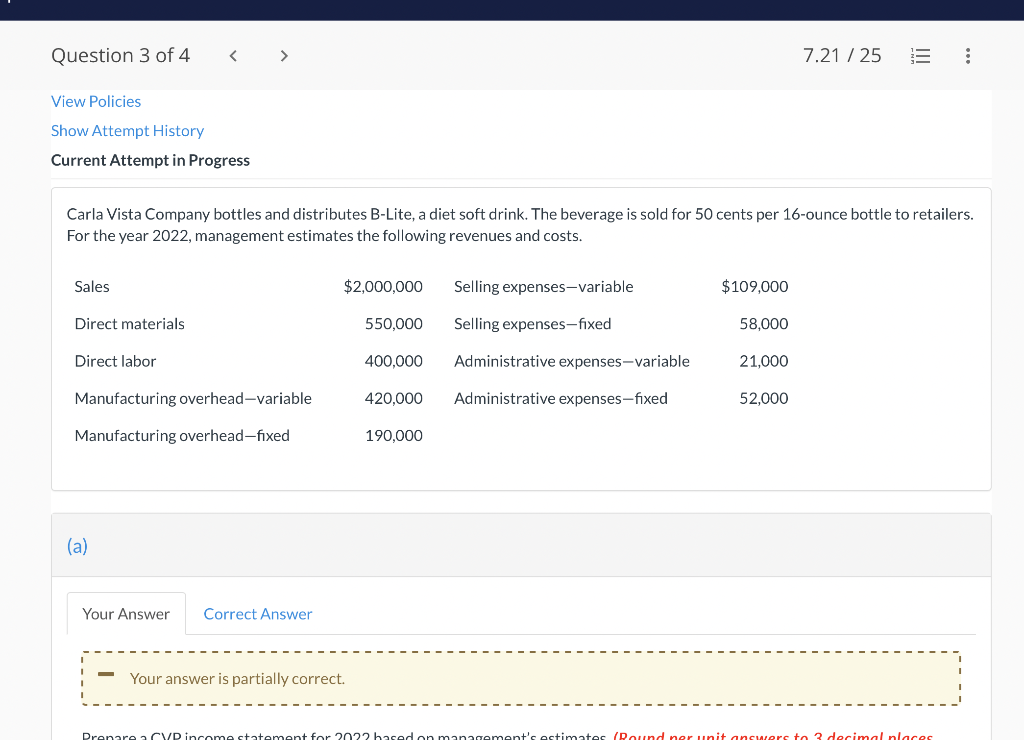

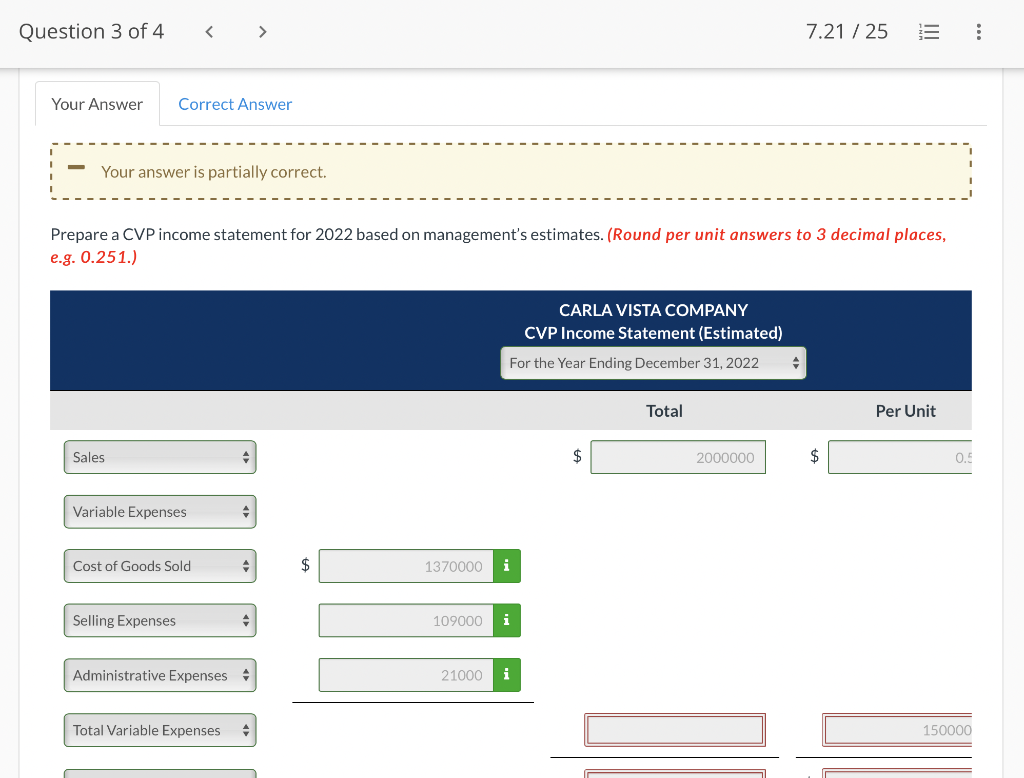

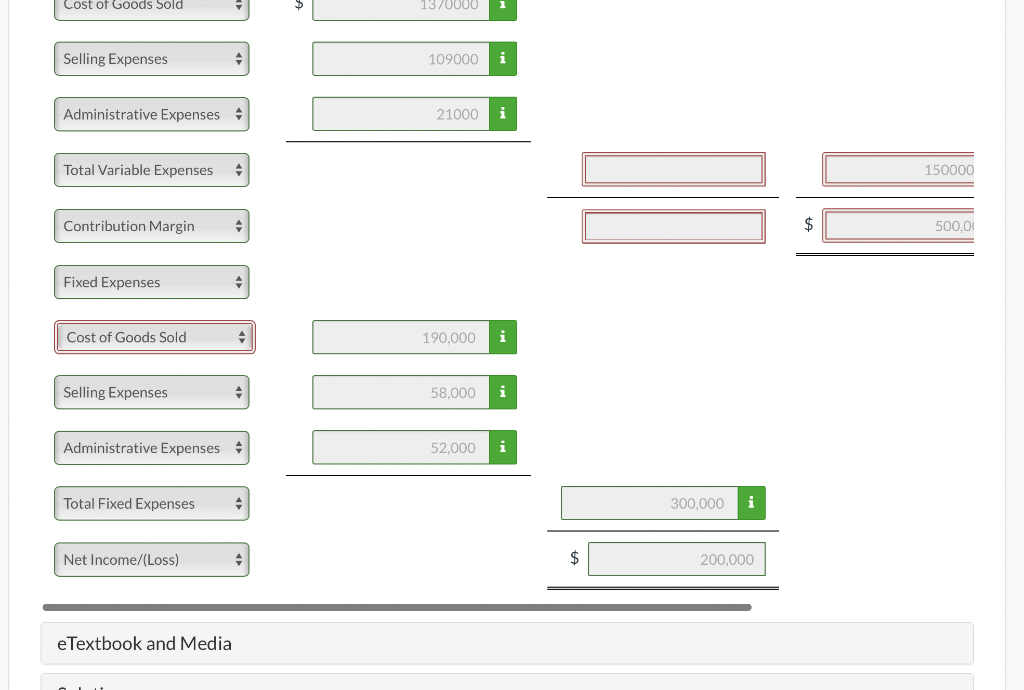

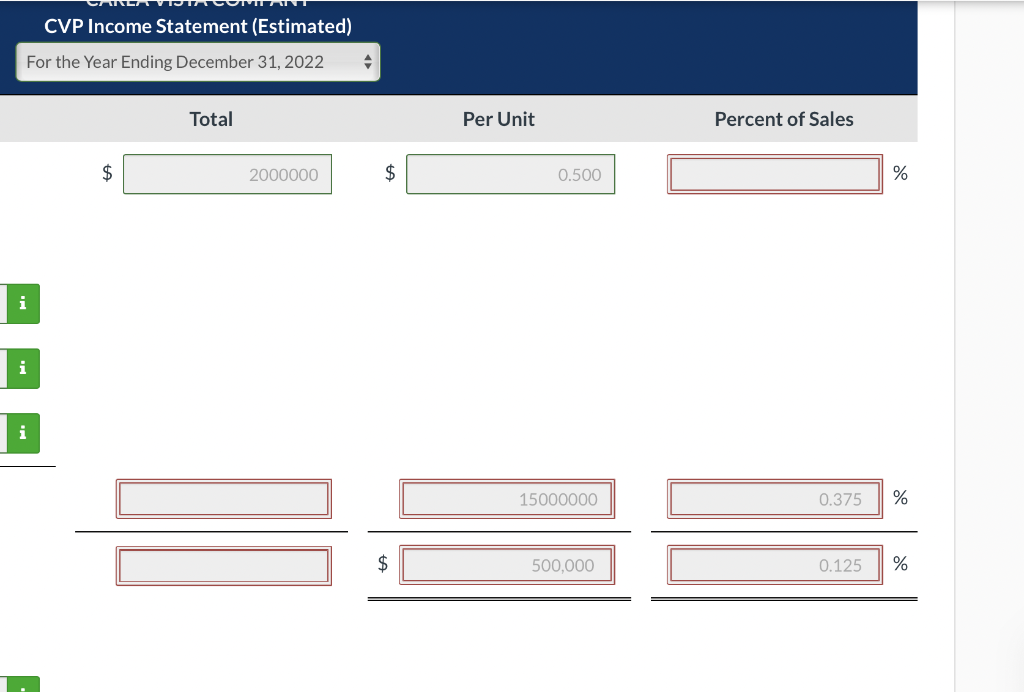

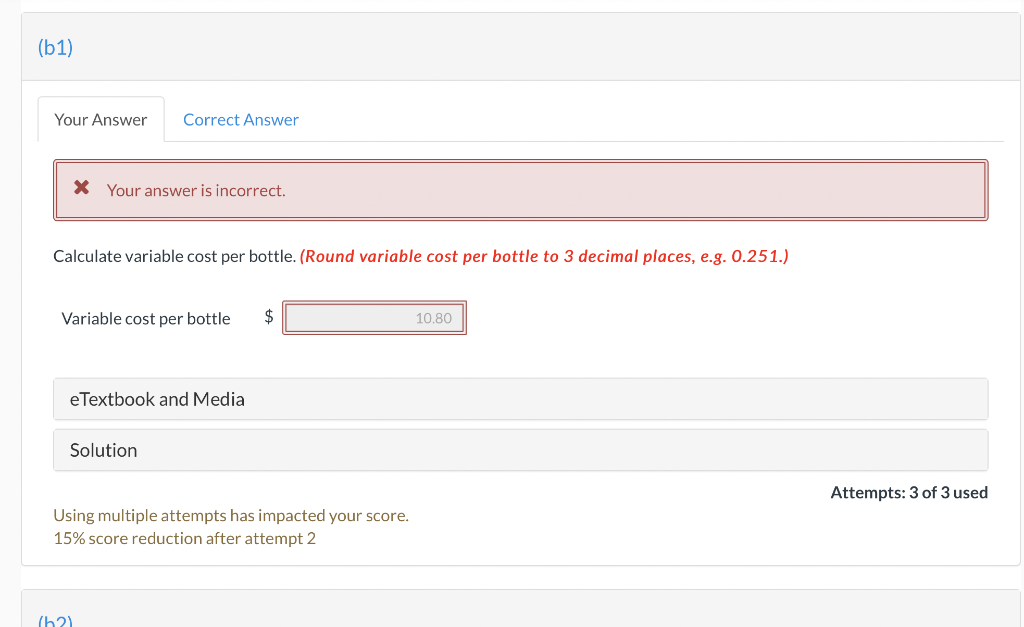

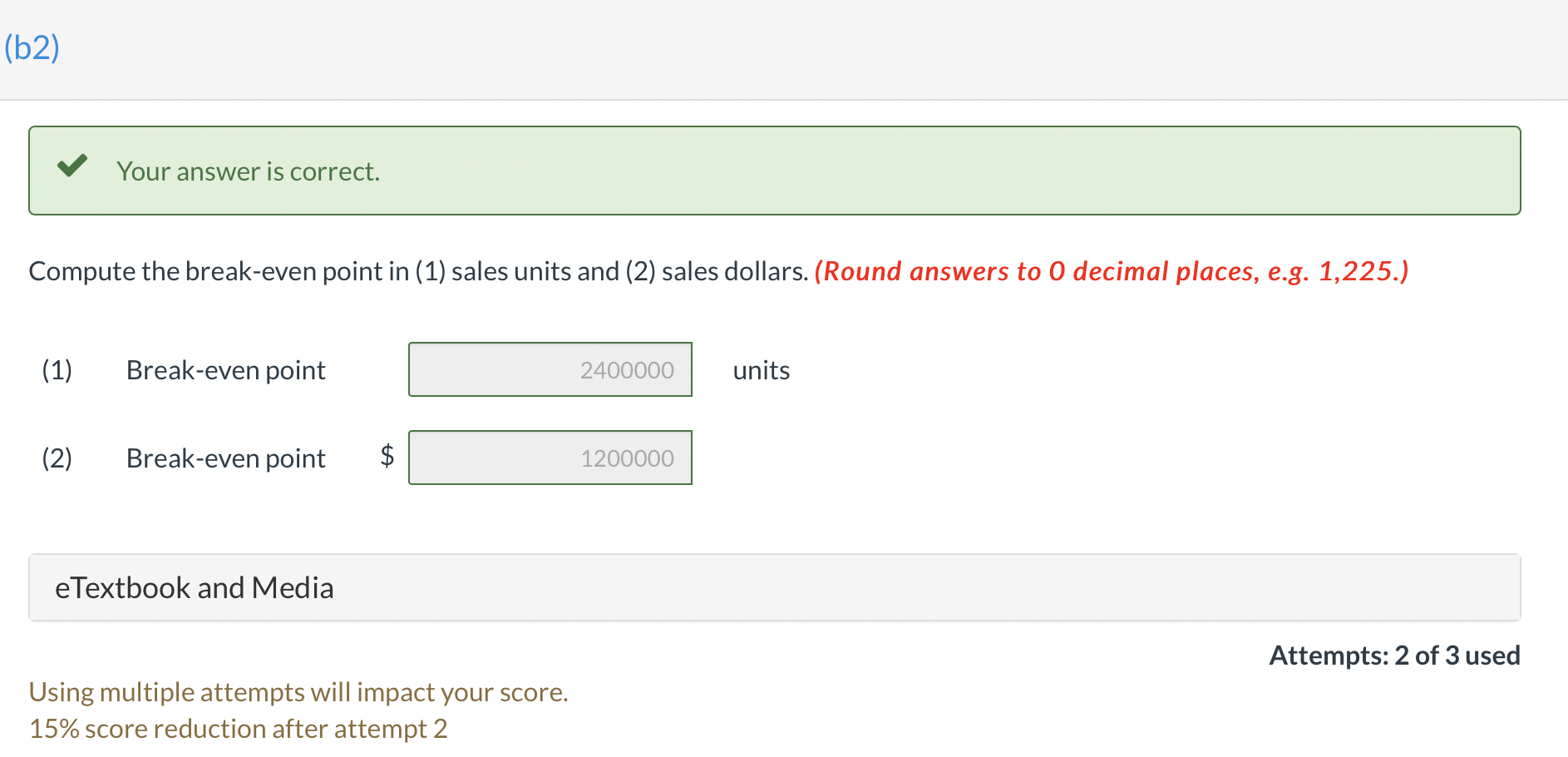

Question 3 of 4 7.21 / 25 View Policies Show Attempt History Current Attempt in Progress Carla Vista Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers. For the year 2022, management estimates the following revenues and costs. Sales $2,000,000 Selling expenses-variable $109,000 Direct materials 550,000 Selling expenses-fixed 58,000 Direct labor 400,000 Administrative expenses-variable 21,000 Manufacturing overhead-variable 420,000 Administrative expenses-fixed 52,000 Manufacturing overhead-fixed 190,000 (a) Your Answer Correct Answer Your answer is partially correct. DrenareacVD income statement for 2022 based on management's estimates (Pound nor unit answe to 2 decimal nlaces Question 3 of 4 7.21 / 25 Your Answer Correct Answer Your answer is partially correct. Prepare a CVP income statement for 2022 based on management's estimates. (Round per unit answers to 3 decimal places, e.g. 0.251.) CARLA VISTA COMPANY CVP Income Statement (Estimated) For the Year Ending December 31, 2022 Total Per Unit Sales $ 2000000 $ 0. Variable Expenses Cost of Goods Sold $ 1370000 Selling Expenses 109000 i Administrative Expenses , 21000 i Total Variable Expenses 150000 Cost of Goods Sold 1370000 Selling Expenses 109000 i Administrative Expenses 21000 i Total Variable Expenses 150000 Contribution Margin 500,00 Fixed Expenses Cost of Goods Sold 4 190,000 i Selling Expenses 58,000 i Administrative Expenses - 52,000 i Total Fixed Expenses 300,000 i Net Income/(Loss) $ 200,000 e Textbook and Media CVP Income Statement (Estimated) For the Year Ending December 31, 2022 Total Per Unit Percent of Sales $ 2000000 $ 0.500 % i i 15000000 0.375 % $ 500,000 0.125 % (61) Your Answer Correct Answer X Your answer is incorrect. Calculate variable cost per bottle. (Round variable cost per bottle to 3 decimal places, e.g. 0.251.) Variable cost per bottle $ 10.80 e Textbook and Media Solution Attempts: 3 of 3 used Using multiple attempts has impacted your score. 15% score reduction after attempt 2 (12) (b2) Your answer is correct. Compute the break-even point in (1) sales units and (2) sales dollars. (Round answers to O decimal places, e.g. 1,225.) (1) Break-even point 2400000 units (2) Break-even point ta 1200000 e Textbook and Media Attempts: 2 of 3 used Using multiple attempts will impact your score. 15% score reduction after attempt 2 (c) X Your answer is incorrect. Compute the contribution margin ratio and the margin of safety ratio. Contribution margin ratio 30 % Margin of safety ratio 25 % e Textbook and Media Save for Later Attempts: 1 of 3 used Submit Answer Using multiple attempts will impact your score. 15% score reduction after attempt 2