Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ONLY ANSWER QUESTION 2!! Thank you ONLY ANSWER QUESTION 2!!!!! Thank you. I do not need question 1 answered.. 1. What is the structure of

ONLY ANSWER QUESTION 2!! Thank you

ONLY ANSWER QUESTION 2!!!!! Thank you. I do not need question 1 answered..

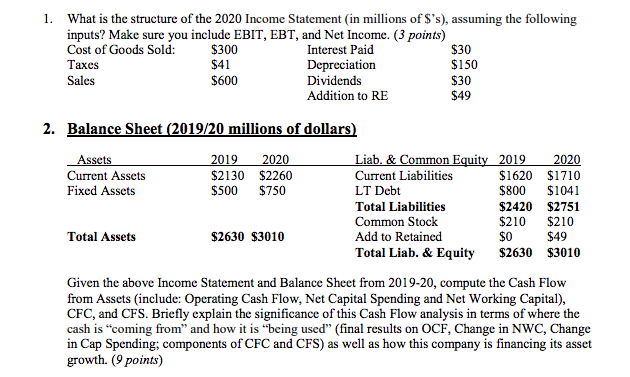

1. What is the structure of the 2020 Income Statement in millions of $'s), assuming the following inputs? Make sure you include EBIT, EBT, and Net Income. (3 points) Cost of Goods Sold: $300 Interest Paid $30 Taxes $41 Depreciation $150 Sales $600 Dividends $30 Addition to RE $49 2. Balance Sheet (2019/20 millions of dollars) Assets 2019 2020 Liab. & Common Equity 2019 2020 Current Assets $2130 $2260 Current Liabilities $1620 $1710 Fixed Assets $500 $750 LT Debt $800 $1041 Total Liabilities $2420 $2751 Common Stock $210 $210 Total Assets $2630 $3010 Add to Retained $0 $49 Total Liab. & Equity $2630 $3010 Given the above Income Statement and Balance Sheet from 2019-20, compute the Cash Flow from Assets (include: Operating Cash Flow, Net Capital Spending and Net Working Capital), CFC, and CFS. Briefly explain the significance of this Cash Flow analysis in terms of where the cash is "coming from" and how it is being used" (final results on OCF, Change in NWC, Change in Cap Spending; components of CFC and CFS) as well as how this company is financing its asset growth. (9 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started