ONLY ANSWERS PLEASE OF EACH NOT JUST THE FIRST ONE

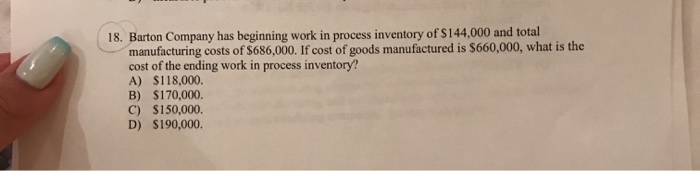

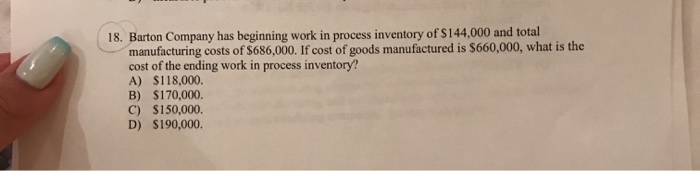

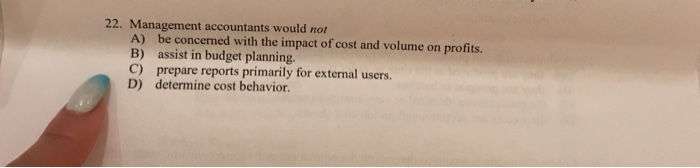

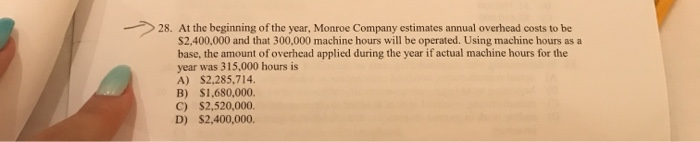

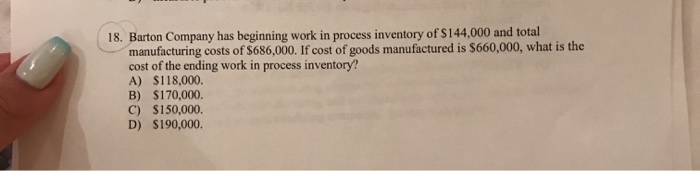

18. Barton Company has beginning work in process inventory of S144,000 and total manufacturing costs of $686,000. If cost of goods manufactured is S660,000, what is the cost of the ending work in process inventory? A) $118,000. B) $170,000 C) $150,000 D) $190,000 22. Management accountants would not A) be concerned with the impact of cost and volume on profits. B) assist in budget planning. C) prepare reports primarily for external users. D) determine cost behavior. 28. At the beginning of the year, Monroe Company estimates annual overhead costs to be S2,400,000 and that 300.000 machine hours will be operated. Using machine hours as a base, the amount of overhead applied during the year if actual machine hours for the year was 315,000 hours is A) S2,285,714 B) $1,680,000 C) $2,520,000 D) $2,400,000 31. Which one of the following should be equal to the balance of the Work In Process Inventory account at the end of the period? A) The total manufacturing costs for the period B) The total of manufacturing overhead applied to work in process for the period C) The total of the amounts transferred from raw materials for the current period D) The sum of the costs shown on the job cost sheets of unfinished jobs 32. Emley Company incurred direct materials costs of $750,000 during the year. Manufacturing overhead applied was $700.000 and is applied based on direct labor costs. The predetermined overhead rate is 70% How much are Emley Company's total manufacturing costs for the year? A) $1,940,000 B) $1,750,000 C) S2,450,000 D) $1,450,000 33. In determining total manufacturing costs on the cost of goods manufactured schedule, A) actual manufacturing overhead costs appear as a deduction. B) beginning work in process inventory should have a zero balance. C) manufacturing overhead applied is added to direct materials and direct labor. D) ending work in process inventory is deducted from beginning work in process inventory 34. 20,000 units in a process that are 70% complete are referred to as: A) 8.000 equivalent units of production B) 20,000 equivalent units of production. C) 14,000 equivalent units of production. D) 6,000 equivalent units of production. 35. Which of the following are period costs? A) Raw materials B) Direct labor and manufacturing overhead C) Direct materials and direct labor D) Selling expenses 36. The subtotal, "Cost of goods manufactured" appears on A) a manufacturing company's income statement. B) both a manufacturing and a merchandising company's income statement. C) neither a merchandising nor a manufacturing company's income statement. D) a merchandising company's income statement. 37. If beginning work in process is 4,000 units, ending work in process is 2.000 units, and the units accounted for equals 15,000 units, what must units started into production be? A) 19,000 B) 11,000. C) 17,000 D) 13,000 Version 3 Page 8 DJ JU0,000. 39. An important feature of a job order cost system is that each job A) has its own distinguishing characteristics. B) consists of one unit of output. C) must be similar to previous jobs completed. D) must be completed before a new job is accepted. 40. Cotter pins and lubricants used irregularly in a production process are classified as A) direct materials. B) miscellaneous expense. C) indirect materials. D) nonmaterial materials. 41. Equivalent units are calculated by A) dividing physical units by the percentage of work done. B) multiplying the percentage of work done by the equivalent units of output. C) multiplying the percentage of work done by the physical units. D) dividing equivalent units by the percentage of work done. 42. A manufacturing process requires small amounts of glue. The glue used in the production process is classified as a(n) A) indirect material. B) miscellaneous expense. C) period cost. D) direct material. 43. Both direct materials and indirect materials are A) merchandise inventory. B) raw materials. C) sold directly to customers by a manufacturing company. D) manufacturing overhead. 44. Which would be an appropriate cost driver for the purchasing activity cost pool? A) Purchase orders B) Machine setups C) Machine hours D) Inspections 45. Which of the following is not an example of an activity cost pool? A) Setting up machines B) Machining C) Machine hours D) Inspecting 46. In a job order cost system, a credit to Manufacturing Overhead will be accompanied by a debit to A) Cost of Goods Manufactured. B) Raw Materials Inventory. C) Work in Process Inventory. D) Finished Goode Inventor