Answered step by step

Verified Expert Solution

Question

1 Approved Answer

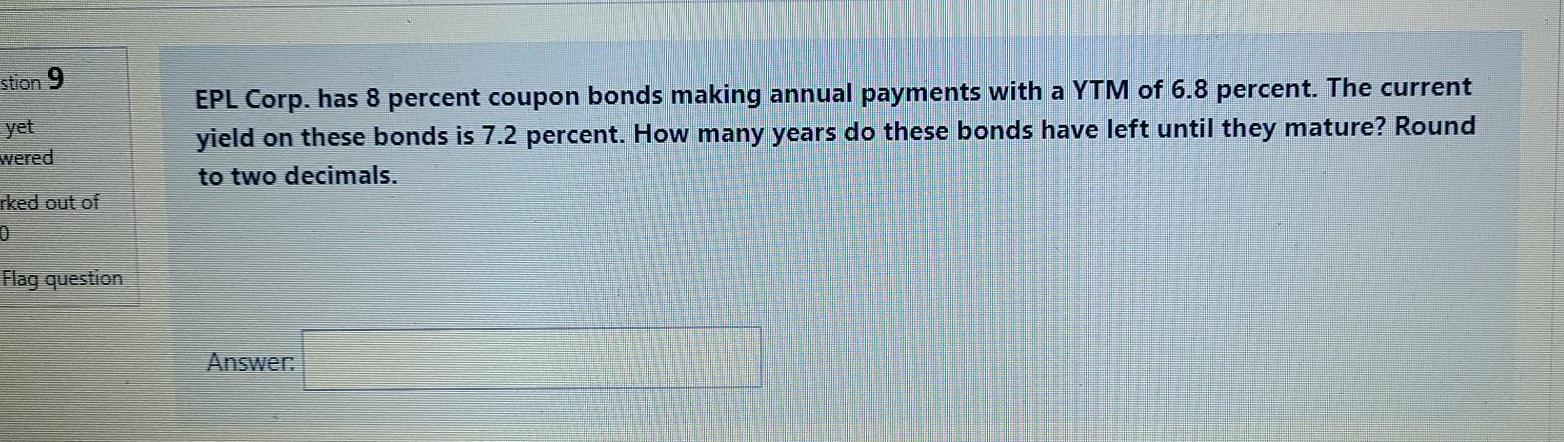

only answers please thank you. stion 9 yet EPL Corp. has 8 percent coupon bonds making annual payments with a YTM of 6.8 percent. The

only answers please thank you.

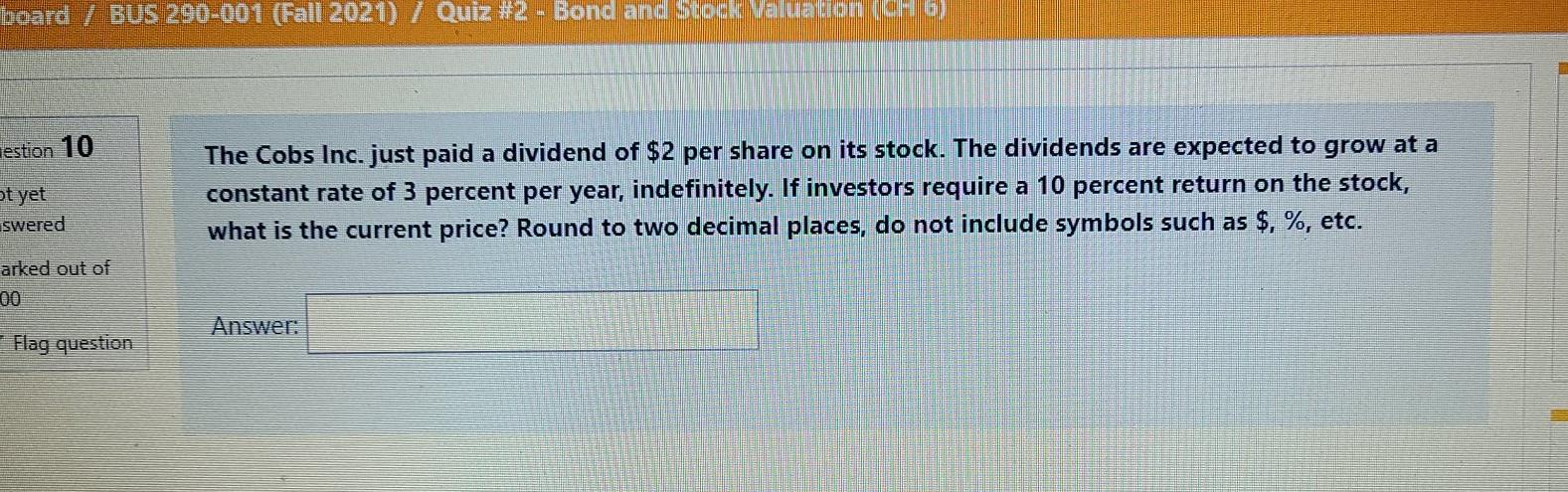

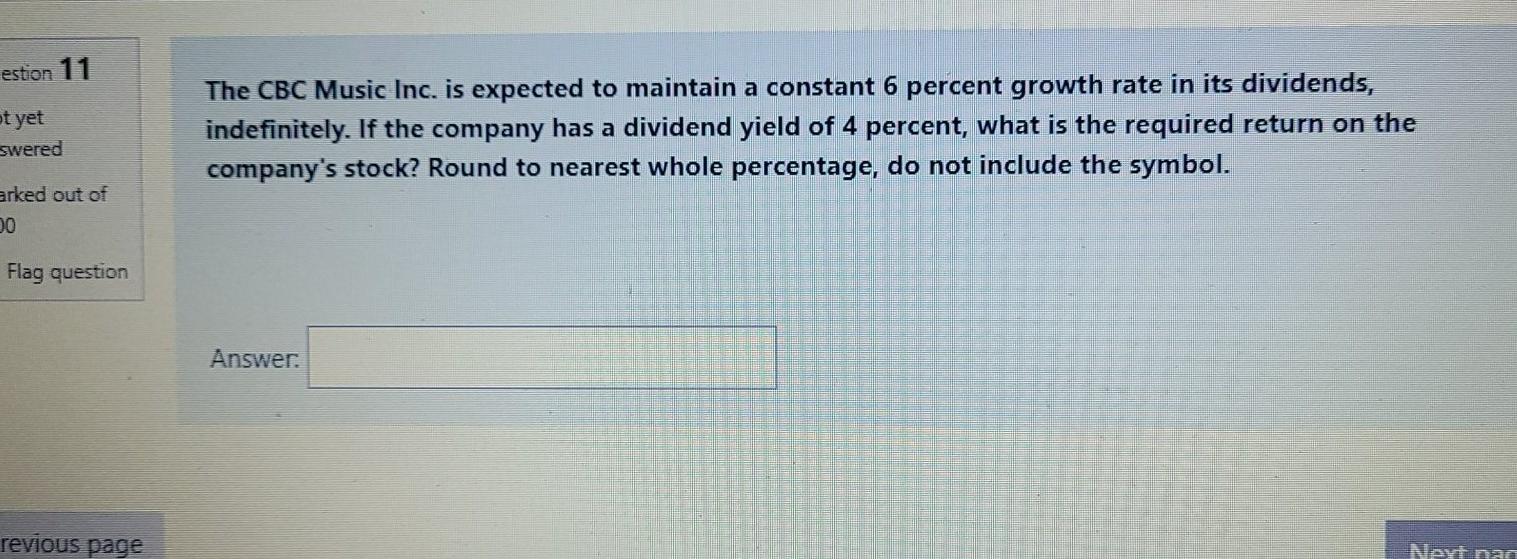

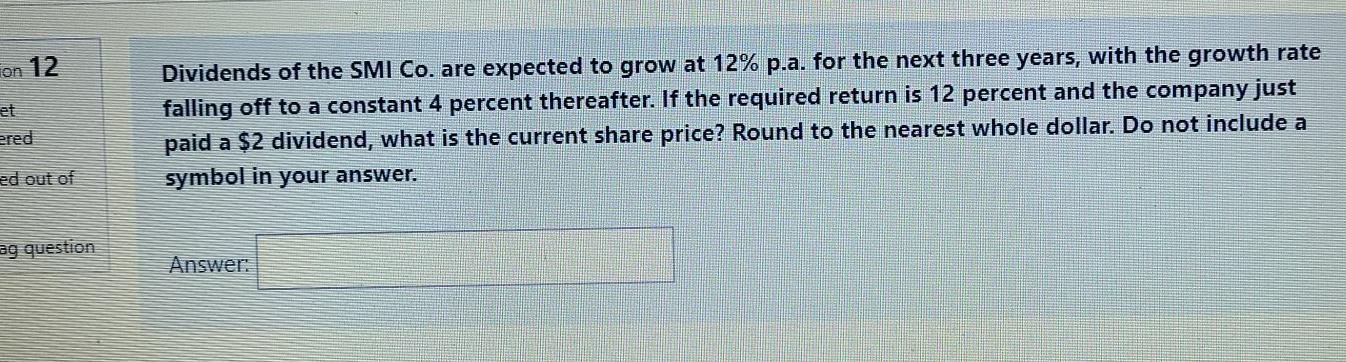

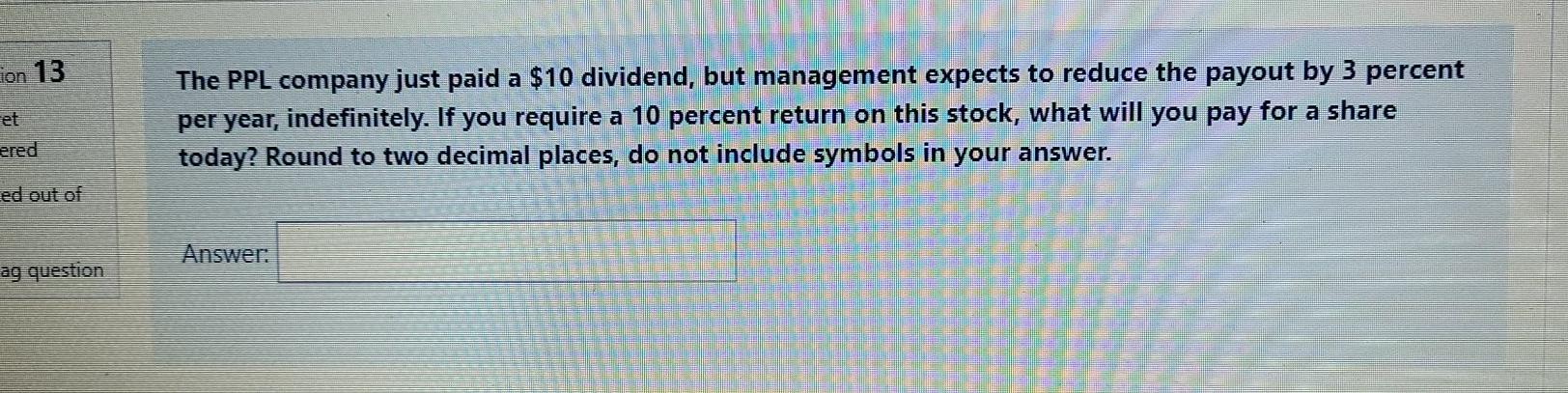

stion 9 yet EPL Corp. has 8 percent coupon bonds making annual payments with a YTM of 6.8 percent. The current yield on these bonds is 7.2 percent. How many years do these bonds have left until they mature? Round to two decimals. wered rked out of 0 Flag question Answer: board / BUS 290-001 (Fall 2021) 1 Quiz #2 - Bond and Stock valuation (Ch 6) estion 10 ot yet swered The Cobs Inc. just paid a dividend of $2 per share on its stock. The dividends are expected to grow at a constant rate of 3 percent per year, indefinitely. If investors require a 10 percent return on the stock, what is the current price? Round to two decimal places, do not include symbols such as $, %, etc. arked out of 00 Answer: Flag question estion 11 ot yet The CBC Music Inc. is expected to maintain a constant 6 percent growth rate in its dividends, indefinitely. If the company has a dividend yield of 4 percent, what is the required return on the company's stock? Round to nearest whole percentage, do not include the symbol. swered arked out of 20 Flag question Answer. revious page Neyi nan con 12 et ered Dividends of the SMI Co. are expected to grow at 12% p.a. for the next three years, with the growth rate falling off to a constant 4 percent thereafter. If the required return is 12 percent and the company just paid a $2 dividend, what is the current share price? Round to the nearest whole dollar. Do not include a symbol in your answer. ed out of ag question Answer: ion 13 et The PPL company just paid a $10 dividend, but management expects to reduce the payout by 3 percent per year, indefinitely. If you require a 10 percent return on this stock, what will you pay for a share today? Round to two decimal places, do not include symbols in your answer. ered ed out of Answer: agStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started