Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only B and C .prepare a year end balance sheet noneed for A The major maintenance and equipment replacement fund is a capital projects funds;

Only B and C .prepare a year end balance sheet noneed for A

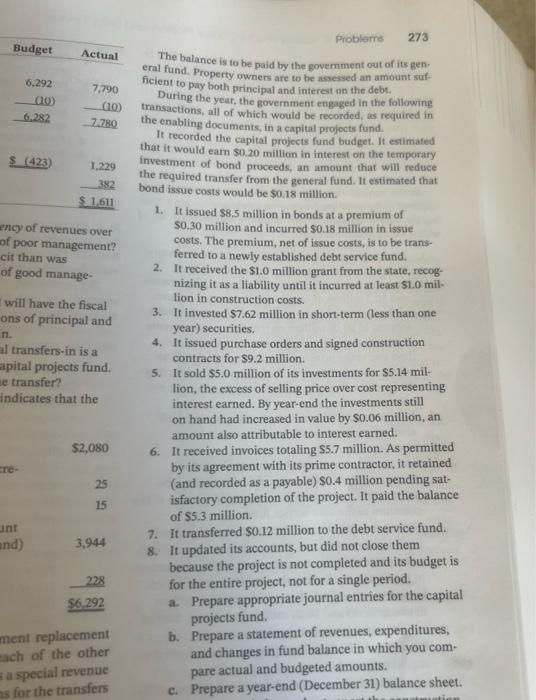

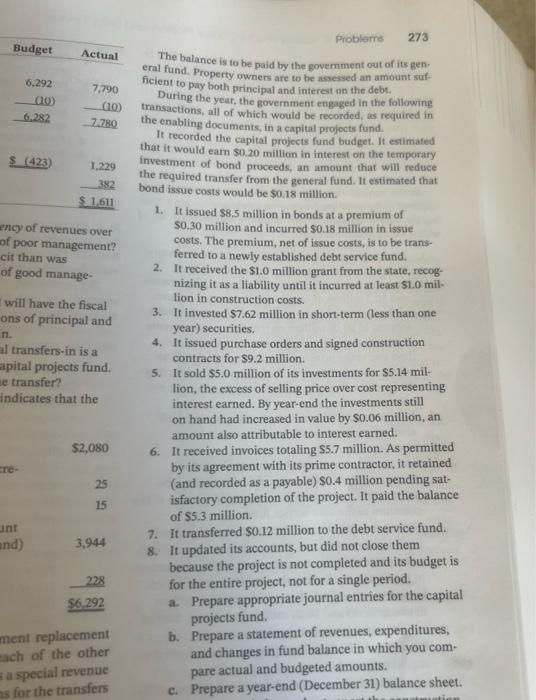

The major maintenance and equipment replacement fund is a capital projects funds; each of the other funds, other than the general fund, is a special revenue fund. What are the most likely reasons for the transfers from the special revenue funds? P. 6-5 The construction and financing phase of a special assessment project is accounted for in a capital projects fund, and the debt service phase is accounted for in a debt service fund (see the next problem). Upon annexing a recently developed subdivision, a gov- ernment undertakes to extend sewer lines to the area. The estimated cost is $10.0 million. The project is to be funded with $8.5 million in special assessment bonds and a $1.0 mil- lion reimbursement grant from the state. P. 6- The c for in A $8.5 exte OW! per Budget 6,292 (10) $ (423) re- 6.282 unt and) Actual 7,790 (10) 7.780 ency of revenues over of poor management? cit than was of good manage- 1,229 382 $ 1,611 will have the fiscal ons of principal and n. al transfers-in is a apital projects fund. se transfer? indicates that the $2,080 25 15 3,944 228 $6,292 ment replacement each of the other a special revenue ns for the transfers Problems 273 The balance is to be paid by the government out of its gen eral fund. Property owners are to be assessed an amount suf- ficient to pay both principal and interest on the debt. During the year, the government engaged in the following transactions, all of which would be recorded, as required in the enabling documents, in a capital projects fund. It recorded the capital projects fund budget. It estimated that it would earn $0.20 million in interest on the temporary investment of bond proceeds, an amount that will reduce the required transfer from the general fund. It estimated that bond issue costs would be $0.18 million. 1. It issued $8.5 million in bonds at a premium of $0.30 million and incurred $0.18 million in issue costs. The premium, net of issue costs, is to be trans- ferred to a newly established debt service fund. 2. It received the $1.0 million grant from the state, recog- nizing it as a liability until it incurred at least $1.0 mil- lion in construction costs. 3. It invested $7.62 million in short-term (less than one year) securities. 4. It issued purchase orders and signed construction contracts for $9.2 million. 5. It sold $5.0 million of its investments for $5.14 mil- lion, the excess of selling price over cost representing interest earned. By year-end the investments still on hand had increased in value by $0.06 million, an amount also attributable to interest earned. 6. It received invoices totaling $5.7 million. As permitted by its agreement with its prime contractor, it retained: (and recorded as a payable) $0.4 million pending sat- isfactory completion of the project. It paid the balance of $5.3 million. 7. It transferred $0.12 million to the debt service fund. 8. It updated its accounts, but did not close them because the project is not completed and its budget is for the entire project, not for a single period. a. Prepare appropriate journal entries for the capital projects fund. b. Prepare a statement of revenues, expenditures, and changes in fund balance in which you com- pare actual and budgeted amounts. c. Prepare a year-end (December 31) balance sheet. ation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started