Question

Consider the market for a good, where demand and supply are given by the following equations. P=34-Qd P=10+2Q, With the aid of a labelled

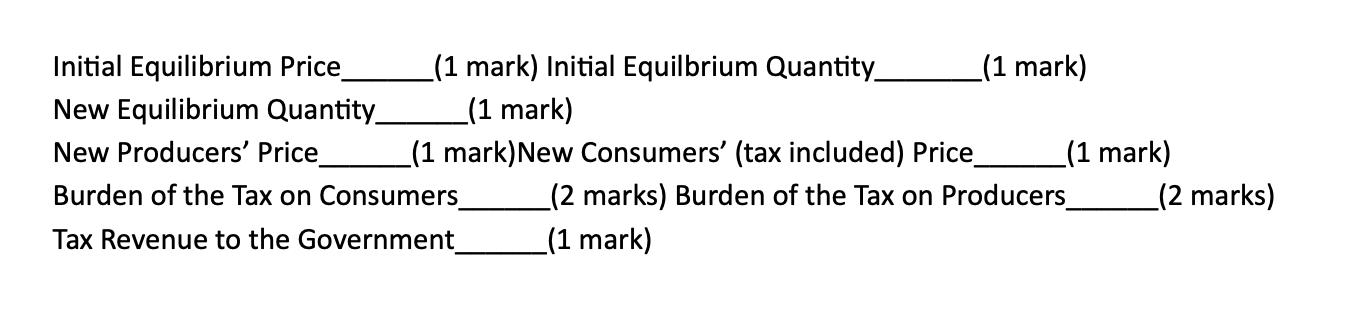

Consider the market for a good, where demand and supply are given by the following equations. P=34-Qd P=10+2Q, With the aid of a labelled diagram analyse the economic effects of a $3 per unit tax on this good, charged to consumers. P Q (1 mark) Initial Equilbrium Quantity_ _(1 mark) (1 mark) New Consumers' (tax included) Price_ Initial Equilibrium Price_ New Equilibrium Quantity_ New Producers' Price_ Burden of the Tax on Consumers Tax Revenue to the Government_ (1 mark) (1 mark) (2 marks) Burden of the Tax on Producers_ (1 mark) (2 marks)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the economic effects of a 3 per unit tax on this good charged to consumers lets start by determining the initial equilibrium price and quantity Given the demand equation P 34 Qa And the sup...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App