Answered step by step

Verified Expert Solution

Question

1 Approved Answer

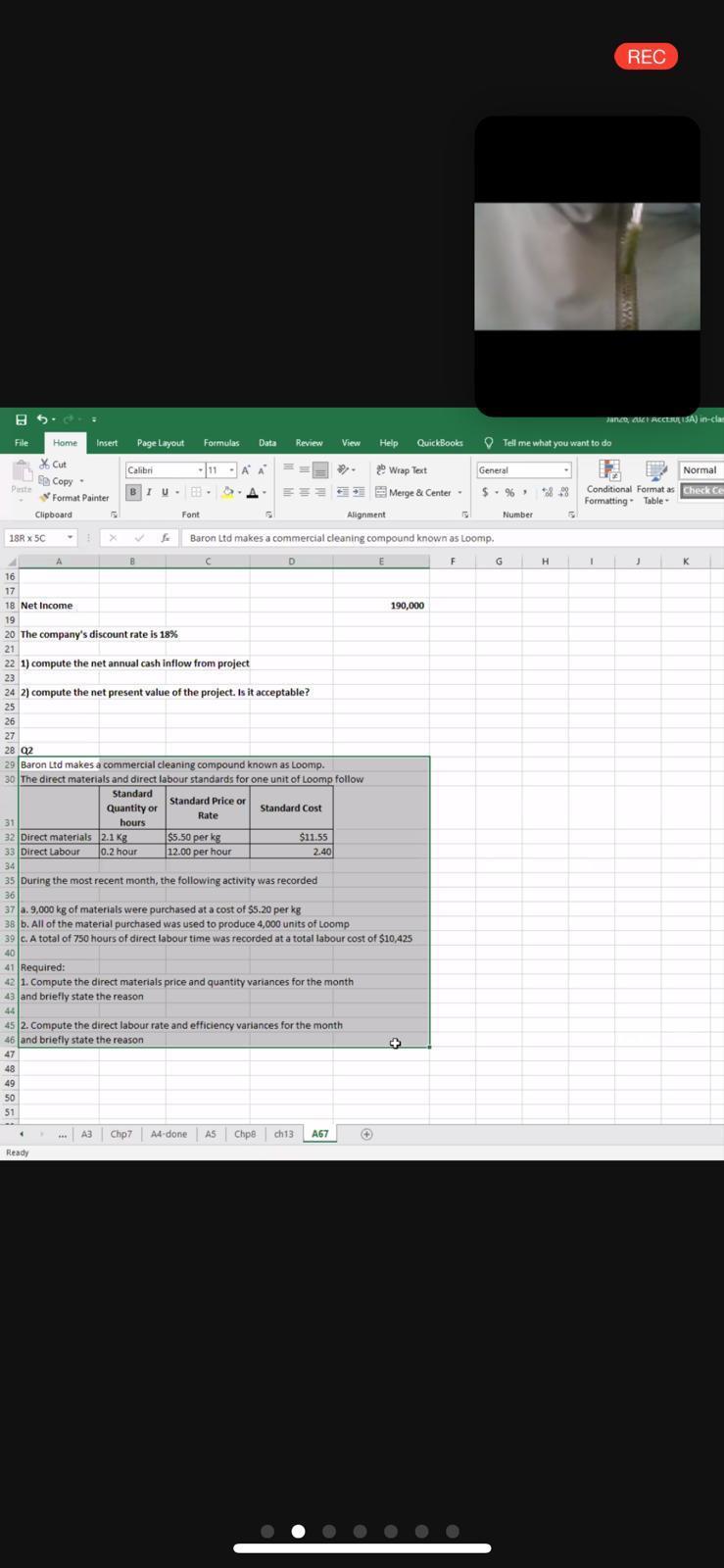

only do 2 question please REC R, AT RECERESA) in-clan File Home Insert Page Layout Formulas Data Review View Help QuickBooks Tell me what you

only do 2 question please

REC R, AT RECERESA) in-clan File Home Insert Page Layout Formulas Data Review View Help QuickBooks Tell me what you want to do X Cut Calibri -111 -AA 2 Wrap Text General Normal Copy Format Painter BIU. Merge & Center - $ %*828 Conditional Format as Check Ce Formatting Table Clipboard Font Alignment Number 18RX 5C Baron Ltd makes a commercial cleaning compound known as Loomp. A B C D E F G H H K 16 17 18 Net Income 190,000 19 20 The company's discount rate is 18% 21 22 1) compute the net annual cash inflow from project 23 24 2) compute the net present value of the project. Is it acceptable? 25 26 27 28 Q2 29 Baron Ltd makes a commercial cleaning compound known as Loomp. 30 The direct materials and direct labour standards for one unit of Loomp follow Standard Standard Price or Quantity or Standard Cost Rate 31 hours 32 Direct materials 2.1 kg $5.50 per kg $11.55 33 Direct Labour 0.2 hour 12.00 per hour 2.40 34 35 During the most recent month, the following activity was recorded , 36 37 a. 9,000 kg of materials were purchased at a cost of $5.20 per kg 38 b. All of the material purchased was used to produce 4,000 units of Loomp 39. A total of 750 hours of direct labour time was recorded at a total labour cost of $10,425 40 41 Required: 42 1. Compute the direct materials price and quantity variances for the month 43 and briefly state the reason 44 45 2. Compute the direct labour rate and efficiency variances for the month 46 and briefly state the reason 47 48 49 50 51 3 Chp7 A4-done AS Chpe ch13 A67 Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started